1. Breaking news this week

Traders expect the Federal Reserve to begin cutting interest rates in March, but uncertainty remains after stronger-than-expected retail sales in December.

- Singapore rejects Bitcoin ETF

The Monetary Authority of Singapore opposed the listing of Bitcoin ETF on the grounds that the cryptocurrency was ineligible as an ETF asset.

- SEC extends Ethereum ETF decision

The SEC extends the decision deadline on Fidelity’s proposed spot Ethereum ETF to March 5, concurrent with other Bitcoin ETF applications.

- Binance launches in Thailand

Gulf Binance, a joint venture between Binance and Gulf Innova, is launching a cryptocurrency exchange service in Thailand to make it accessible to the public.

- Accelerated SEC Timeline for Bitcoin ETF Options

The SEC is targeting approval of spot Bitcoin ETF-based options by the end of February.

- Ripple Entity for SEC Requests

Ripple argues in response to the SEC’s enforcement request that it is seeking irrelevant information and disputes the need for new data.

- SEC and Coinbase Complexities

The SEC and Coinbase are awaiting a judge’s decision on whether the exchange’s trading of the 12 tokens on the secondary market violates securities laws.

2. Blockchain performance

In this section, we mainly analyze the best performing blockchains based only on 7-day changes and the two best performing blockchains among the top five with the highest TVL.

2.1. Top Blockchain Performers by 7-Day Change

| blockchain | 7-day change (%) |

| method | +357% |

| Big Sean | +185% |

| pulse chain | +120% |

| ICP | +109% |

| Dogechain | +59.50% |

Among the top blockchain performers by 7-day change, Mode took an impressive lead at +357%, followed by Viction at +185%. PulseChain shows a notable +120%, while ICP and DogeChain show positive trends with +109% and +59.50% respectively.

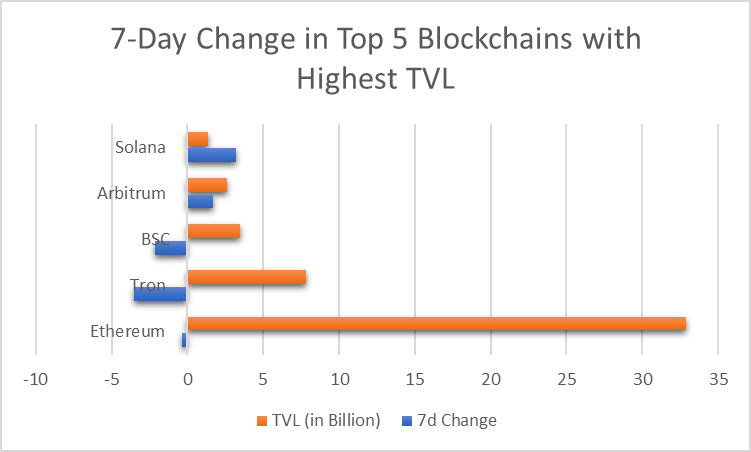

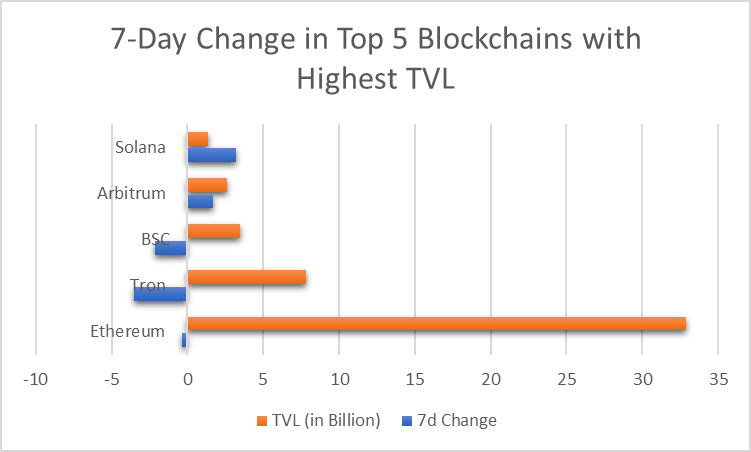

2.2. Top Performers: 7-Day Change of Top 5 Blockchains with Highest TVL

| blockchain | 7 days change | TVL (in billions) |

| Ethereum | -0.35% | $32.884b |

| tron | -3.49% | $7.827 trillion |

| BSC | -2.11% | $3.476 billion |

| decision | +1.67% | $2.631 billion |

| Solana | +3.19% | $1.362 billion |

In the realm of best-performing blockchains based on 7-day change and highest TVL, Ethereum remains stable with a slight decline of -0.35%, boasting a respectable TVL of $32.884 billion. Solana achieved a TVL of $1.362 billion with solid growth of +3.19%. Other competitors such as Arbitrum, Tron and BSC have 7-day changes varying from -3.49% to +3.19%.

3. Cryptocurrency market analysis

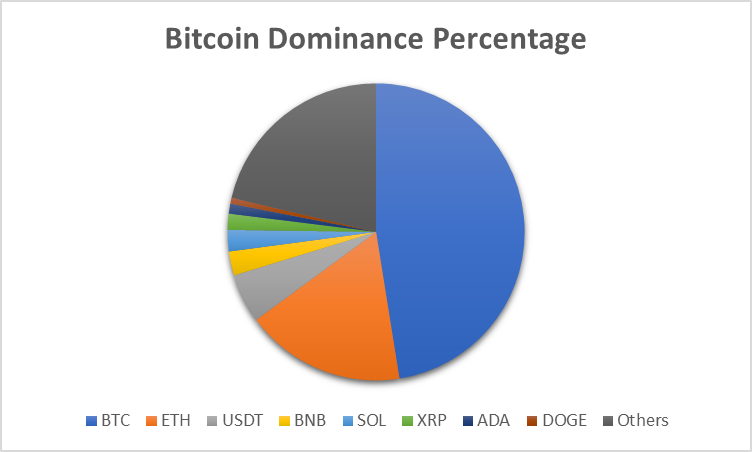

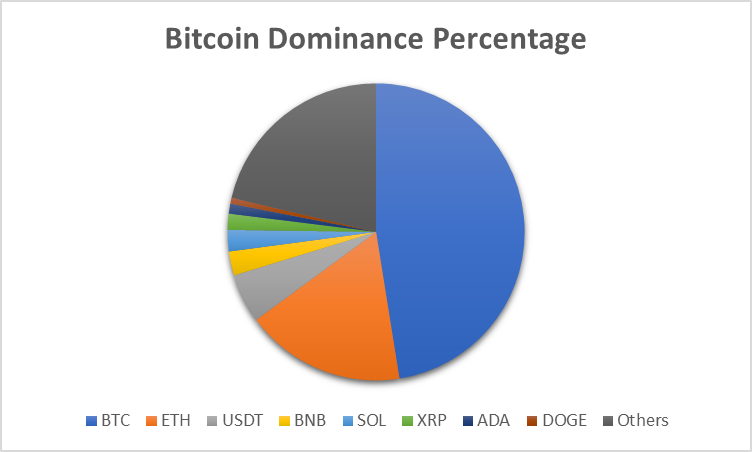

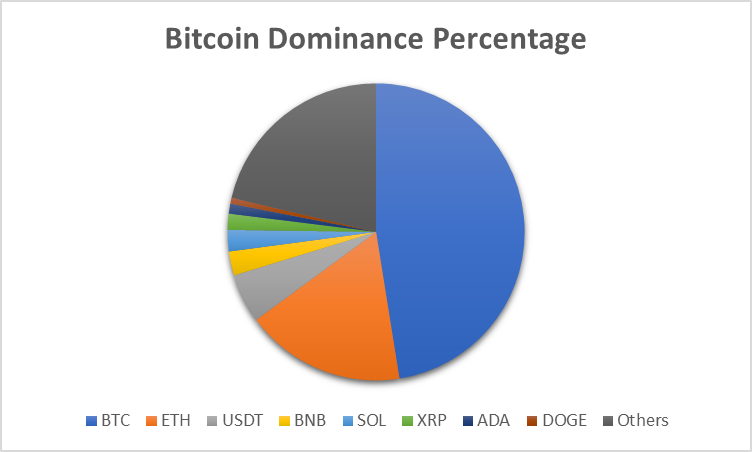

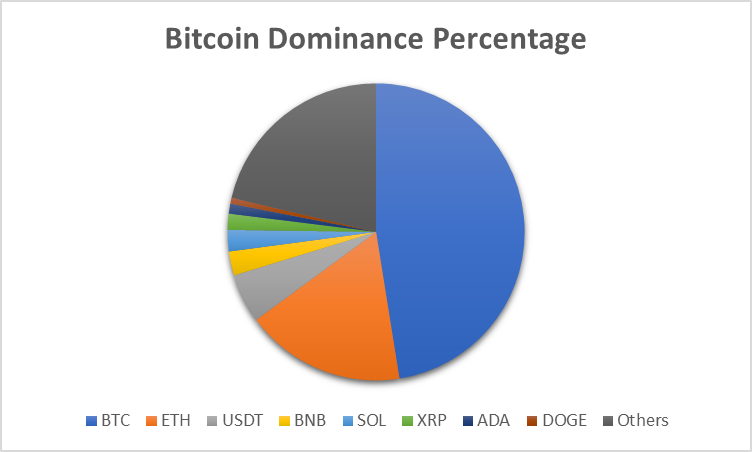

3.1. Bitcoin Price and Dominance

| cryptocurrency | price | market capitalization | dominance ratio | 7d- Market capitalization change |

| BTC | $41,517.05 | $814,183,398,032 | 47.6% | -3.7% |

| ETH | $2,472.54 | $297,227,466,946 | 17.47% | -3.1% |

| USDT | $0.993 | $94,931,461,114 | 5.36% | -0.0% |

| BNB | $312.61 | $48,091,288,144 | 2.63% | +4.5% |

| brush | $91.56 | $39,659,679,333 | 2.33% | -1.2% |

| XRP | $0.5464 | $29,726,797,725 | 1.76% | -4.8% |

| ADA | $0.5104 | $17,911,980,946 | 1.09% | -6.9% |

| viceroy | $0.078 | $11,222,007,173 | 0.65% | -2.7% |

| etc | 21.34% |

Bitcoin (BTC) leads the way with a price of $41,517.05, a significant market capitalization of $814.18 billion and a dominance of 47.6%. The 7-day market capitalization rate of change is -3.7, a negative index. Ethereum (ETH) followed with a price of $2,472.54, a market capitalization of $297.23 billion, and a 7-day market capitalization change of -3.1%. Binance Coin (BNB) stands out with a positive 7-day change of +4.5%, a price of $312.61 and a market capitalization of $48.09 billion.

3.2. Cryptocurrency Market Top Gainers and Losers of the Week

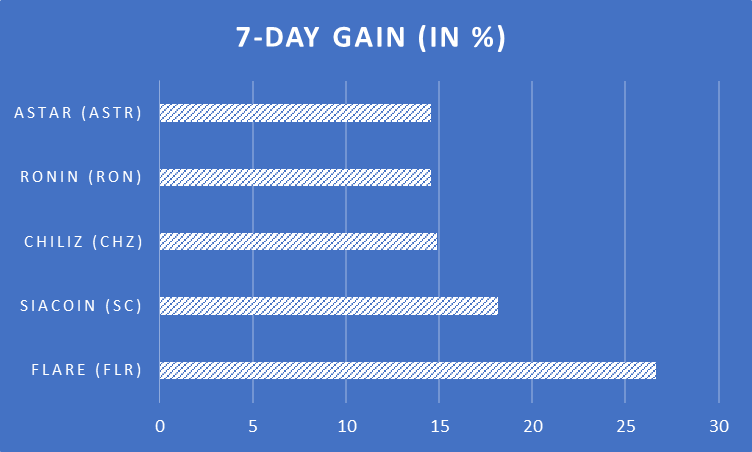

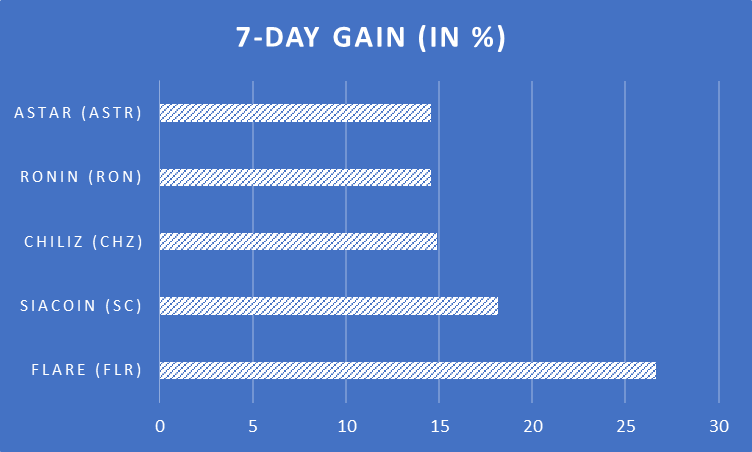

Here is a list of this week’s top gainers and top losers in the cryptocurrency market. The analysis is performed using 7-day gain and 7-day loss indices.

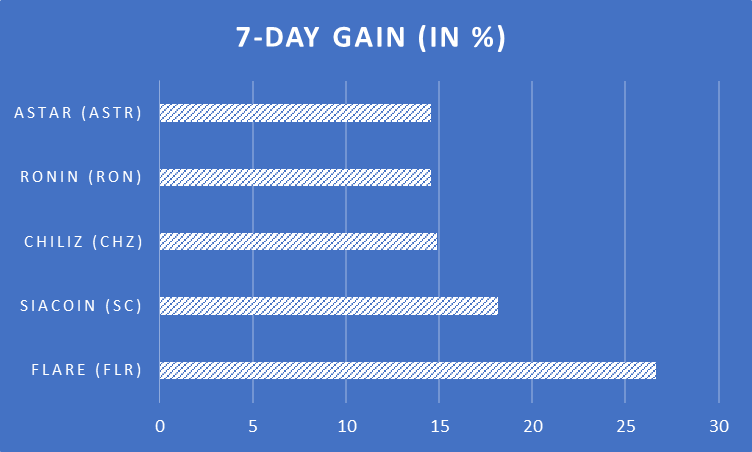

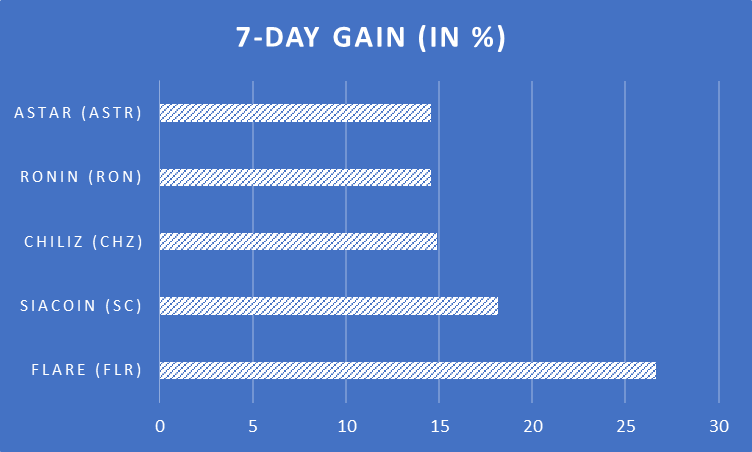

3.2.1. Top cryptocurrency gainers of the week

| cryptocurrency | price | 7 day gain |

| Flare (FLR) | $0.02213 | 26.62% |

| Siacoin (SC) | $0.01095 | 18.13% |

| Chiliz (CHZ) | $0.09643 | 14.87% |

| Ronin (RON) | $2.10 | 14.57% |

| ASTR | $0.174 | 14.56% |

Top gainers in the cryptocurrency space this week include Flare (FLR), up 26.62% in 7 days, Siacoin (SC), up 18.13% to $0.01095, Chiliz (CHZ), up 14.87% to $0.09643, and Ronin (RON). ) was up 14.57% at $2.10, while Astar (ASTR) was up 14.56% at $0.174.

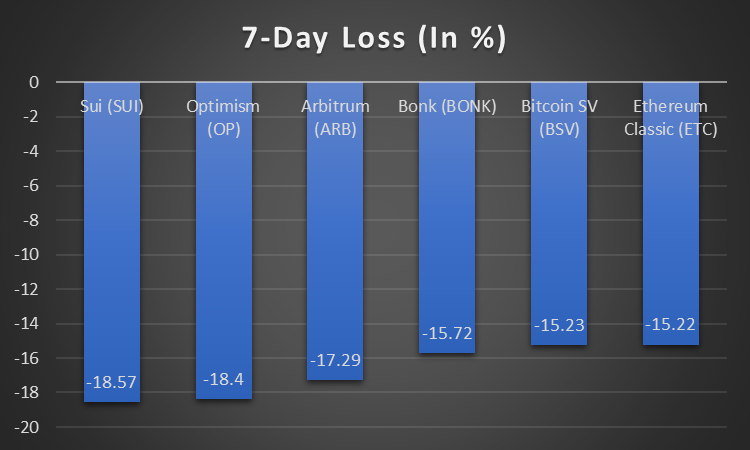

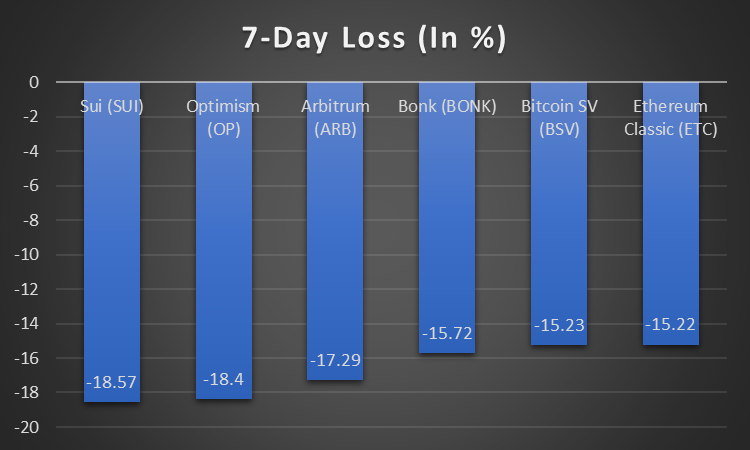

3.2.2. Top Crypto Losers of the Week

| cryptocurrency | price | 7 day loss |

| Sui (SUI) | $1.08 | -18.57% |

| Optimism (OP) | $3.13 | -18.40% |

| Arbitrage (ARB) | $1.79 | -17.29% |

| BONK | $0.00001133 | -15.72% |

| Bitcoin SV (BSV) | $71.57 | -15.23% |

| Ethereum Classic (ETC) | $24.69 | -15.22% |

The biggest decliners in the cryptocurrency market this week were Sui (SUI), led by a 7-day loss of -18.57%, followed by Optimism (OP), down -18.40% to $3.13. Arbitrum (ARB), Bonk (BONK), Bitcoin SV (BSV), and Ethereum Classic (ETC) also experienced losses ranging from -15.22% to -17.29%, indicating a difficult week for these assets.

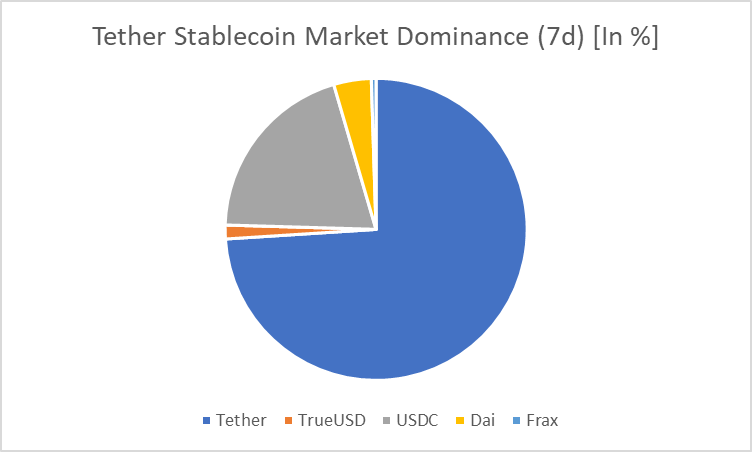

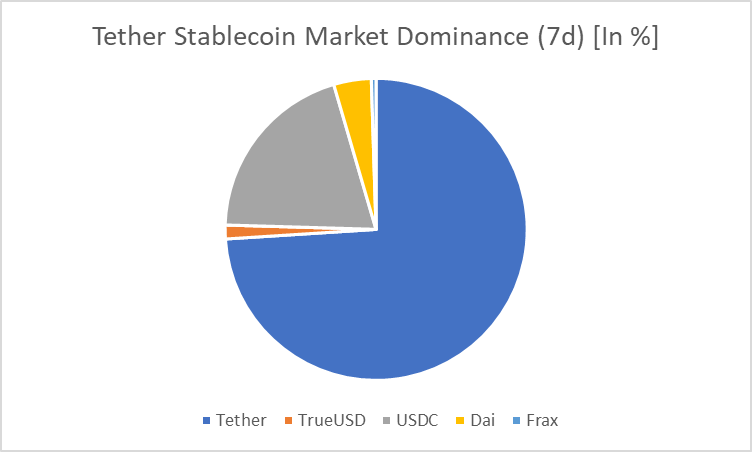

3.3. Stablecoin Weekly Analysis

| stablecoin | Market capitalization (7d) | Market power (7d) (%) | Trading volume (7 days) |

| rope | $94,967,646,331 | 72.25% | $45,051,204,444 |

| TrueUSD | $1,876,926,357 | 1.44% | $128,811,385 |

| USDC | $25,524,310,090 | 19.54% | $7,508,298,350 |

| die | $5,166,646,630 | 3.93% | $157,000,259 |

| Frax | $648,627,425 | 0.49% | $11,020,426 |

In this week’s analysis of stablecoin performance, Tether (USDT) stands out with a massive trading volume of $45.05 billion, highlighting its widespread utility. Tether also has the highest market capitalization at $94.97 billion and a 72.25% market share. USDC dominates the market at 19.54% with a notable trading volume of $7.51 billion and a significant market capitalization of $25.52 billion.

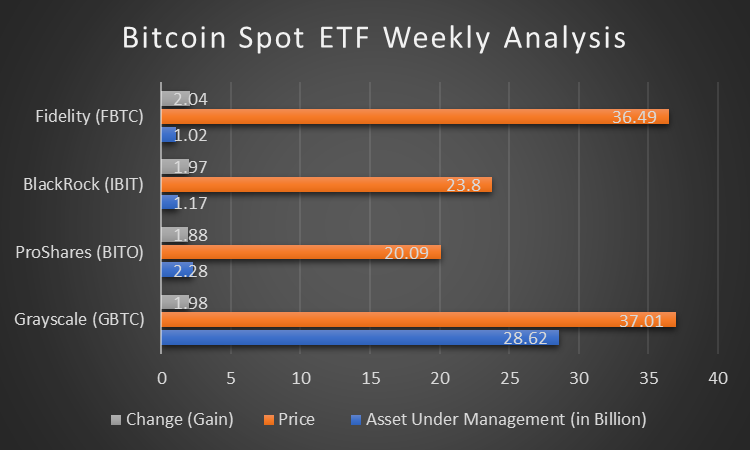

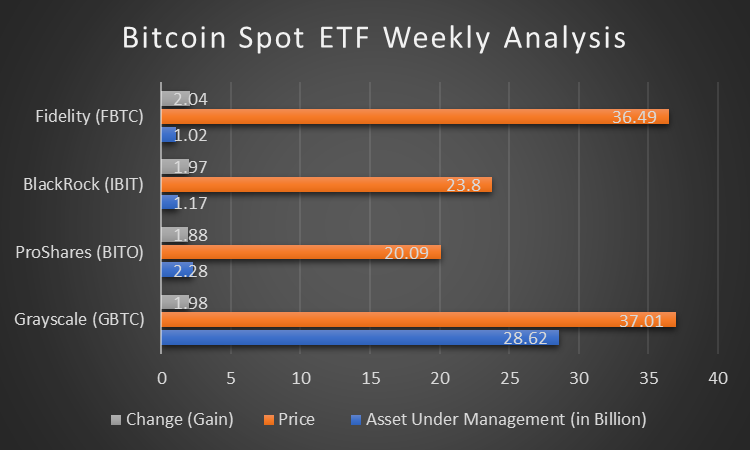

4. Bitcoin Spot ETF Weekly Analysis

| Bitcoin Spot ETF | Operating assets (unit: billion) | price | change (gain) |

| Grayscale (GBTC) | $286.2B | $37.01 | +1.98% |

| ProShares (BITO) | $22.8B | $20.09 | +1.88% |

| Blackrock (IBIT) | $1.17 billion | $23.80 | +1.97% |

| Fidelity (FBTC) | 1.02 billion dollars | $36.49 | +2.04% |

In this week’s analysis of Bitcoin spot ETFs, Grayscale (GBTC) leads the way with $28.62 billion in assets under management and a price of $37.01. Notably, Fidelity (FBTC) posted an impressive 2.04% gain, with AUM of $1.02 billion and a price of $36.49. ProShares (BITO) and BlackRock (IBIT) also showed positive changes, up 1.88% and 1.97%, respectively. This reflects a dynamic week in which Fidelity stood out with impressive value gains.

5. DeFi market weekly status analysis

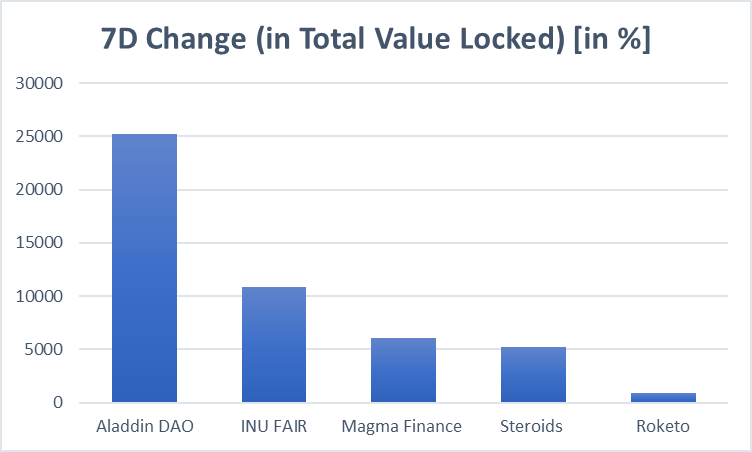

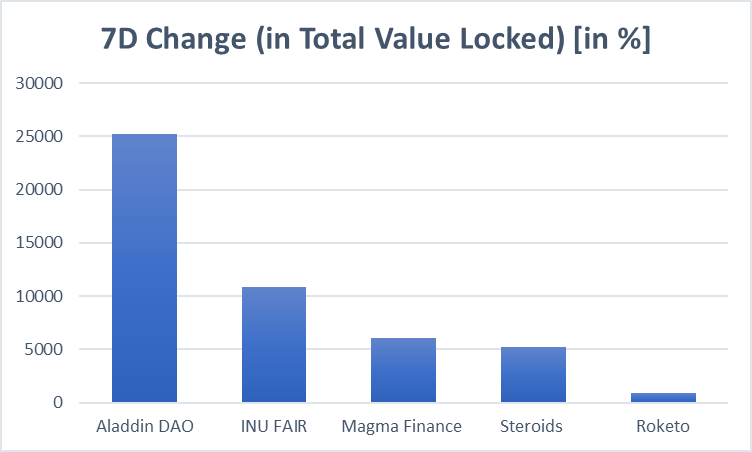

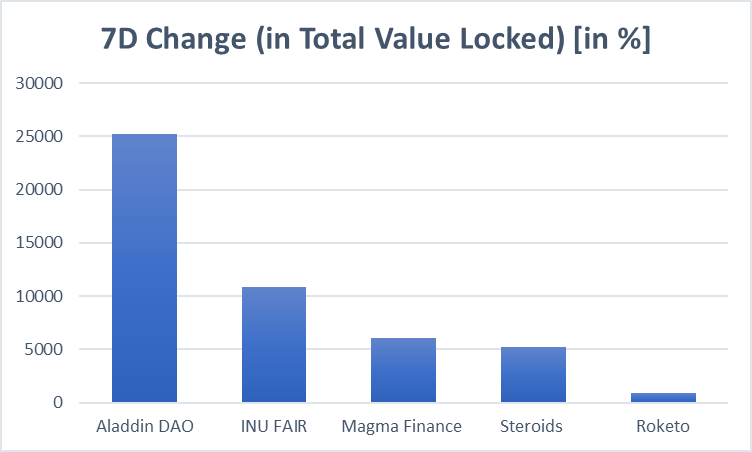

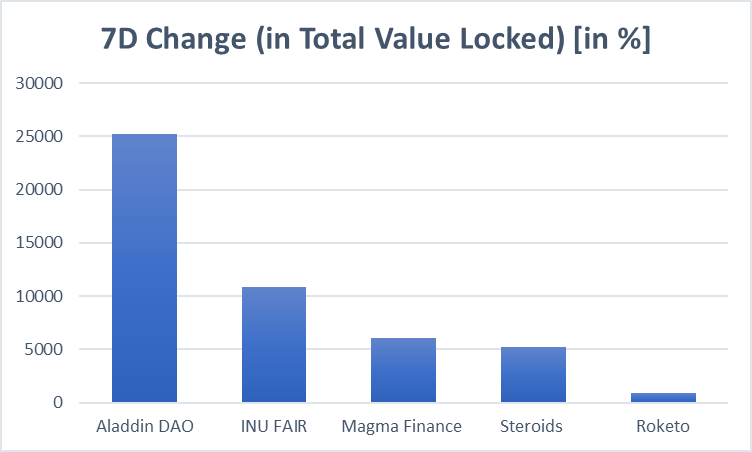

| DeFi Protocol | 7d change (total value locked) (%) |

| Aladdin DAO | +25212% |

| Inupair | +10852% |

| magma finance | +6066% |

| steroid | +5204% |

| Rocketto | +851% |

This week’s DeFi market analysis observed impressive growth in Total Volume Locked (TVL) across a variety of protocols. Aladdin DAO leads with a 7-day change of +25212%, followed by INU FAIR with +10852%, Magma Finance with +6.66%, Steroids with +5204%, and Roketo with +851%.

6. NFT Marketplace: Basic Weekly Analysis

| NFT Marketplace | 7-day rolling volume | 7 day rolling trade | volume change | Market share (based on daily trading volume) |

| blur | 34705.91 | 42920 | +11.91% | 54.19% |

| blur aggregator | 19661.24 | 23917 | +35.32% | 17.83% |

| When open | 10870.06 | 35894 | -6.81% | 15.45% |

| Cryptopunk | 2470.67 | 36 | +57.37% | 7.89% |

| jewel | 1931.81 | 7354 | -11.34% | 1.84% |

This week’s fundamental analysis of NFT marketplaces revealed a notable trend. Blur and Blur Aggregator show significant volume increases of +11.91% and +35.32% with market shares of 54.19% and 17.83% respectively. Opensea, on the other hand, experiences a change in volume of -6.81% but maintains a respectable market share of 15.45%. Cryptopunk accounts for a market share of 7.89% with an impressive volume change of 57.37%. However, Gem maintains a market share of 1.84% with an 11.34% change in sales.

6.1. Top NFT Collectibles Selling This Week

| NFT collectibles | Price (USD) |

| Cryptopunk #6912 | $475,676.56 |

| Cryptopunk #4506 | $349,195.00 |

| Art Block #78000643 | $243,379.25 |

| Azuki #5889 | $236,049.33 |

| Cryptopunk #6889 | $227,976,52 |

Notable transactions in this week’s NFT collectible sales include CryptoPunk #6912 for $475,676.56 and CryptoPunk #4506 for $349,195.00. Art Blocks #78000643 secured a respectable value of $243,379.25, while Azuki #5889 and CryptoPunks #6889 secured prices of $236,049.33 and $227,976.52, respectively.