- Ark Invest’s tactical moves: Ark Invest’s decision to sell Coinbase and Robinhood shares represents a strategic response to evolving market conditions impacted by the approval of a spot Bitcoin ETF.

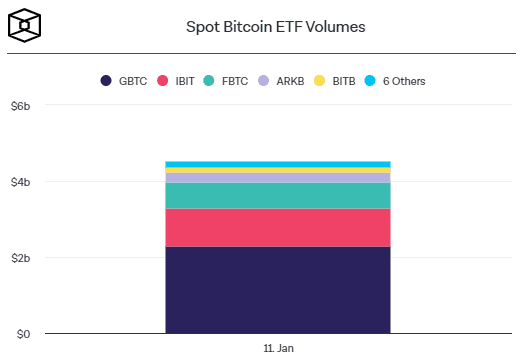

- Bitcoin ETF Impact: The selloff in Coinbase and Robinhood shares highlights the immediate impact regulatory decisions will have on major players in the cryptocurrency and trading sectors. As Bitcoin ETFs gain traction, their influence on market dynamics is becoming increasingly clear.

Cathie Wood’s Ark Invest had a notable move in the market, losing $4.4 million in Coinbase shares and nearly $4.3 million in stocks. robin hood Shared on Thursday. The sell-off coincided with both stocks falling at market close.

Bitcoin ETF Impact:

When news broke on Thursday that the United States had approved a spot Bitcoin ETF, investors were left pondering the implications. Shares of Coinbase, the cryptocurrency custodian for some of these ETFs, and Robinhood, which offers spot Bitcoin ETFs for customers, fell. Coinbase shares closed down 6.7% at $141.16, while Robinhood closed down 3.5% at $11.71.

Deals from Ark Invest:

The Ark Innovation ETF, managed by Cathie Wood’s firm, executed a strategic move selling 26,301 shares of Coinbase Global Inc. and 341,592 shares of Robinhood Markets Inc. ARK Next Generation Internet ETF also participated in the sale, selling 4,980 shares of Coinbase stock and 341,592 shares of Robinhood Markets Inc. On the same day, Robinhood shares the stock.

Bitcoin ETF Buzz Makes Waves: Impact on Coinbase and Robinhood

Rumors of the approval of a spot Bitcoin ETF in the US have resonated throughout the markets, influencing the decisions of major companies such as Ark Invest. As investors digested the news, major players in the cryptocurrency and trading space, Coinbase and Robinhood, faced downward pressure on their stock prices. This sell-off by Ark Invest adds an interesting layer to the evolving story of how Bitcoin ETFs impact major market participants.

Also Read: Whale Alert: Ethereum Moved to Binance, Coinbase Worth $136 Million

Market Dynamics Visible: Coinbase, Robinhood, and Bitcoin ETFs Surge

Market dynamics came alive as Coinbase and Robinhood reacted to the surge in Bitcoin ETFs. While Ark Invest has taken steps to reduce its holdings, broader market sentiment has been affected by the approval of a spot Bitcoin ETF.

Understanding the interplay between major investment firms, major stocks, and the larger cryptocurrency market can provide insight into the changing landscape in response to regulatory decisions and investor sentiment.