Cryptocurrency Exchange Bybit The announcement of a major update with the introduction of digital rupee payments marks a significant step forward in the integration of central bank digital currencies (CBDCs) within the crypto space. The move aims to enhance the security of Indian rupee users and potentially attract a wider merchant base to the platform.

Bybit’s Strategic Moves on Digital Rupees

Bybit, a prominent Dubai-based cryptocurrency exchange, has taken a major step forward in strengthening its payment infrastructure by integrating the Indian digital rupee (e-rupee). The move is not only in line with the growing trend of central bank digital currencies, but also aims to enhance security and simplify transactions for Indian users.

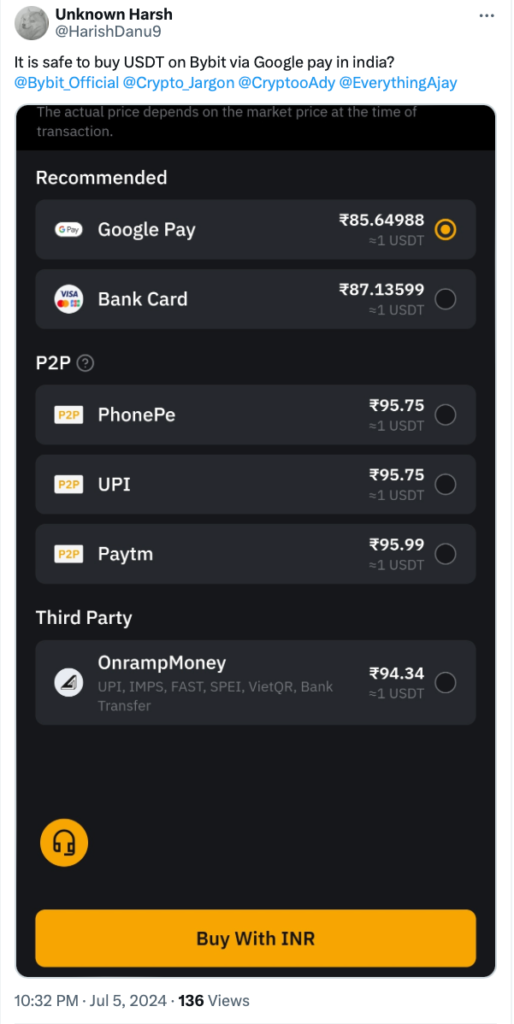

According to Bybit, e-Rupee will function as a wallet-based payment solution that complements existing payment methods such as bank transfers, Paytm, and Unified Payments Interface (UPI). This diversification of payment options is expected to increase user convenience and attract a wider merchant base to the platform.

Enhanced security and expanded payment options

The introduction of e-rupee is seen as a major step towards mitigating the security risks associated with traditional bank accounts. Joan Han, Bybit’s Head of Sales and Marketing, emphasized that the integration of digital rupee aims to: “Improve the payment experience for INR users.” Ensuring greater reliability and trust in transactions. This initiative is expected to attract more merchants to the platform, further increasing its appeal.

Currently, e-rupees are used for peer-to-peer trading on Bybit. The retail version of the digital rupee, which was launched as part of a pilot project, was launched in December 2022, following the launch of the wholesale version. Despite its potential, adoption of e-rupees has been slow, with limited use in the wholesale sector and criticism over its complexity.

The Future of Digital Rupees and CBDCs

The integration of e-rupees on Bybit highlights the evolving role of CBDCs in the cryptocurrency market. The Reserve Bank of India’s efforts to enhance the functionality of the digital rupee, including its programmability, reflects ongoing initiatives to enhance its usability. For example, in April 2024, IndusInd Bank used a programmable e-rupee to repay carbon credits to farmers. However, some users still find e-rupees cumbersome and their use is still relatively limited.

The addition of digital rupees on Bybit is expected to set a precedent for other exchanges and financial platforms, demonstrating the potential benefits and challenges of integrating CBDCs into digital finance.

Also Read: Crypto Tax Update: No Changes to Virtual Digital Assets in 2024 Budget