This article explains bullish candlestick patterns and why it is important to understand them well when trading.

Previous articles published up to current cover Chart Pattern Basicsall Continuous Pattern GuideLoss role of triangle And an article about Cup and Shoulder Trading.

hammer

The hammer pattern is a bullish candle that indicates a possible trend reversal. The pattern is defined by a small green body at the top of the candle and a long shadow resembling the shape of a hammer.

Indicator of Hammer Pattern

- A candle with a small body.

- The candle is green, so close > open.

- The shadow becomes noticeably longer than the actual body.

- The top shadow is very short or not present at all.

- You have to consider the situation.

- The hammer pattern is most important when a downtrend is occurring.

- The effectiveness of the hammer as a potential reversal indicator increases when its body forms near strong support levels.

Hammer pattern analysis

The hammer indicates that buyers have regained market control despite initial selling pressure. This marks the end of a downtrend and the beginning of an uptrend. The validity of the hammer pattern can increase with higher trading volumes, indicating significant buyer interest in a trend reversal.

Hammer pattern direction

bullish reversal – The hammer is a sign that a downtrend is losing momentum and a bullish reversal may occur soon.

check mark – The hammer pattern is a signal in itself, but traders usually wait for confirmation in the form of a bullish candle to show that a reversal is occurring.

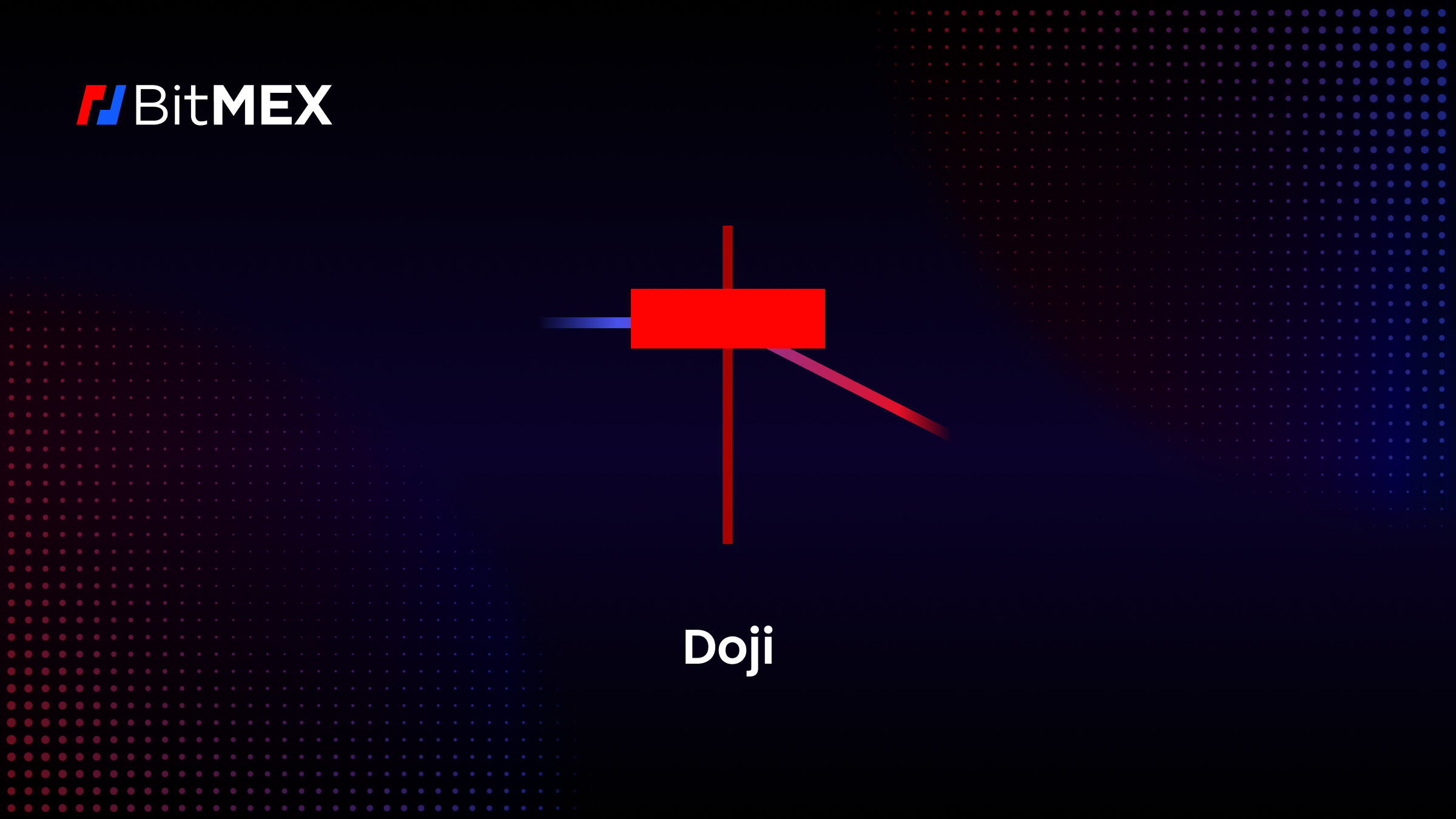

dragonfly doji

The dragonfly doji is very similar to the mallet, featuring a small body at the top of the candlestick and a long lower shadow similar to that of a dragonfly.

Indicator of Dragonfly Doji Pattern

- A candle with a small body.

- The candle is red, so open > close.

- The shadow becomes noticeably longer than the actual body.

- There is no top shadow at all or it is very small.

- You have to consider the situation.

- The seal dragonfly pattern is most important when a downtrend appears.

- The effectiveness of the Dragonfly Doji pattern as a reversal indicator increases when a body forms near a support level.

Interpretation of Dragonfly Doji Pattern

This pattern indicates that the price has successfully moved higher after some initial selling pressure, thus starting an upward movement.

The length of the lower shadow suggests that the price reached its lowest level during the period but was able to close near the open. This indicates significant support at this price level and that buyers are willing to suppress further price declines.

Although relatively high volume adds more weight to reversal signals, traders typically wait for the next candle to close higher to confirm a reversal before entering a trade.

Dragonfly Doji Pattern Direction

bullish reversal

A Dragonfly Doji usually appears after a downtrend and indicates a reversal in an uptrend. This signals a bullish change in market sentiment. As a result, traders may see this as a potential opportunity to initiate a long position.

check

If the next candle closes higher than the Dragonfly Doji close, further support is added for a possible reversal. This indicates that buyers are gaining momentum.

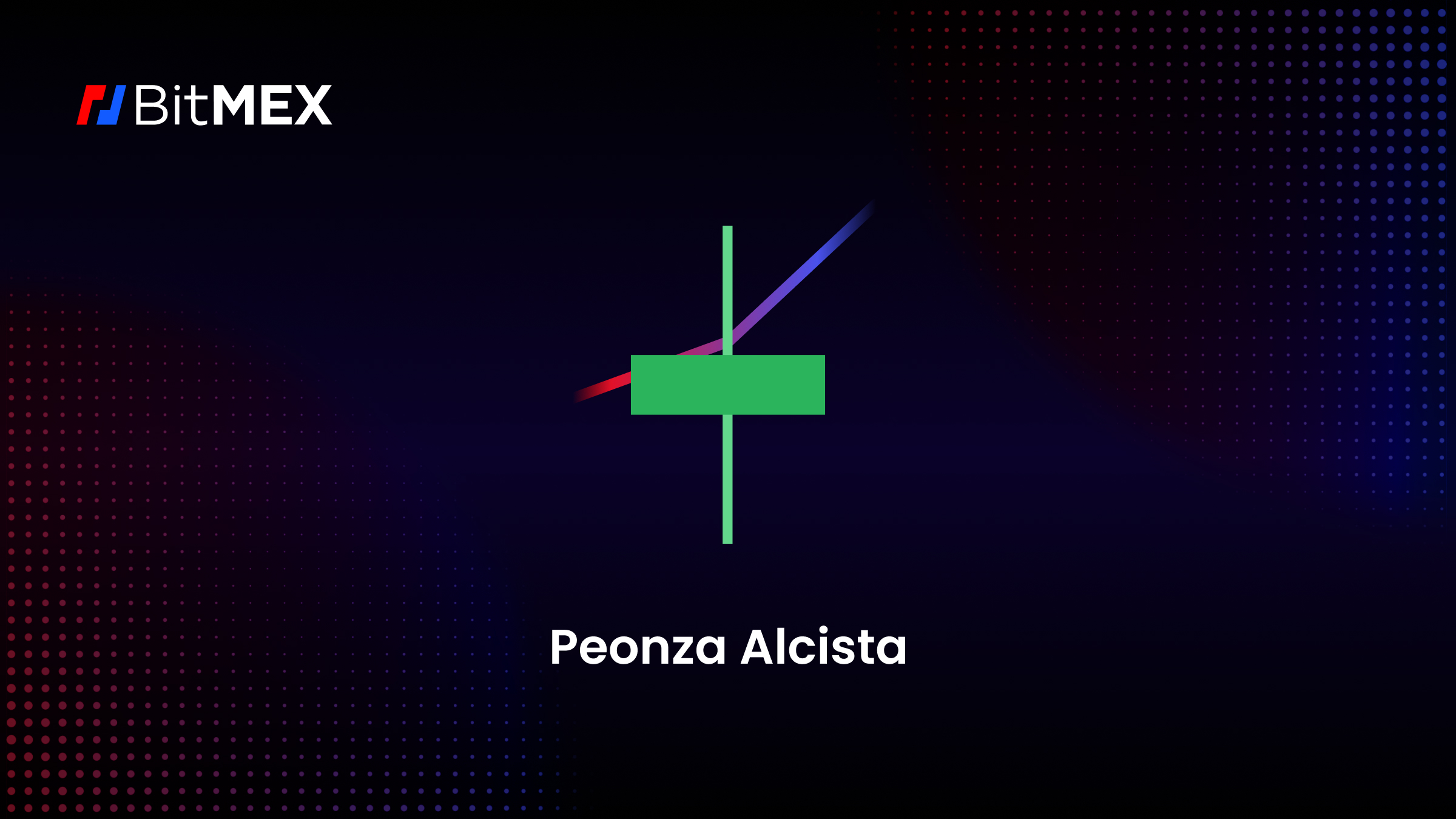

stubborn spinning tower

A bullish top is a bullish chart pattern characterized by a small body and two upper and lower shadows of equal length.

Indicator of a bullish top pattern

- A candle with a small body.

- It’s a green candle, so close price > open price.

- The shadow becomes noticeably longer than the actual body.

- The top shadow is very short or not present at all.

- You have to consider the situation.

- Bullish highs are most important when a downward trend continues.

- The validity of a bullish peak as a reversal indicator increases when its body forms near a strong support line.

Interpreting a Bullish Spinning Top Pattern

This means that despite initial fluctuations between buyers and sellers in the market, buyers eventually took control and drove prices up. The striking shape of this pattern makes it approachable even for beginners and provides a clear visual indication of possible trend changes.

Additionally, advanced traders value the importance of this pattern because it shows a state of uncertainty in the market, followed by a reversal in line with broader technical analysis, and can complement strategies.

Direction of a bullish top pattern

bullish reversal

A bullish peak in the green body after a prolonged downtrend indicates that sellers are losing momentum and buyers are taking the lead. This may indicate that the downtrend is decreasing and that an uptrend is about to begin.

Let’s analyze it in the next article. neutral candle pattern Find out how it could potentially impact your trading strategy.

Theories aside, if you want to start trading cryptocurrency derivatives or find spots on BitMEX, you can find all the existing products there. here. For more educational materials on BitMEX trading, especially derivatives, please visit: this page.

To be the first to know about new listings, product launches, giveaways, and more, we invite you to join us on: online community Connect with other operators. For the latest information, you can also follow us on: Xor our blog why Advertisements on the site.