Key Takeaways

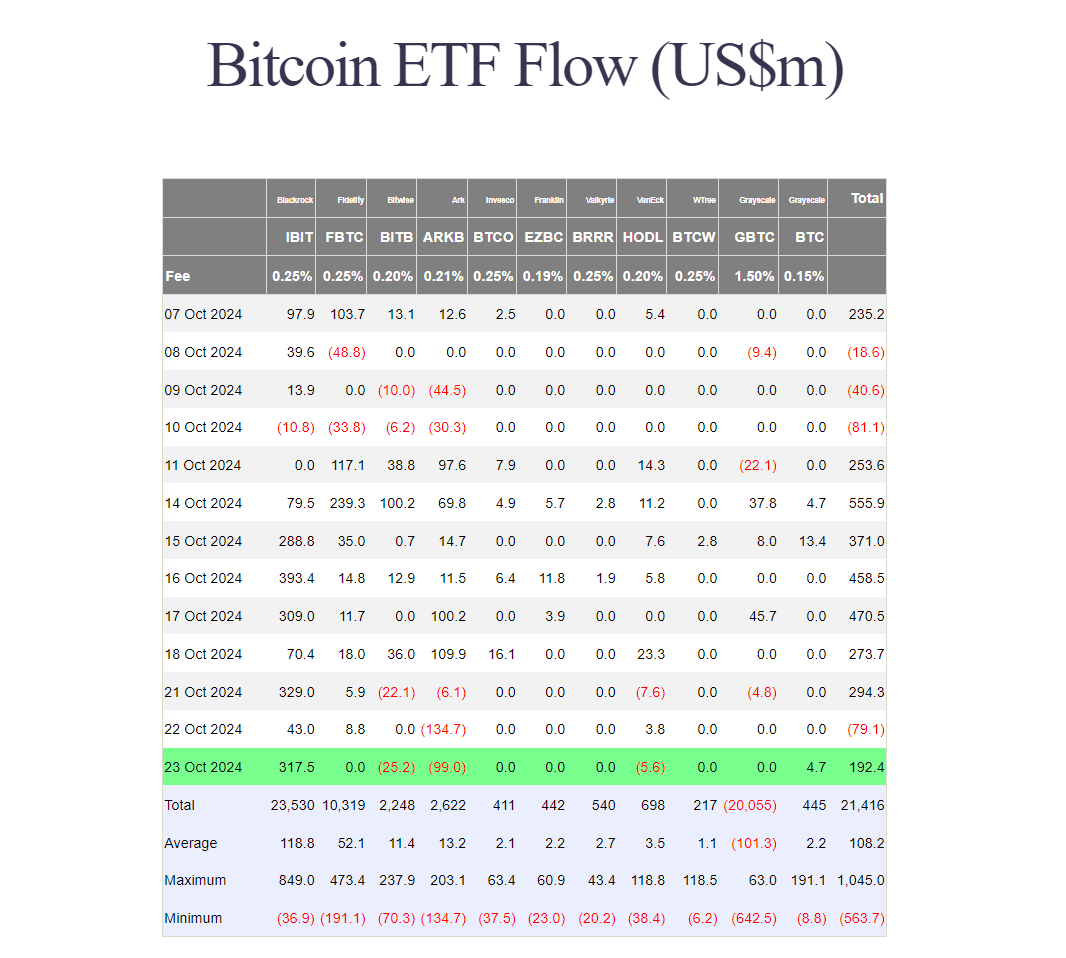

- BlackRock’s iShares Bitcoin Trust gained inflows of more than $317 million, contrasting with losses for other ETFs.

- Bitcoin price peaked at $69,500 last week and is currently hovering around $67,000, and remains highly volatile.

Share this article

BlackRock’s iShares Bitcoin Trust (IBIT) continues to attract investor attention, ending Wednesday with net inflows of more than $317 million while most rival ETFs struggle to maintain their winning streak.

Grayscale’s Bitcoin Mini Trust, a BTC fund following IBIT, yesterday reported a profit of nearly $5 million, according to Farside Investors data. In contrast, ARK Invest’s ARKB, Bitwise’s BITB, and VanEck’s HODL suffered a combined loss of nearly $130 million.

With massive inflows from IBIT and additional capital from BTC, the US spot Bitcoin ETF group reversed its negative trend yesterday, pulling in around $192 million overall.

These funds showed mixed trends this week, unlike last week when no net hemorrhage was reported. The trend turned negative on Tuesday after posting a profit of $294 million on Monday.

The ARKB fund, which saw inflows of more than $300 million last week, took a big hit. The ETF has recorded about $240 million in redemptions so far this week, nearly wiping out gains from last week. Meanwhile, GBTC outflows appear to have subsided. The fund lost about $5 million on Monday.

Recent performance is consistent with Bitcoin’s price movements. According to CoinGecko, Bitcoin has retreated since peaking at $69,500 last week, currently hovering around $67,000.

Standard Chartered analysts are confident that the biggest cryptocurrency will revisit its previous all-time highs before the next president is elected, increasing the chances of an “Uptober”.

However, the recent decline could dampen the “Uptober” outlook, especially with the US presidential election just around the corner. Bitcoin could face a “sell the news” scenario ahead of a major event.

As the election approaches, investors are often speculating about how the results could affect various asset classes, including cryptocurrencies. These expectations could increase volatility, potentially leading traders to sell assets to lock in profits before the election results are announced.

Bitcoin’s recent price movements are more likely influenced by broader macroeconomic trends than by direct political events. However, significant news related to the election may trigger a reaction from investors who may seek to adjust their portfolios based on perceived risks or opportunities. Some analysts predict that Trump’s victory could lead to a surge in Bitcoin prices due to his pro-cryptocurrency stance.

After the election, markets are likely to get little rest as the next FOMC meeting takes place where the Fed will set interest rates.

The central bank is expected to cut interest rates by 25 basis points as part of its ongoing monetary policy adjustments, which analysts suggest could push Bitcoin prices higher.

Share this article