Bitcoin saw a significant decline over the weekend, with BTC falling from $70,090 on April 11 to $64,400 on April 13. Despite early fears of a wider conflict unfolding in the Middle East and the start of a potential market downturn, Bitcoin's price stabilized around $50,000. As of April 15, it is $66,000.

To understand the nature of these fluctuations (whether they represent simple short-term corrections or more significant changes), it is important to examine the behavior of various market participants, especially short-term and long-term holders.

Short term holders (STH) and long term holders (LTH) react differently to market volatility. STHs are generally more sensitive to price changes and external events and tend to sell their holdings during market declines. In contrast, LTH typically maintains its position through volatility, reflecting its commitment to Bitcoin's long-term value.

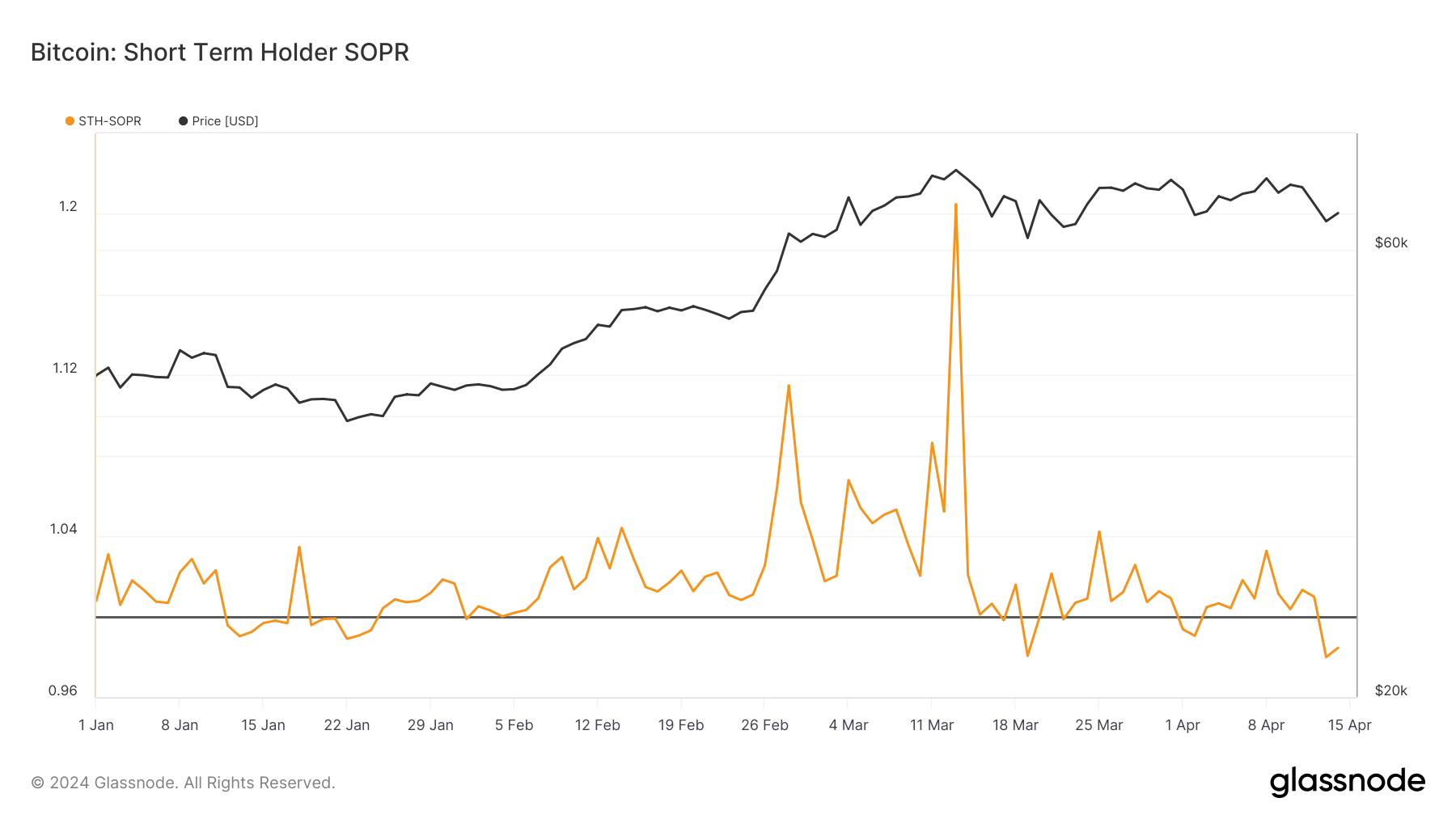

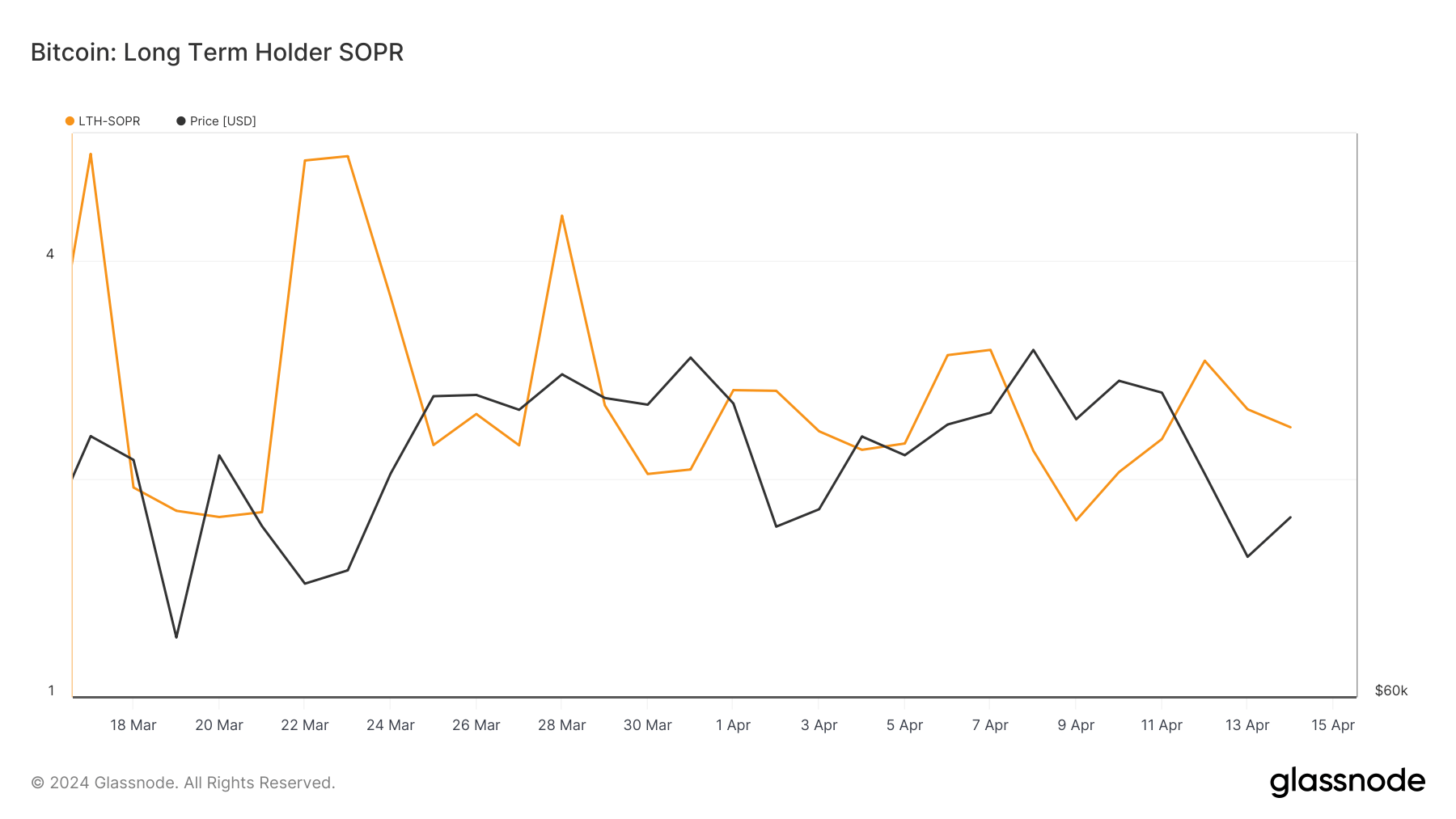

One of the best indicators to assess immediate market reaction is the Spent Output Profit Ratio (SOPR). This measures the percentage of profit realized by coins moved on-chain. SOPR values greater than 1 mean that coins are sold at a profit on average, while values less than 1 mean they are sold at a loss. To understand the nuance, this metric should be analyzed as STH SOPR and LTH SOPR to capture the distinct behavior of the two groups.

During the decline, STH SOPR plummeted from 1.009 on April 12 to a yearly low of 0.979 on April 13. This indicates that short-term holders are selling Bitcoin at a loss. This indicator recovered slightly to 0.984 on April 14, but is still below the break-even point of 1.

When Bitcoin reached highs above $73,000 earlier this year, STH SOPR peaked at 1.204, demonstrating profitable selling by short-term holders. Moreover, on April 13, the Bitcoin consumption price of STH was $65,130, which exceeded the spot trading price of $64,900, indicating that a significant number of STHs were being sold at a loss.

Long-term holders, on the other hand, have shown much more resilience. As Bitcoin price fell below $70,090, LTH SOPR rose from 2.271 on April 11 to 2.913 on April 12. This suggests that long-term holders are still selling at significant profits despite the economic downturn. This number was slightly adjusted to 2.358 by April 14, but remained well above the break-even point.

Just looking at SOPR, we can see that the weekend decline did not shake the confidence of long-term holders. Over the last week or so, the balance of long-term holders has been increasing, while only a small number of those selling in declining markets are realizing profits.

Meanwhile, the behavior of short-term holders showed panic, with many deciding to cut their losses and sell their BTC. This suggests a reactionary approach to market news and price movements and further confirms the long-term trend associated with STH.

The difference in responses between these two groups demonstrates the importance of sector analysis and shows that while short-term sentiment may be shaky, the long-term outlook remains solid.

The post Bitcoin's Weekend Drop Rocks Short-Term Holders appeared first on CryptoSlate.