On-chain highlights

definition:The Puell Multiple is calculated by dividing Bitcoin’s daily issuance value (in USD) by the 365-day moving average of the daily issuance value.

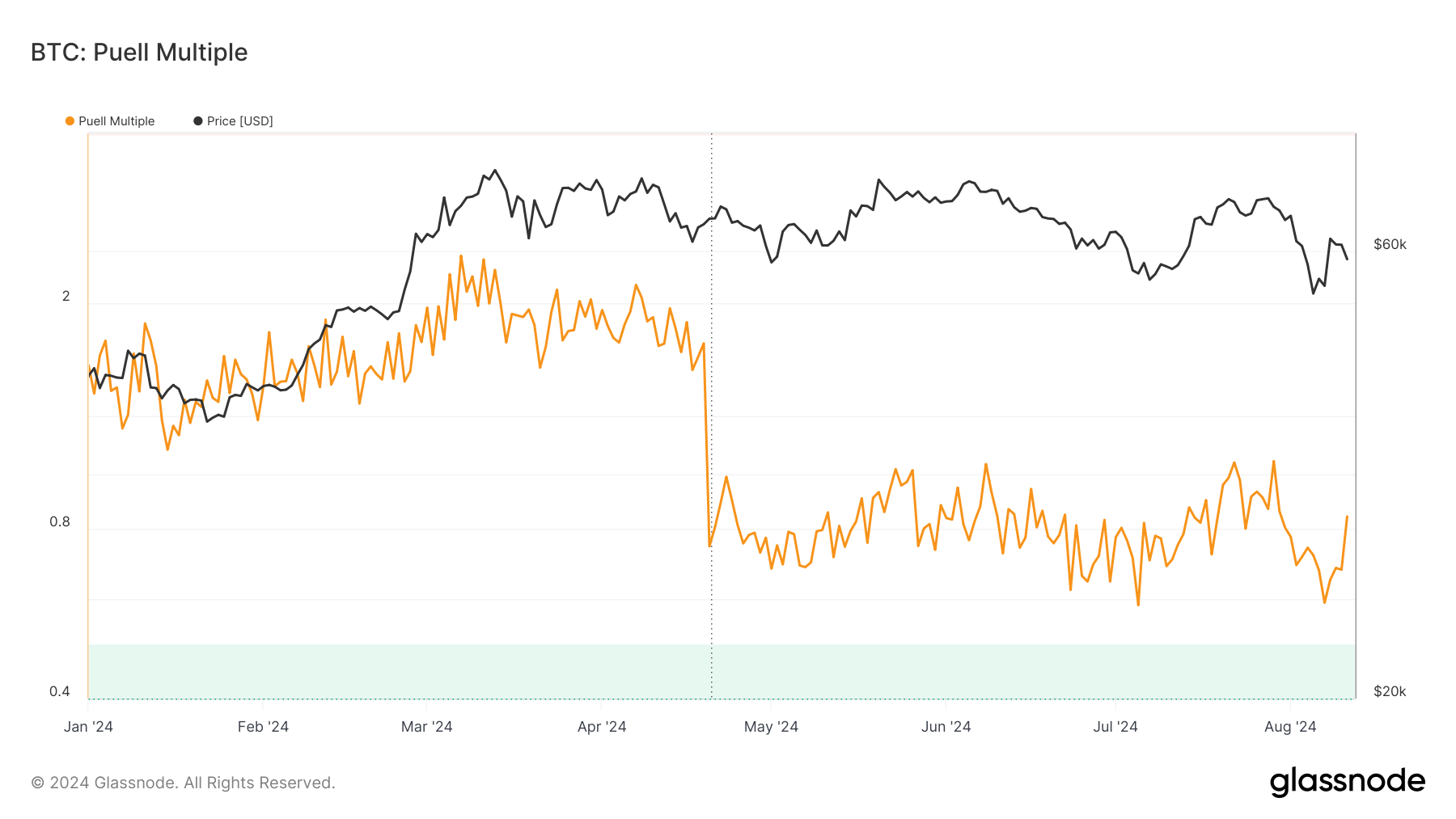

The Puell Multiple, which measures the ratio of Bitcoin’s daily issuance value to its 365-day moving average, fell to 0.8 in April after the halving, indicating that miner profits are under stress.

Historically, these declines have coincided with market bottoms, but this year the recovery appears to have been more prolonged. Despite Bitcoin’s relative price stability, the Puell Multiple has struggled to recover since reaching its low in April, reflecting ongoing market uncertainty.

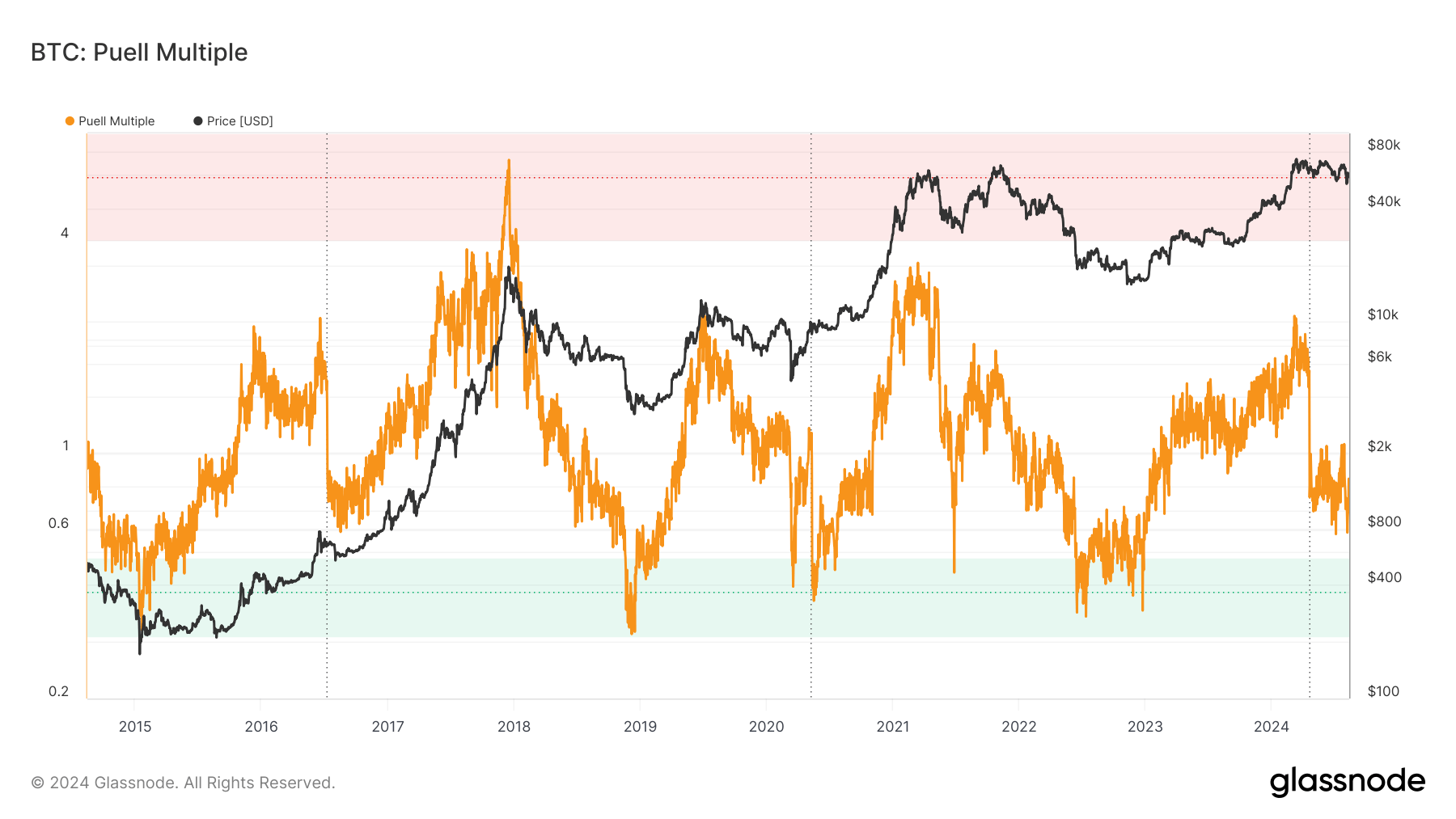

The long-term chart of the Puell Multiple highlights a distinct cyclical pattern that corresponds to major market changes. The peaks of this indicator have historically coincided with strong bull markets, such as those in late 2017 and early 2021, and are often preceded by significant corrections.

In contrast, this indicator typically bottoms during bear markets, signaling low miner profitability and a potential market bottom. Current levels remain well below these historical peaks, suggesting that Bitcoin has shown resilience but has not yet entered an overvalued phase, and may indicate that more upside momentum is needed to reach previous bullish conditions.

The article Bitcoin’s P/E Multiple Struggles to Recover from Post-April Halving Downtrend first appeared on CryptoSlate.