Main takeout

- BITCOIN raised 13%in April despite the broader market sales.

- As the user migrated to another network, the dominance of Ether Lee’s smart contract fee has been greatly reduced.

Share this article

Bitcoin showed the flash of stocks and independence in April and renewed that it is evolving into a true macro hedge. But Vaneck’s recent data tells a different story.

In the monthly summary on Monday, Vaneck analysts say that flagship encryption assets are still closely traded with traditional markets and are promptly synchronized with the main index after short radiation.

Bitcoin showed signs of separation from American stocks in the week ends on April 6. While stocks and gold decreased, Bitcoin rose from $ 81,500 to $ 84,500 on weekends, suggesting potential shifts with independent price behavior.

This divergence hoped that Bitcoin could be able to move away from traditional dangerous asset behaviors to the new highest point. However, the amount of exercise has not lasted for a long time, and the asset soon resumed the transaction according to the stock market.

Vaneck for data from Vaneck Research and Artemis XYZ provides more context in this field.

In early April, the BTC and S & P 500 on the 30 -day moving average correlation dropped to less than 0.25 in early April, but rebounded quickly to about 0.55 by the end of this month.

Nevertheless, Bitcoin was superior to major stock indexes for a month. The NASDAQ composite dropped 1% and the S & P 500 only increased.

Perhaps the volatility of Bitcoin has decreased by 4% in April. Despite the increase in the volatility of the stock market as the tension in designated and trade has increased.

Structural tail wind is being built

According to Vaneck, despite the fact that Bitcoin still acts like dangerous assets in the short term, structural tail winds, including aggressive corporate BTC accumulation, can set long -term radiation stages.

Analysts suggest that individuals, companies, and central banks see Bitcoin as sovereign and correlated shops, which can escape traditional risk assets in long -term action.

According to analysts, Russia and Venezuela, who have already begun to accept Bitcoin’s utility in international trade, are the initial cases of this change.

The accumulation of bitcoin at the company level was activated in April. To summarize, the strategy added 25,400 BTCs to the shares, while the Metaplanet and Semler Scientific also made significant purchases.

The main highlight of this month was the launch of the new venture XXI (TWENTY ONE) formed by Softbank, Tether, and Cantor Fitzgerald to acquire more than $ 3 billion Bitcoin.

As institutional exposure moves from speculative betting to long -term strategic positioning, Bitcoin’s role in the company’s loan control table is increasing.

Encryption is found by chance as Bitcoin keeps maintaining steadily.

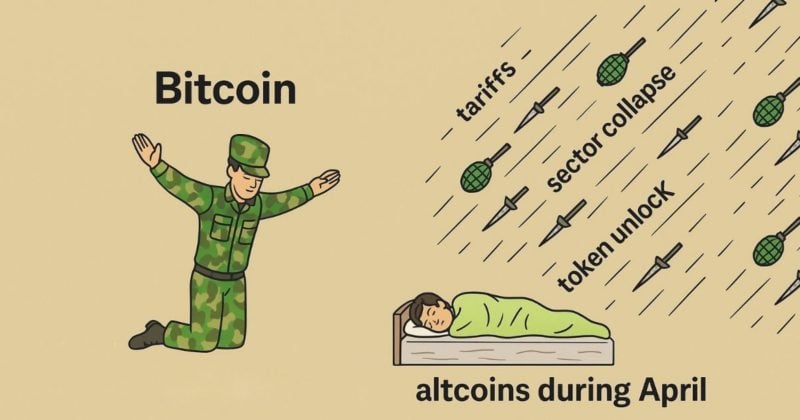

Bitcoin avoided tariffs, but Altcoins were not lucky.

According to Vaneck, Layer 1 Networks, along with Ethereum, Solana and SUI, led to a decrease with a big blow between 66% and 68% in January’s highest scores. Marketvector Smart Contract Leaders Index (MVSCLE) decreased by 5% in April and has now fallen 34%.

The slump followed the sale of global stocks caused by new trade tariffs due to unlocking and severe losses in speculative sectors such as Defi AI, DESCI and AI Agent. Meme Coin trading volume also increased 93% between January and March.

However, according to Vaneck, some chains have met trends, including SUI, Solana and Stacks.

Solana has risen 16%, increasing the interest of network upgrades and institutional finance. Ethereum, on the other hand, dropped 3%to another 3%, leading to poor colleagues as commission erosion and layer 2 competition continued.

Solana’s April was quiet but constructive. The network has launched SIMD-0207, a computing upgrade that sets the stage of future throughput profit. Solana Foundation also began to depend on the delegation to prioritize the ecosystem value that presents a low performance validation that depends on the delegation.

Validator Dynamics is a key part of chain governance, as about 18%of the Staked SOL is managed on the basis. Some questions of MEME Coin Sustainability have continued to dominate trading activities. In April, MEME COINS accounted for 95%of all DEX activities in the chain except SOL and Stablecoin.

Sui’s strengths go beyond the price. In April, the daily Dex volume increased by 45%, placing one of the most active chains. It was the top 10 in the Smart Contract Platform revenue and raised the highest stablecoin turnover to 716%. Core developer Mysten Labs was praised for the speed and response of the crowded class.

In contrast, Ether Reeum faces the mounting pressure. The hierarchy 1 fee revenue dropped from 74%two years ago to about 14%. Developers have proposed major changes, including switching to RISC-V architecture for faster ZK-Proofs, increased 100 times gas restrictions through EIP-9698, and running parallel transactions according to EIP-9580.

But Ethereum’s tier 2 continued to work with users. The placement of Flashbots for the basic and optimism reduced the confirmation time to 200 millimeters, and Arbitrum introduced gas payment with non -ETH tokens to further weaken the role of ETH. The core dilemma still remains. Hierarchy 2 depends on Ether Leeum’s security while eroding the fee base.

TRON and Hyperliquid, meanwhile, were the highest in more daily blockchain revenue than Solana and Ethereum.

According to Vaneck, TRON’s dominance in the niche market of Stablecoin and hyperklicade helps to generate $ 1.7 million and $ 1.4 million every day, respectively.

Speculative energy continued to disappear. At one time, the meme coin that drove the volume by crossing the chain saw trading activities and emotion plunge. MEME COINS accounted for 35% of Solana’s DEX activities in April, but Marketvector Meme Coin Index fell 48% year -on -year, but fell 48% every year.

Share this article