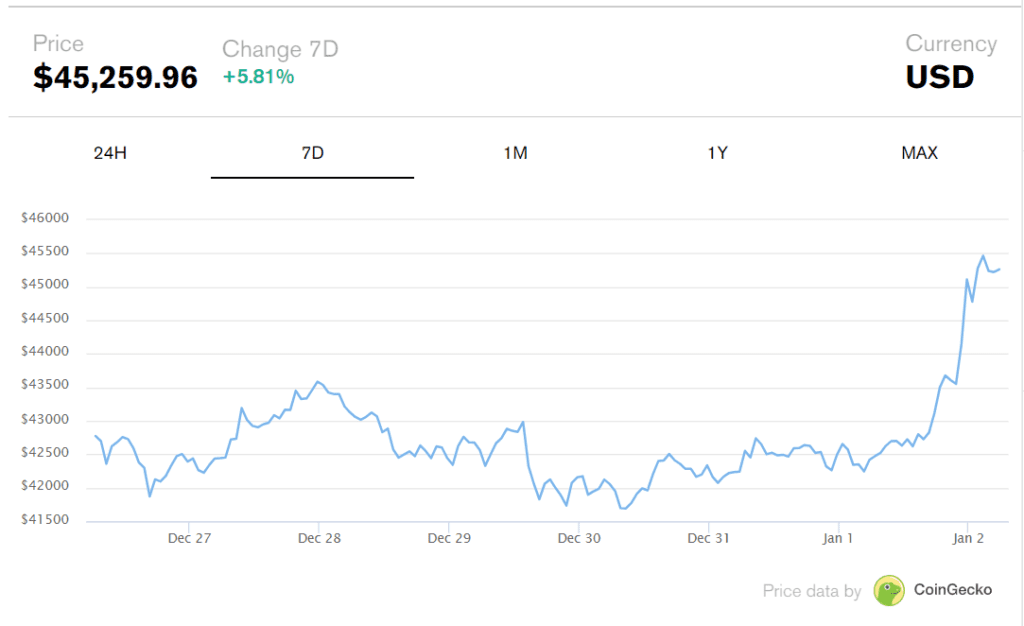

bitcoin It surged on New Year’s Day, briefly reaching the $45,000 threshold for the first time since April 2022. The cryptocurrency’s recent rise mirrored the volatile highs and lows seen in January of the previous year.

The price roller coaster has seen Bitcoin oscillate above $45,000 several times, with intermittent drops as low as $36,000, reminiscent of the wild swings observed during the same period in 2022. Bitcoin reached $45,000 on April 5, 2022, and fell significantly to $15,742 on November 9, according to CoinGecko data. Despite this volatility, on New Year’s Day market capitalization exceeded $836 billion and trading volume reached $22 billion.

BTC’s upward trajectory and SEC’s ETF decision

Bitcoin is currently up more than 171% since this time last year, with notable gains of 13% over the past month and 5% on the day. The cryptocurrency started 2023 at less than $17,000 per coin, and has shown a surprisingly bullish trend since then. The general anticipation of the SEC’s decision on a Bitcoin spot ETF was the main reason for this surge.

Throughout 2023, the cryptocurrency community waited for the SEC’s approval of a Bitcoin spot ETF, but numerous deadlines passed without official action on the pending application. Will 2024 finally see the long-awaited approval? And what impact could this have on Bitcoin’s price trajectory?

Also Read: Bitcoin Millionaires Soar: Over 90,000 Addresses Now Hold $1 Million Worth of BTC

Bitcoin Market Capitalization Milestones and Competitive Position

Beyond the numbers, hitting $45,000 represents a psychological barrier for investors, often boosting confidence and sparking trading activity. Bitcoin’s rise to this level signals an impending challenge to surpass previous year’s highs, starting just below $50,000.

The surge in market capitalization of cryptocurrencies paints an impressive picture. Bitcoin’s value, now exceeding $855 billion, has surpassed Tesla’s market capitalization and has since surpassed Warren Buffett’s Berkshire Hathaway Inc. and Meta Platforms (formerly Facebook), proving its dominance in the financial landscape.

Key Takeaways:

- Impact of SEC’s ETF Decision: The long-awaited SEC ruling on the Bitcoin spot ETF continues to impact Bitcoin’s price action, sparking bullish momentum.

- Market Capitalization Milestone: Bitcoin’s surge boosts its market cap, surpassing major companies such as Tesla, Berkshire Hathaway, and Meta Platforms, and highlights Bitcoin’s growing importance in the world of finance.