Bitcoin surpassed $57,000 on February 27, reaching its highest level since November 2022. This surge, which saw the price skyrocket from $54,000 to $57,300 in 24 hours, led many to see it as the start of a bullish rally, especially for Bitcoin. half a year.

Despite the huge profits, the expected wave of liquidations did not follow.

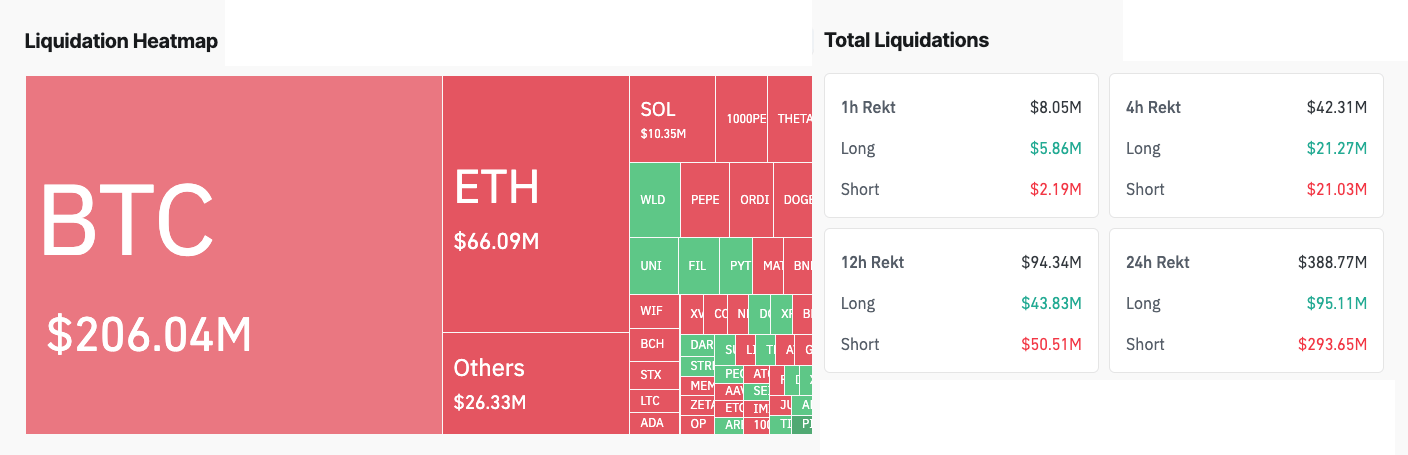

Between February 26 and February 27, 86,351 traders experienced liquidations, totaling $387.15 million. However, Bitcoin-related liquidations amounted to approximately $206 million. Divided into $175 million short and $30 million short, this figure shows that the market remains resilient even in the face of unexpected large-scale liquidations.

The relatively quiet reaction in terms of liquidations following Bitcoin’s sharp price rise can be attributed to a number of factors that mitigate the impact of these volatile movements on the derivatives sector of the market.

First, the liquidation distribution indicates that the market is not significantly leveraged. In scenarios where market sentiment is overwhelmingly bullish or bearish, sudden price movements for multiple positions can trigger a series of liquidations.

However, in this case, the more balanced positioning suggests that traders were not overly tilted toward a bearish outlook, which would have made them vulnerable to pressure from a price surge.

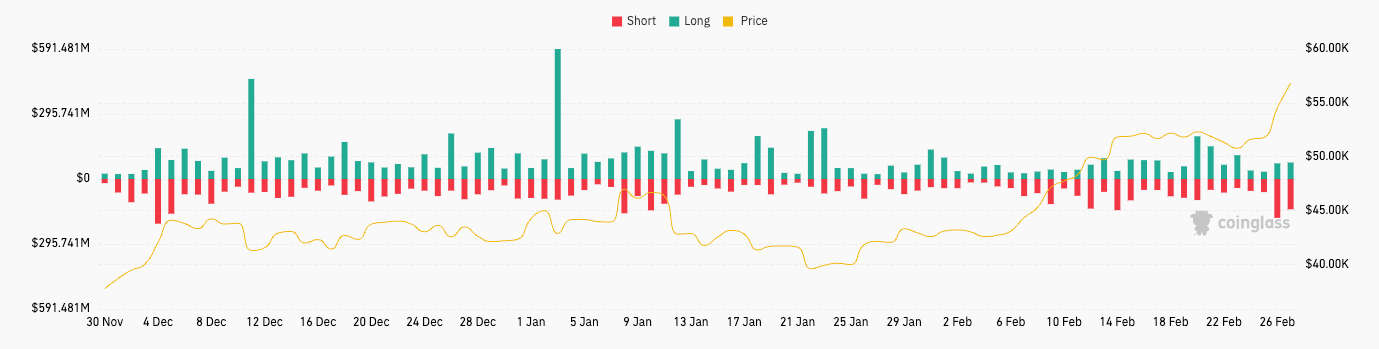

This balanced liquidation is not an unusual phenomenon, but part of a consistent pattern observed in recent weeks. BTC liquidation totals on February 27 were significant but did not deviate much from the daily averages over the past few weeks.

This consistency signals a shift toward more conservative leverage levels among market participants and a more even distribution across bullish and bearish positions. This strategic positioning essentially cushions the market from the shock of rapid price movements, mitigating the risk of large-scale liquidations.

This is consistent with: CryptoSlate’s Previous analysis of the derivatives market has shown that Bitcoin options are almost equally split between calls and puts. An increase in open interest in February signaled a prevailing bullish outlook in the market, while a balanced call-to-put ratio signaled caution among traders.

This caution, seen in defensive strategies and a notable rise in bearish bets, likely prevented a domino effect of cascading short-term liquidations that could eat into Bitcoin’s daily returns.

The post Bitcoin surges to $57,000 but fails to spark liquidation storm, defies expected trend appeared first on CryptoSlate