Bitcoin (BTC) Enthusiasts were greeted with excitement as the leading cryptocurrency soared above $57,000 after a long period of consolidation. With an incredible 9.62% surge, the price of Bitcoin soared to $56,486, marking a significant milestone in the cryptocurrency market. The surge has not only reignited investor optimism, but also pushed Bitcoin’s market capitalization above $1.1 trillion for the first time since 2021.

Disconnect from traditional markets: BTC vs. S&P 500

Surprisingly, Bitcoin’s surge on a day when the S&P 500 was down highlighted Bitcoin’s growing independence from traditional stocks. While the S&P 500 ended the day down 0.5%, Bitcoin defied the odds with an impressive 10% gain. This separation from traditional markets highlights the maturity of the cryptocurrency market and signals a shift in investor sentiment towards digital assets.

Bitcoin’s performance this year has outpaced traditional assets such as stocks and gold, with its price reaching its highest level against the precious metal in more than two years. Bitcoin’s price has surged 33% since the beginning of the year, not only capturing the attention of institutional investors but also sparking the rise of alternative cryptocurrencies such as Ethereum and Binance Coin (BNB).

Bitcoin ETF Breaks Records: Institutional Adoption Surges

Since January 11, a staggering $5.6 billion has flowed into various Bitcoin exchange-traded funds (ETFs) launched in the U.S., indicating a significant expansion in institutional interest. These capital inflows into Bitcoin ETFs and the impending Bitcoin halving have strengthened positive sentiment towards the cryptocurrency market.

On Monday, Bitcoin ETFs collectively hit an all-time high with trading volume of $2.4 billion, with BlackRock’s IBIT alone accounting for more than $1 billion. Additionally, Grayscale’s GBTC recorded its lowest outflows to date, indicating a surge in institutional capital allocation despite uncertain market conditions.

It’s official, the New Nine Bitcoin ETF broke its all-time trading volume record today with $2.4 billion. That barely beat the first day, but is about double the recent daily average. $GO Of that amount, it earned $1.3 billion, breaking the record by about 30%. pic.twitter.com/MiCs1rzttM

— Eric Balchunas (@EricBalchunas) February 26, 2024

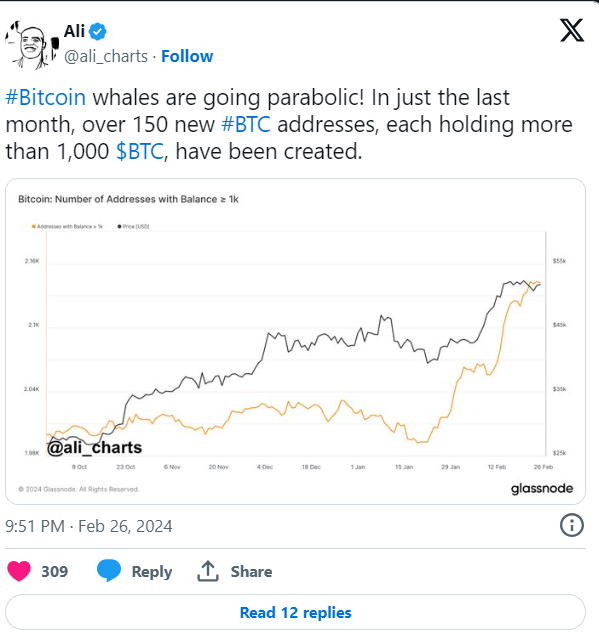

MicroStrategyThe prominent business intelligence company further fueled the optimism by announcing this month that it had acquired approximately 3,000 additional Bitcoin tokens, bringing its total Bitcoin holdings to approximately $10 billion. Moreover, whale purchases have surged over the past month, with more than 150 new addresses each holding more than 1,000 BTC created during this period, indicating growing confidence among large investors in Bitcoin’s long-term potential.