Posted: March 4, 2024 3:47 AM Updated: March 4, 2024 3:52 AM

Correction and fact check date: March 4, 2024, 3:47 AM

briefly

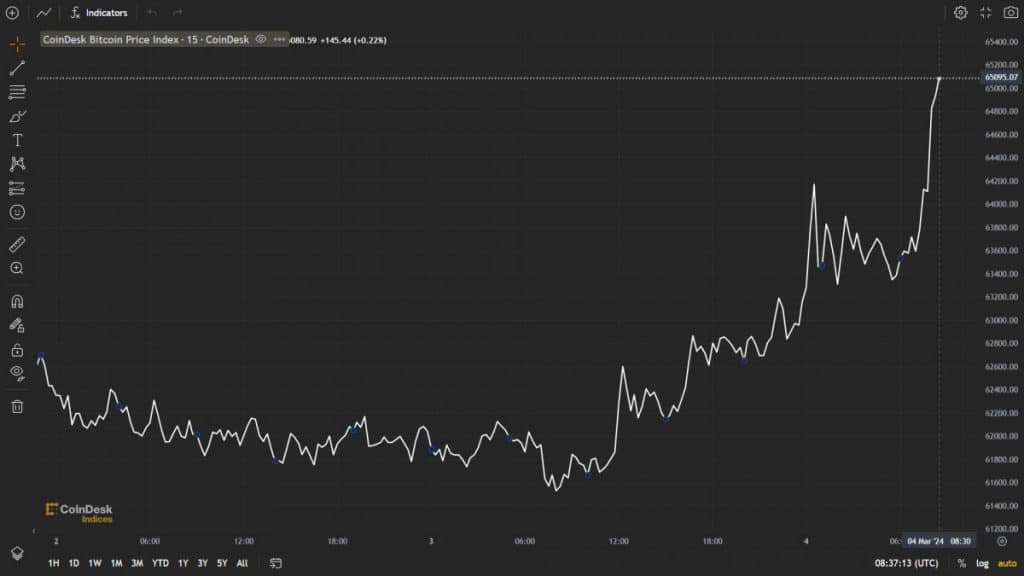

Bitcoin (BTC) price surpassed $65,000 and reached $65,520 with a 6% growth rate, marking its highest level since November 2021.

Bitcoin (BTC) price has surged to a new high, surpassing $65,000 ($65,520) and remains about 7% below its all-time high hit in November 2021. According to the analysis, BTC is currently showing upward momentum above the $62,000 resistance level. It indicates a breakout and potential upward move towards the $70,000 range.

After last week’s surge, Bitcoin price maintained a strong position above the $60,000 support zone, laying the foundation for a new upward trend. Afterwards, the uptrend began and surpassed the resistance level of $62,000.

In particular, on the hourly chart of the BTC/USD pair, a major bearish trend line was broken at the resistance level of $62,300. The pair broke above the 76.4% Fibonacci retracement level moving down from the $63,583 swing high to the $60,108 low.

Bitcoin is currently trading above $65,000 and above the 100-hour simple moving average (SMA). Immediate resistance is observed near $63,800, with the next resistance potentially at $66,500. A move above this could set the stage for further upside towards the $70,000 resistance zone.

If the bullish momentum continues, the price is likely to exceed $66,000. A further upside could potentially push the price towards the 1.618 Fibonacci extension level derived from the downward move between the $63,583 swing high and $60,108 low located at $65,730.

A downside correction is likely if Bitcoin struggles to break above the $64,000 resistance zone. Immediate support for the downtrend is found near the $62,750 level. Initial key support is at $62,250 as indicated by the 100-hour simple moving average (SMA).

A close below $62,250 could lead to a noticeable decline towards the $61,000 area. Further losses could lead the price towards the $60,000 support area.

The latest price action came during daily open interest, which measures the total value of all outstanding Bitcoin futures contracts across exchanges. Bitcoin futures on centralized exchanges have reached an all-time high of $27.53 billion, according to Coinglass data. Additionally, spot Bitcoin ETFs have seen a significant increase in assets under management, with BlackRock’s IBIT reaching $10 billion last week.

Cumulative trading volume for spot Bitcoin ETFs reached $73.91 billion as of March 1, compared to $29.19 billion on February 1.

disclaimer

In accordance with the Trust Project Guidelines, the information provided on these pages is not intended and should not be construed as legal, tax, investment, financial or any other form of advice. It is important to invest only what you can afford to lose and, when in doubt, seek independent financial advice. Please refer to the Terms of Use as well as the help and support pages provided by the publisher or advertiser for more information. Although MetaversePost is committed to accurate and unbiased reporting, market conditions may change without notice.

About the author

Alisa is a reporter for Metaverse Post. She focuses on everything related to investing, AI, metaverse, and Web3. Alisa holds a degree in Art Business and her expertise lies in the fields of art and technology. She developed a passion for journalism through her work with VCs, notable cryptocurrency projects, and science writing. You can contact us at (email protected).

more articles

alice davidson

Alisa is a reporter for Metaverse Post. She focuses on everything related to investing, AI, metaverse, and Web3. Alisa holds a degree in Art Business and her expertise lies in the fields of art and technology. She developed a passion for journalism through her work with VCs, notable cryptocurrency projects, and science writing. You can contact us at (email protected).