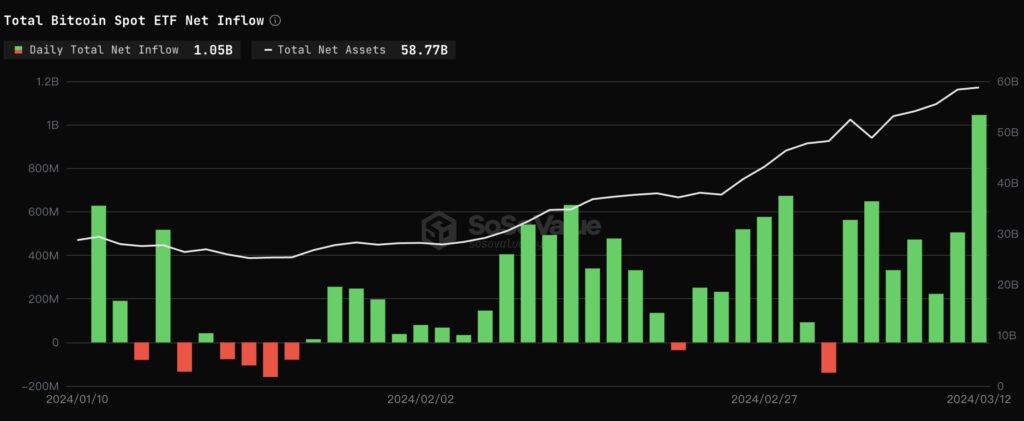

The Spot Bitcoin ETF achieved unprecedented success, with daily net inflows reaching $1.05 billion, sending Bitcoin price soaring to an all-time high of $73,000. The surge in ETF activity marks a significant milestone for the cryptocurrency market and highlights investors’ growing appetite for digital assets.

Spot Bitcoin ETF Breaks Records: Day of Noteworthy Inflows

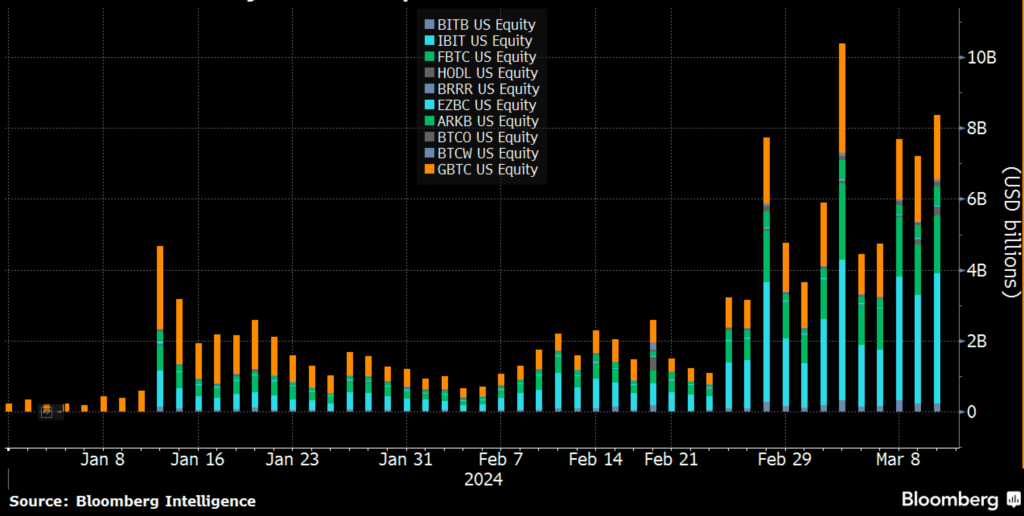

March 12 was a watershed moment for spot Bitcoin ETFs, with net inflows soaring to an unprecedented $1.05 billion. SoSo value. This surge in inflows coincides with the ETF’s second-highest trading volume day, indicating strong investor interest in Bitcoin and related investment vehicles. Notably, inflows of over $1 billion represent the highest daily net inflows since the launch of Bitcoin ETFs in the United States.

Bitcoin price reaches new peak: $73,000 milestone reached

Bitcoin’s meteoric rise saw its price surge more than 2% in 24 hours, breaking the $73,000 barrier and setting a new record high. The resilience and bullish momentum of cryptocurrencies reflects investor confidence amid a backdrop of increasing institutional adoption and favorable market dynamics.

Spot Bitcoin ETF sparks market frenzy

The unprecedented net inflow of $1.05 billion into spot Bitcoin ETFs highlights surging demand for the digital asset among both institutional and retail investors. Major ETFs, including BlackRock’s iShares Bitcoin ETF (go) VanEck Bitcoin Trust ETF (hoddle), has witnessed significant inflows, indicating a broader trend of capital inflows into cryptocurrency investment vehicles. VanEck’s decision to cut management fees to 0% further amplifies investor interest, accelerating competition among ETF providers.

Also Read: BlackRock’s Bitcoin ETF Surpasses MicroStrategy’s Crypto Reserves

Bitcoin futures and options market flourishes

With Bitcoin’s record performance, the futures and options markets are experiencing a flurry of activity, with total open interest reaching unprecedented levels. CME Bitcoin futures open interest hit a new milestone of $11.47 billion, reflecting institutional preference for Bitcoin derivatives despite concerns about rising funding rates. Market sentiment remains buoyant amid predictions that Bitcoin will ultimately surge to $100,000, highlighting continued optimism surrounding the cryptocurrency’s future trajectory.