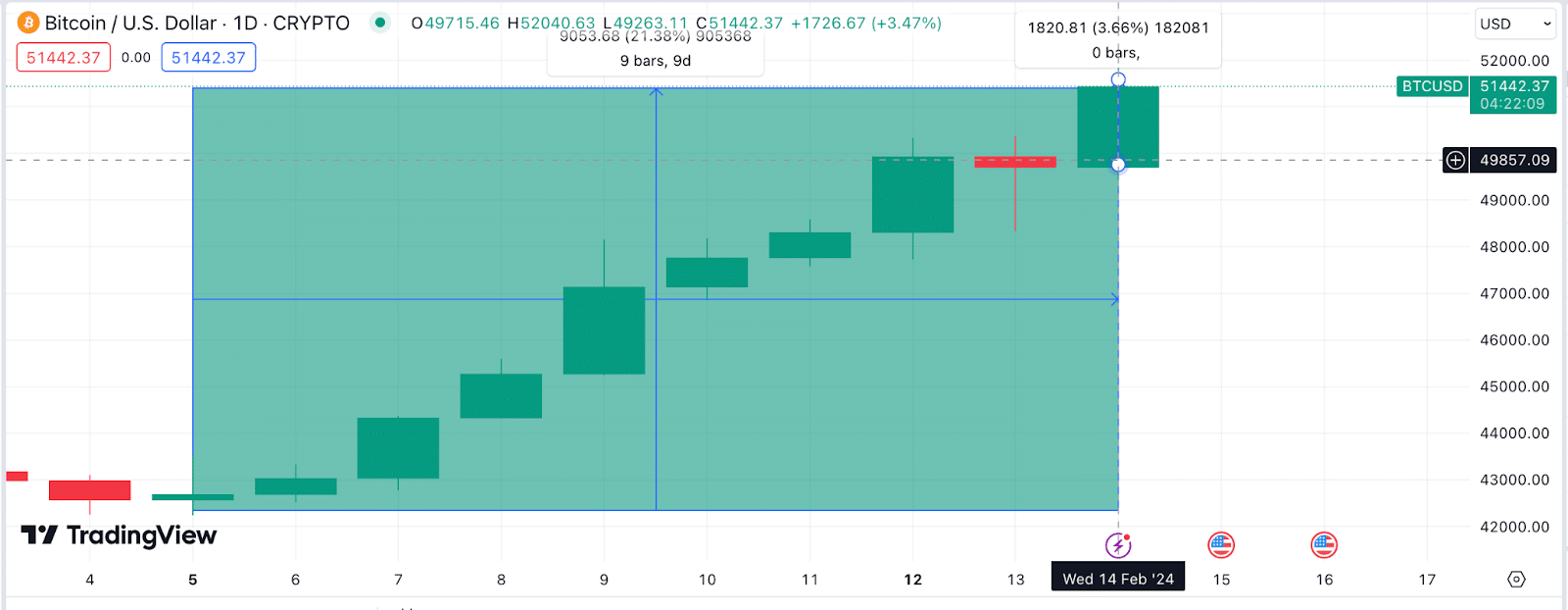

Bitcoin (BTC) price broke above $51,000 on February 14, forming a rare Valentine’s Day winning pattern, and ETF inflows suggest a retest of $55,000 is possible.

Bitcoin made history on Valentine’s Day, with the price of BTC rising to a New Year’s high of $52,040 within a single day period on February 14.

Bitcoin records Valentine’s Day winning streak for 5 years in a row

Thanks to an unusually high buying trend from institutional investors, the price of BTC surpassed $52,000 for the first time since 2021, putting the month-on-month gain at 20%.

Data shows that over the past four Valentine’s Days since 2020, the price of Bitcoin has risen 1.3%, 3.03%, 1.13%, and 1.9%, respectively.

BTC price rose 3.66% during the daily period on February 14 to a high of $52,040, extending its Valentine’s Day winning streak to five years in a row.

Breaking it down further, starting in 2020, a holder who bought BTC the night before Valentine’s Day and sold it at midnight would have made a total profit of $4,196.

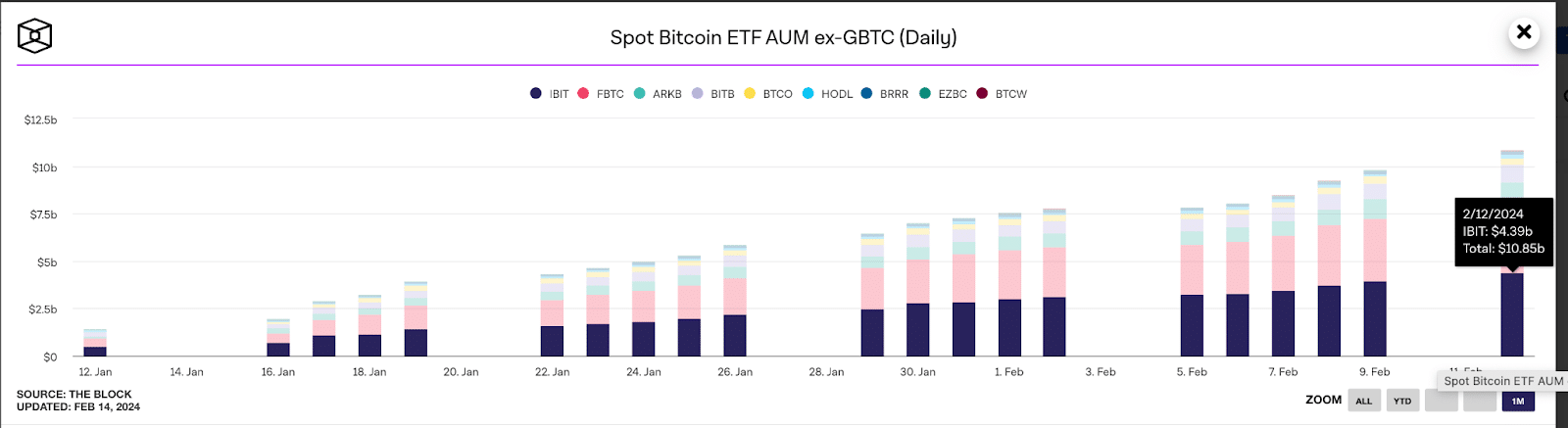

Beyond the price chart, the BTC spot ETF has received significant capital inflows this week, which could lead to an uptrend towards $55,000.

Bitcoin ETF AUM exceeds $10 billion.

In another strong Valentine’s Day record, the BTC spot ETF recorded net inflows of $631 million. Investors have stepped up capital inflows into spot ETF derivatives this week as initial uncertainty cools the multi-billion dollar sell-off in Grayscale (GBTC).

As of February 14, the cumulative assets under management (AUM) of all 10 newly launched spot ETF products recorded $10.9 billion.

ETF companies captured in TheBlock’s calculations include BlackRock, Fidelity, ARK Invest/21Shares, Bitwise, Franklin, Invesco/Galaxy, VanEck, Valkyrie, WisdomTree, and Hashdex.

As of their first day of trading on January 11, these companies had a combined AUM of $851 million. This means that capital stock has increased by about 9.2% over the last 31 days, or 1,150%, for a cumulative daily growth rate of $77 million per day.

Effectively, the chart shows that investors are becoming increasingly confident after an initial few weeks of uncertainty, reflected in accelerated capital inflows.

If this buying trend continues at the current pace, BTC price appears poised for another rally towards the $55,000 region in the coming days.