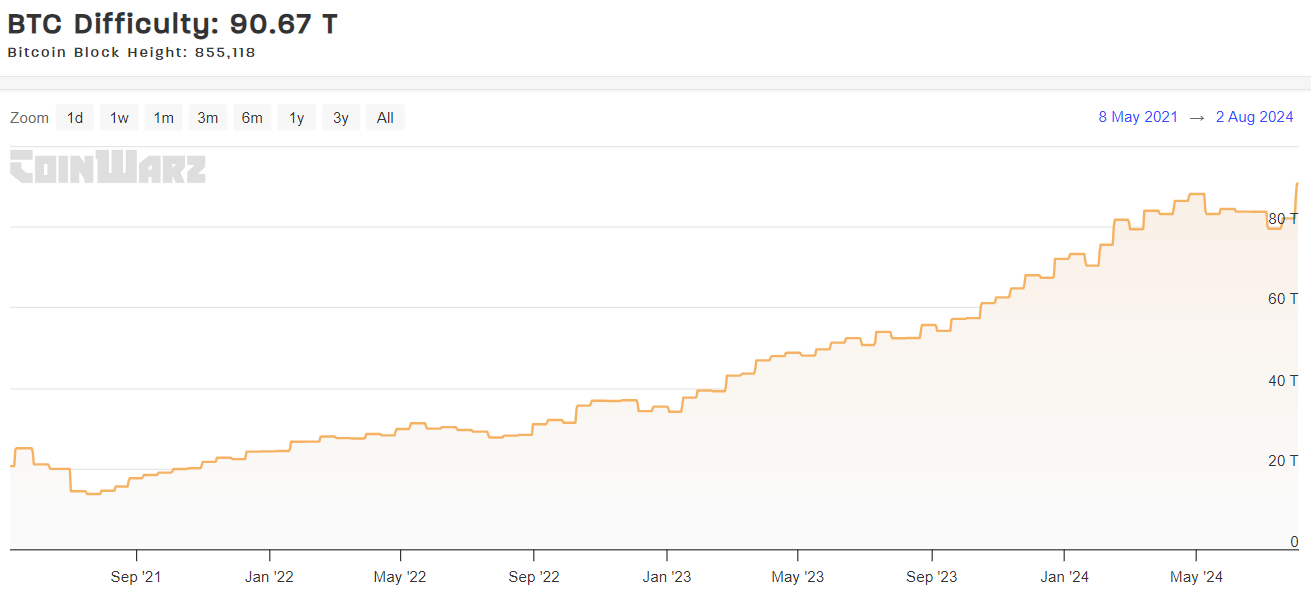

- Bitcoin’s network difficulty reached an all-time high of 90.67 trillion as of August 2, 2024.

- Bitcoin’s hash rate reached a record high of 677 EH/s on July 27, strengthening network security.

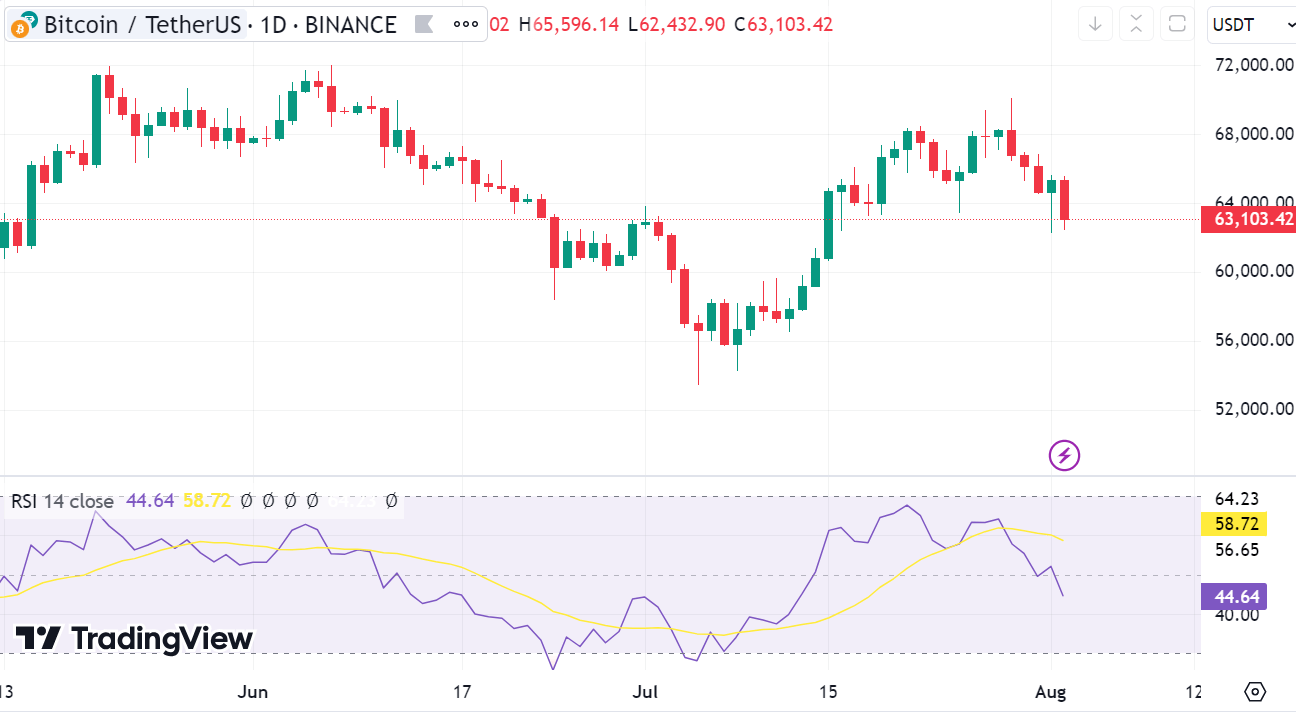

- If Bitcoin’s RSI reaches 44, it could potentially signal a sell-off. The price could test $58,000.

According to data from CoinWarz, Bitcoin will reach 90.67 trillion on August 2, 2024, setting a new record for network difficulty.

This milestone marks a significant rebound after three months of reduced difficulty and signals miners’ regained confidence in the cryptocurrency network.

A higher difficulty means that more computing power is needed to mine new Bitcoin blocks, which could potentially increase operational costs and affect Bitcoin’s future supply and price dynamics.

Bitcoin’s hash rate also hit an all-time high.

On July 27, Bitcoin’s hash rate soared to a record high of 677 EH/s, reflecting the robust and secure network infrastructure. This peak suggests increased competition among miners and reinforces the network’s resilience to potential security threats.

A higher hash rate not only indicates increased mining activity, but also increases investor confidence, which has the potential to have a positive impact on the Bitcoin price.

BTC Price Downward Pressure Increases

Bitcoin is currently trading at $63,103.42, up 0.17% over the last 24 hours. The cryptocurrency is fluctuating between $62,248 and $65,593, suggesting a modest recovery trajectory despite recent volatility.

If this trend continues, Bitcoin could avoid the $62,000 resistance level, potentially opening the way for new all-time highs.

However, Bitcoin’s Relative Strength Index (RSI) is at 44.64, indicating that the cryptocurrency is approaching a sell-off state.

A declining RSI indicates a decline in bullish momentum, and if bears strengthen, Bitcoin could test the next support level of $58,000. If market pressure persists, further declines could follow.

Overall, Bitcoin’s network difficulty and hashrate increase underscores the strengthening and competitive mining environment. These factors are essential to assessing the health and security of the network as Bitcoin navigates its ongoing price volatility.