quick take

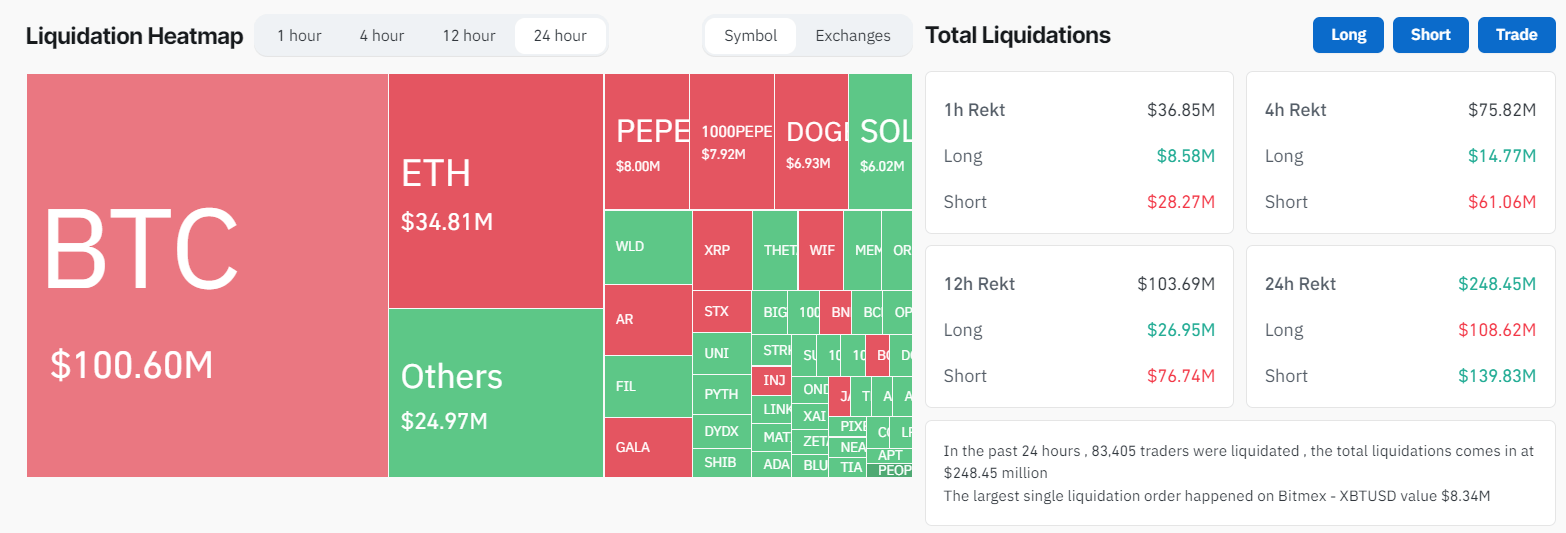

Bitcoin is currently showing strong market performance, starting at around $57,000 per day and heading towards the $60,000 benchmark. A significant wave of liquidations worth approximately $250 million has hit the digital asset markets in the last 24 hours. According to Coinglass, this is a liquidation worth approximately $140 million, indicating a slight bias toward short selling.

During the same period, Bitcoin experienced $100 million worth of liquidations, mainly due to short selling, which amounted to $70 million, according to Coinglass data.

At the same time, Exchange Traded Fund (ETF) inflows recorded its third-best performing day, highlighting the growing interest of institutional investors in this digital asset. A notable mention is BlackRock, which posted a record daily performance with net inflows of $520 million.

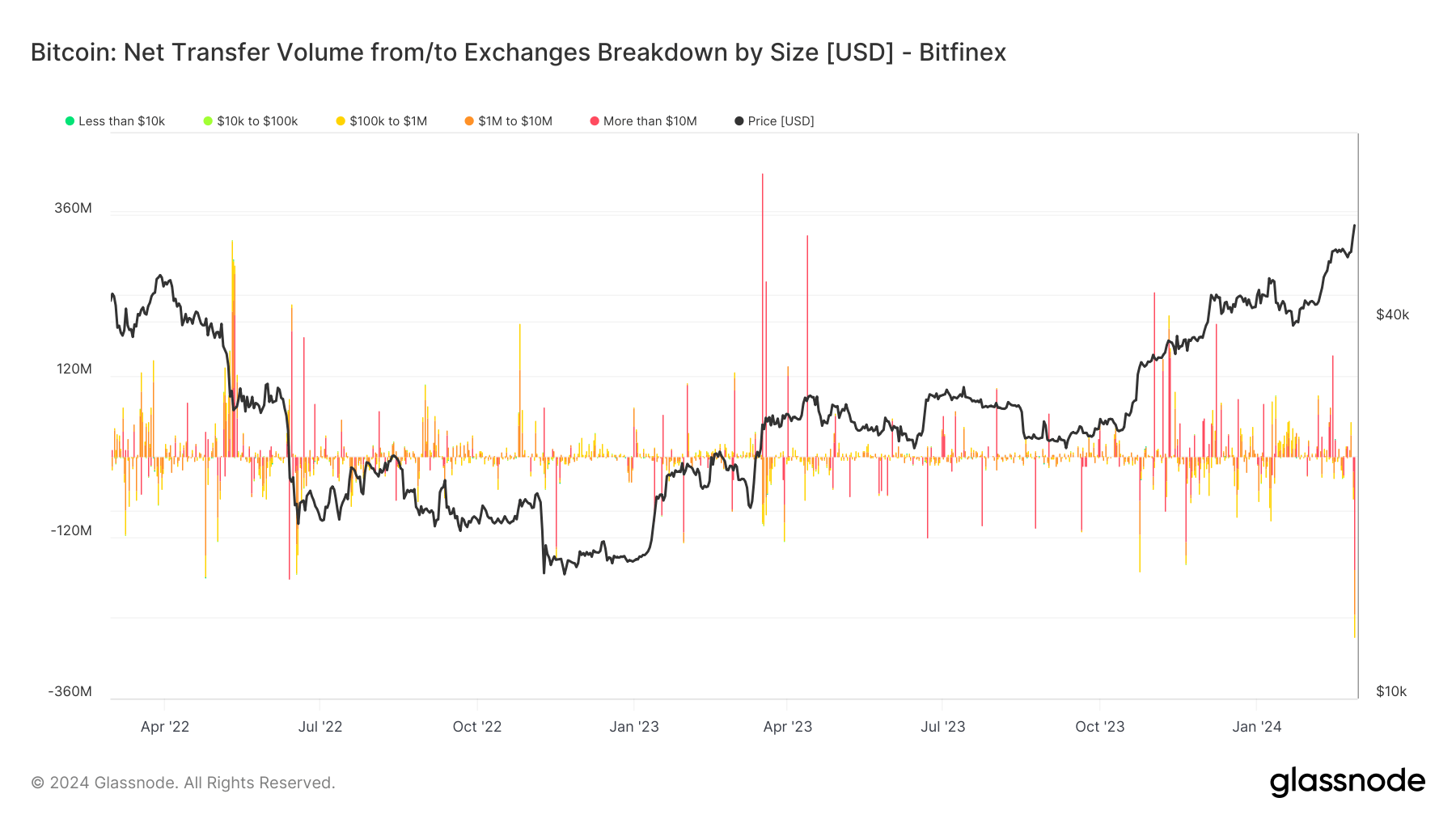

On this day, Bitfinex recorded the largest Bitcoin withdrawal since 2021, exceeding $240 million. This significant offload, estimated to be worth 5,000 Bitcoins, is primarily due to large-scale whale activity.

The post Whale Trading and ETF Records Give Bitcoin a Push toward $60,000 appeared first on CryptoSlate.