- Altcoins surge: Altcoins saw significant growth in 48 hours, generating over $48 billion in revenue and reshaping the cryptocurrency landscape.

- Bitcoin’s Position: Despite Bitcoin’s decline in dominance, Bitcoin’s holding power remains strong, especially with the potential approval of a spot ETF looming.

Cryptocurrency investors have seen a surge in altcoin activity. Bitcoin’s dominance declines It has been hovering around 54% for the past few days before increasing to 53%. Over the past 48 hours, more than $48 billion has flowed into altcoins into the market, reshaping the cryptocurrency landscape and hinting at a potential shift in market dynamics.

Altcoin momentum growth

Altcoins have experienced significant surges over the past two days, increasing their overall market capitalization (excluding Bitcoin) by 6.83% to $48.66 billion. Notable altcoins such as Solana and Optimism showed impressive gains of between 14% and 31% in a single day.

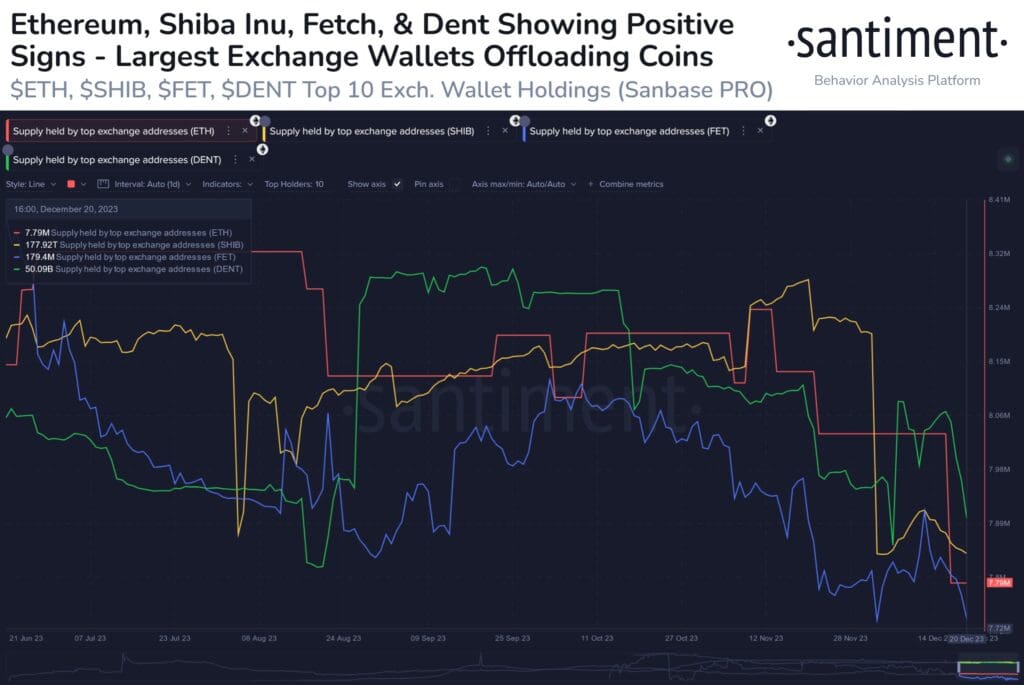

This surge is the culmination of ongoing accumulation observed in recent weeks, which has resulted in significant assets being moved out of exchange wallets. Coins such as Ethereum, Shiba Inu, Fetch, and Dent have recorded significant outflows from exchange wallets, indicating a shift to long-term asset holding strategies. Over the past three months, approximately $778 million worth of ETH, $54.6 million worth of SHIB, and approximately $48 million worth of FET have been withdrawn from the exchange’s wallets.

Market Sentiment and Bitcoin Retreat

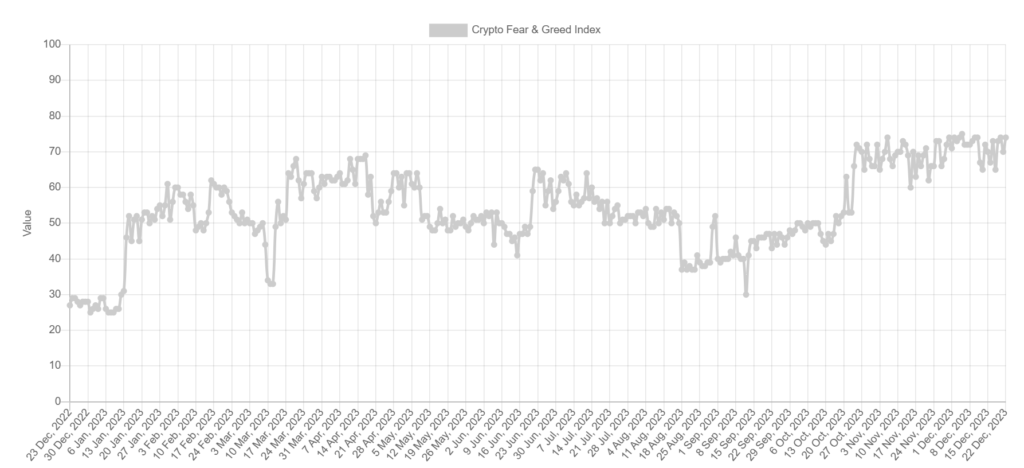

Market sentiment reflected in the Crypto Fear and Greed Index currently displays greedy sentiments, indicating optimistic expectations. Prolonged greed can often trigger profit-taking selling by investors, potentially leading to a market correction. However, despite this clear bullish sentiment, the likelihood of a significant decline in altcoins remains uncertain.

Bitcoin Dominance and Altcoin Season

Bitcoin’s dominance serves as a key indicator of the overall health of the market. The decline in Bitcoin dominance means the increasing influence of altcoins in the market, often referred to as “altcoin season.” Bitcoin’s dominance is now down to 53%, a slight change after failing to surpass 54%. However, this decline does not necessarily signal a change in market trends. Bitcoin remains in an excellent position, especially in anticipation of imminent spot ETF approval.