The global cryptocurrency market capitalization is currently hovering around $3.4 trillion on Sunday, down from an additional $170 billion in valuation compared to last week.

The previous all-time high of $3.8 trillion (18.7% surge) was helped by impressive price action in Bitcoin (BTC), which soared to $99,655 in sight of $100,000. Last check on Sunday morning, it was just under $97,000.

Here are some companies in the gaming market sector that performed well last week:

SAND retests 6-month resistance.

Despite starting the week on a weak note due to increased volatility, gaming token Sandbox (SAND) ended last week up 11%.

From November 17th to 21st, SAND fell 17%. However, the recovery followed after the bears found firm support in the Fib. 0.236($0.3245). On November 23, SAND rallied above the Fib. It hit the June high of $0.4591 with resistance of 38.2% at $0.3871.

SAND rebounded further in the new week after closing last week up 11%, retesting six-month resistance today at $0.6525, up 31%. The asset’s hopes for a sustained uptrend depend on whether it can clear this resistance and head towards the Fib. 1.618 ($0.9178).

Sandboxes are part of a broader metaverse trend that provides virtual spaces for users to socialize, trade, and create. High-profile collaborations with brands and personalities like Adidas and Snoop Dogg have led to increased visibility.

MANA rises 51%

Decentraland (MANA) followed a similar trajectory to SAND. However, MANA showed greater resilience, ultimately ending the week up 51%.

After falling just 6% from November 17-20, MANA staged a stunning comeback this new week, reaching a nine-month high above $0.72.

However, MANA appears to be forming a rising wedge pattern, suggesting that sellers are struggling to maintain control of the market. Additionally, RSI surged to 84.21, which despite its bullish nature indicates that MANA has entered overbought territory.

If MANA remains within the wedge at this level, declines could continue this week. Nonetheless, the uptrend could continue if it can cross MANA’s upper trendline and close above $0.7280.

Decentraland launched its ICO in 2017 and raised approximately $24 million. The platform allows users to buy, sell, and build virtual land parcels using MANA.

It has since grown into a prominent Metaverse project that emphasizes user ownership, creativity, and decentralization.

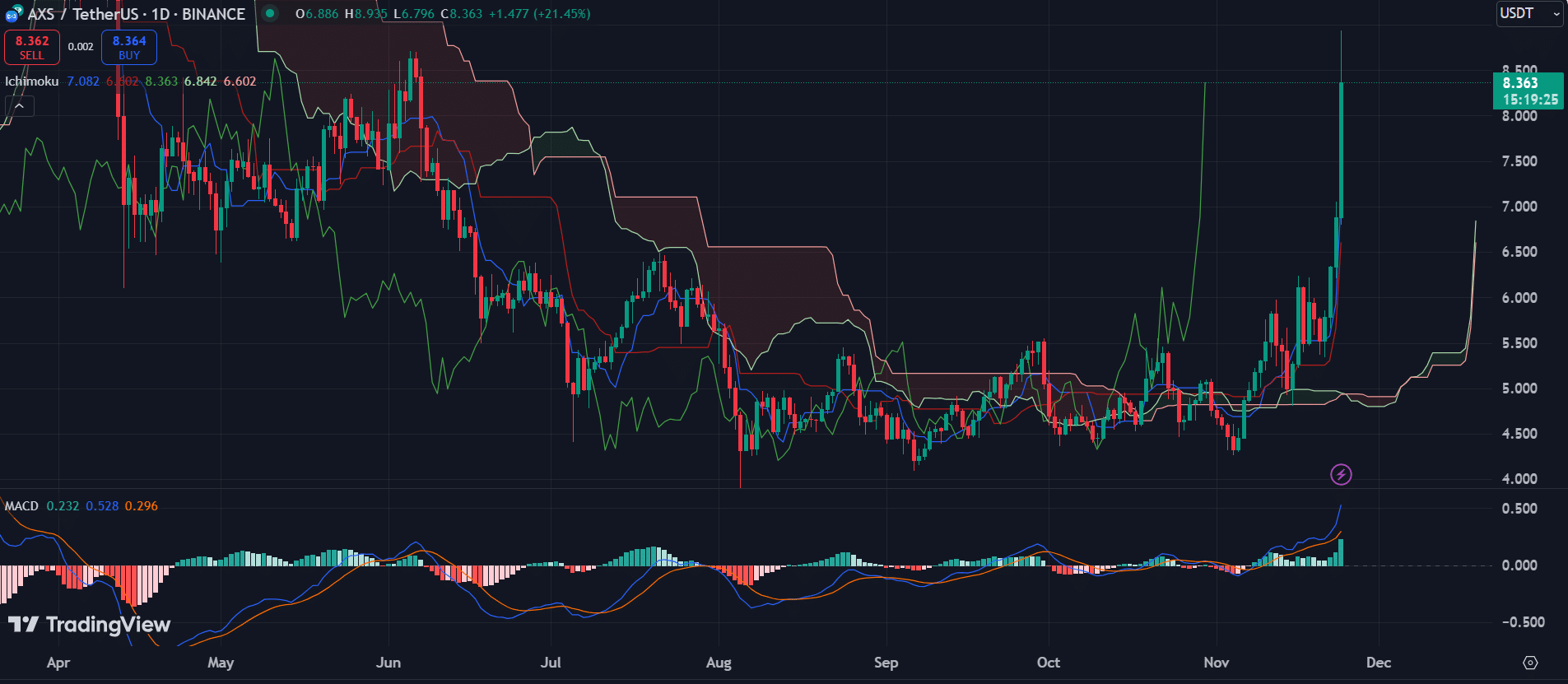

AXS eyes $9

Axie Infinity (AXS) likewise built bullish momentum. It soared 31% from a low of $5.34 on November 21 to a six-month high of $7.050 on November 23.

After falling, it rose 12% last week.

However, the new stock started off strong this morning with AXS up 21.78%. AXS rebounded to a local high of $8.935, noting the $9 price it traded at its lowest level since April.

Axie Infinity attempted a breakout above Ichimoku Cloud and is currently trading above the cloud, which acts as a support area. Tenkan-sen and Kijun-sen are also bullishly aligned.

The MACD indicator confirms this bullish trend as the MACD line crosses above the signal line and the histogram is increasing positive.

Considering the break above the Ichimoku Cloud and the bullish alignment of the MACD, AXS appears to be in a strong upward trend. If sustained, price may target higher resistance levels. The coin would need to break $9 this week to be in a better position.

Created by Vietnam-based Sky Mavis, Axie Infinity is a blockchain-based game that utilizes a “Play-to-Earn” model. This allows players to earn cryptocurrency through gameplay. This has been a major driver of interest in non-fungible tokens (NFTs), gaming, and the decentralized finance space.