Two Wall Street asset managers will support spot Bitcoin ETFs, nearly two months after the product launched on major U.S. exchanges.

Bank of America’s Merrill Lynch and Wells Fargo are allowing customers with brokerage accounts to buy spot bits following billions of dollars in demand eight weeks after the launch of the Bitcoin (BTC) ETF. Coin (BTC) ETFs will be allowed to be traded. Bloomberg first reported the news, citing unnamed sources with knowledge of the matter.

Spot Bitcoin ETF issuers include some of the largest U.S. asset managers such as BlackRock and Fidelity. But wirehouses and traditional banks initially refrained from offering the product to customers. Crypto.news previously reported that Vanguard, Citi Bank, and UBS boycotted the launch of a Bitcoin-backed investment vehicle.

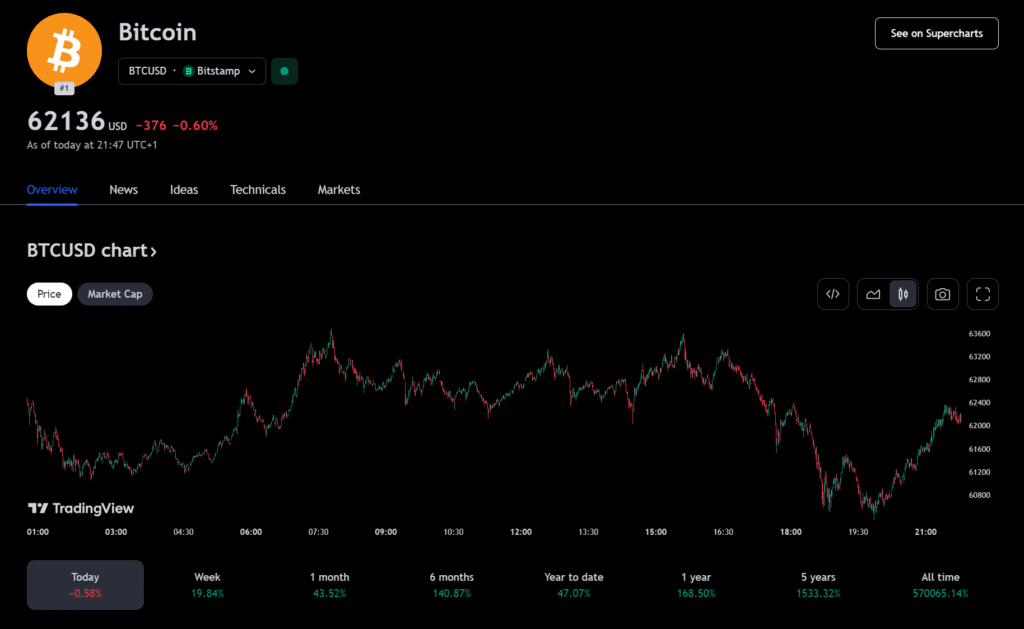

Nonetheless, spot Bitcoin ETF providers have amassed more than $20 billion in assets under management (AUM), driven by the rising Bitcoin price. The token is up nearly 50% this year as the ETF wrapper draws capital from retail investors, hedge funds and other capital controllers.

Spot Bitcoin ETF captures tradfi stakeholders.

Citigroup and UBS began allowing some customers to purchase Bitcoin spot ETFs on their platforms in January. Merrill Lynch and Wells Fargo will also provide Bitcoin exposure to clients who request it.

Another Wall Street stalwart, Morgan Stanley, is reportedly considering providing access to spot BTC ETF trading for its clients. Matt Hougan, chief investment officer at Bitwise, said in an interview with CNBC that more large trading firms will enter the market, bringing billions of dollars of sideline capital into Bitcoin through ETFs.