At $130, Nvidia stock is cheap. NVIDIA stock is not a bubble | Stephen McBride | Coins | December 2024

NVIDIA stock is not a bubble

nvidia stock It’s one of the best-performing stocks in recent years.

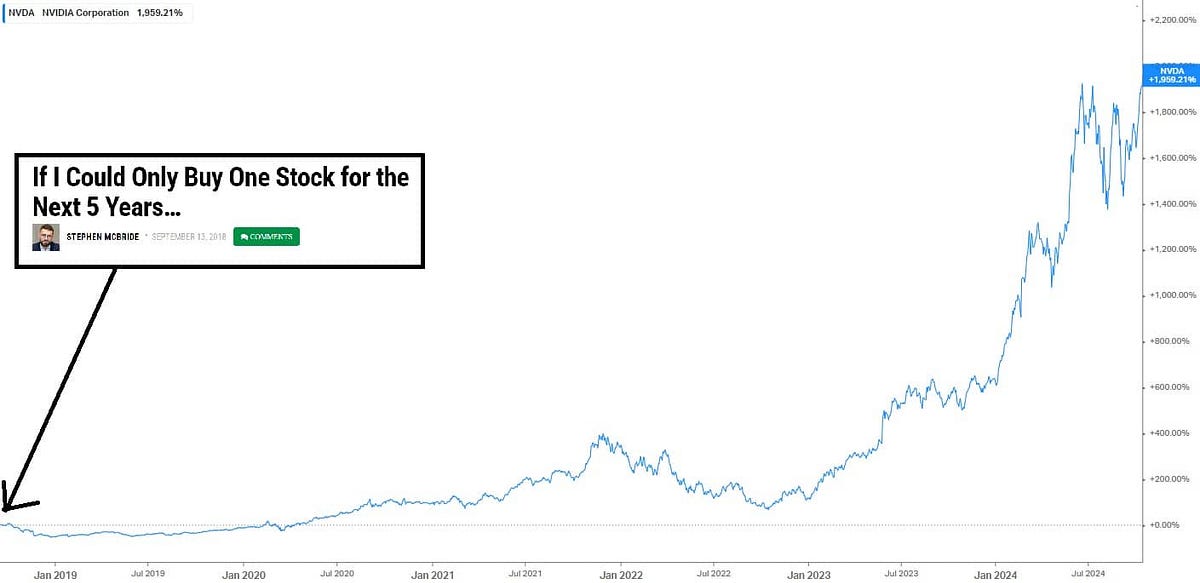

NVDA surged 240% in 2023 and 170% in 2024. And since I first recommended Nvidia in 2018, it has skyrocketed by about 2,000%.

And despite some people calling Nvidia stock a bubble, it actually appears to be significantly undervalued.

People have been saying that Nvidia is an expensive stock for years.

Looking at the PE (Price to Earnings) ratio, it is trading at a high value of 49 times trailing earnings.

But considering that Nvidia’s profits have doubled in the last year, that valuation makes sense. Anyone who runs a business knows how difficult it is to double net profits in one year. Nvidia is growing like a nimble startup, but it’s growing into a multi-billion dollar business.

To understand how undervalued Nvidia stock is with a P/E ratio of 49, take a look at the following chart.

Source: TrendSpider

The last time Nvidia’s trailing PE ratio was at this level, the stock soared 740% in less than two years.

I prefer forward PE ratios over lagging PE ratios.

Instead of looking at the past 12 months, we look at how much revenue the company expects to make over the next 12 months.

Again, this metric shows that Nvidia’s valuation today is one of the cheapest in the last three years.

Source: Koipin

The insatiable demand for Nvidia’s GPUs highlights why this stock is still a good buy at its current price.

Elon Musk’s xAI recently launched the Colossus supercomputer, which boasts 100,000 Nvidia H100 GPUs.

But Musk’s ambitions don’t end there. He plans to deploy the new GPU supercluster by next summer. It plans to use 300,000 NVIDIA Blackwell B200 GPUs, the ‘world’s most powerful chip’ for AI.

Not to be outdone, the Meta Platform (META) is close to completing its own 100,000 GPU cluster.

Meanwhile, two unnamed tech giants are planning to invest $125 billion in supercomputers in North Dakota. One of them could be Microsoft’s (MSFT) rumored $100 billion Stargate supercomputer.

Demand has been so high that Musk and Oracle (ORCL)’s Larry Ellison have “begged” Nvidia CEO Jensen Huang for more GPUs.

Goldman Sachs (GS) analysts recently reaffirmed Nvidia’s Buy rating, citing strong demand for accelerated computing beyond traditional hyperscalers such as Amazon (AMZN), Microsoft, and Google (GOOG).

Nvidia’s customer base is expanding as companies and even sovereign nations begin to invest in AI computing clusters. This diversification is very important as it mitigates the risk of over-reliance on a few key customers.

Nvidia’s dominance in the AI chip market remains unrivaled, with its H100 GPUs accounting for a 90% share.

Many tech giants are developing custom silicon, but these efforts currently pose no significant threat to Nvidia’s market position.

The company’s pace of innovation ensures that it remains a leading supplier of AI hardware.

Bottom line: Nvidia stock can be bought as low as $140.