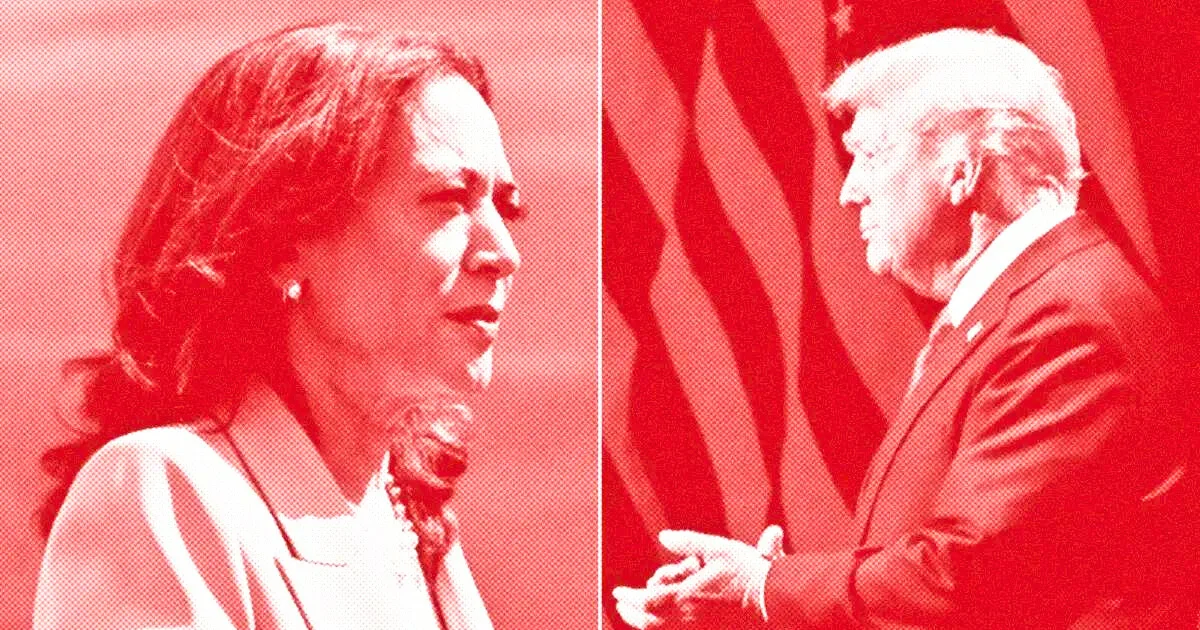

As of October 16, 2024, Donald Trump is ahead of Kamala Harris by 17 points on the decentralized prediction market Polymarket. Trump accounts for 58.5% of bets, while Harris accounts for 41.3%.

Both candidates have had recent fluctuations in their approval ratings, but Trump’s position has strengthened ahead of this update. In contrast, traditional national polls showed a tight race, with Harris holding a slight two-point lead.

Trump’s approval rating surged just a few weeks before the election. Meanwhile, Harris responded to Trump’s efforts to engage this demographic by launching a digital asset protection initiative targeting black male voters. Her campaign promises to establish a fair regulatory framework for digital asset investors.

Trump also introduced a cryptocurrency token linked to his new platform, World Liberty Financial. However, the launch has been met with criticism, with some labeling it a potential pump-and-dump scheme. The platform website experienced problems shortly after launch, and there were only 9,000 token holders.

In 2019, Trump publicly criticized cryptocurrencies, saying he was not a fan of Bitcoin or other digital currencies. However, President Trump appears to have softened his stance recently, even suggesting a plan to make the United States the ‘world’s cryptocurrency capital.’ Trump’s key cryptocurrency-related proposals include:

SEC Chairman Gary Gensler Replaced: Gensler, known for its strict stance on cryptocurrency regulation, has faced criticism within the cryptocurrency community. Trump has suggested he would replace Gensler with someone more cryptocurrency-friendly to ease restrictions and encourage innovation.

Creating US Bitcoin Reserves: Trump floated the idea of requiring the Federal Reserve to hold Bitcoin as a reserve asset, similar to gold, to bolster the country’s strategic assets.

Block central bank digital currency (CBDC): Trump opposes the Treasury’s creation of a digital dollar. We believe this is a move that potentially undermines the decentralized nature of cryptocurrency.