quick take

Hong Kong ETF

Hong Kong recently approved Bitcoin and Ethereum ETFs, following in the footsteps of the United States, where BTC funds have seen tremendous success.

However, Eric Balchunas, senior analyst at Bloomberg ETFs, predicts that Hong Kong ETFs may not see significant inflows and total amounts could be less than $1 billion. He said:

“Our estimate is that $500 million is all of this combined.”

Balchunas cited several reasons for skepticism, including the small size of Hong Kong's ETF market, currently valued at about $50 billion.

According to Balchunas, Hong Kong-based ETFs are also not accessible to Chinese locals for official investment. The market is dominated by three smaller issuers – Bosera, China AMC, and Harvest – with no major players like BlackRock participating.

Additionally, the ecosystem supporting these ETFs may have lower liquidity and efficiency, potentially resulting in wide spreads and premium discounts. Moreover, these ETFs are expected to have fees in the 1-2% range, which is much higher than the much lower fees commonly seen in the US ETF market.

US ETFs

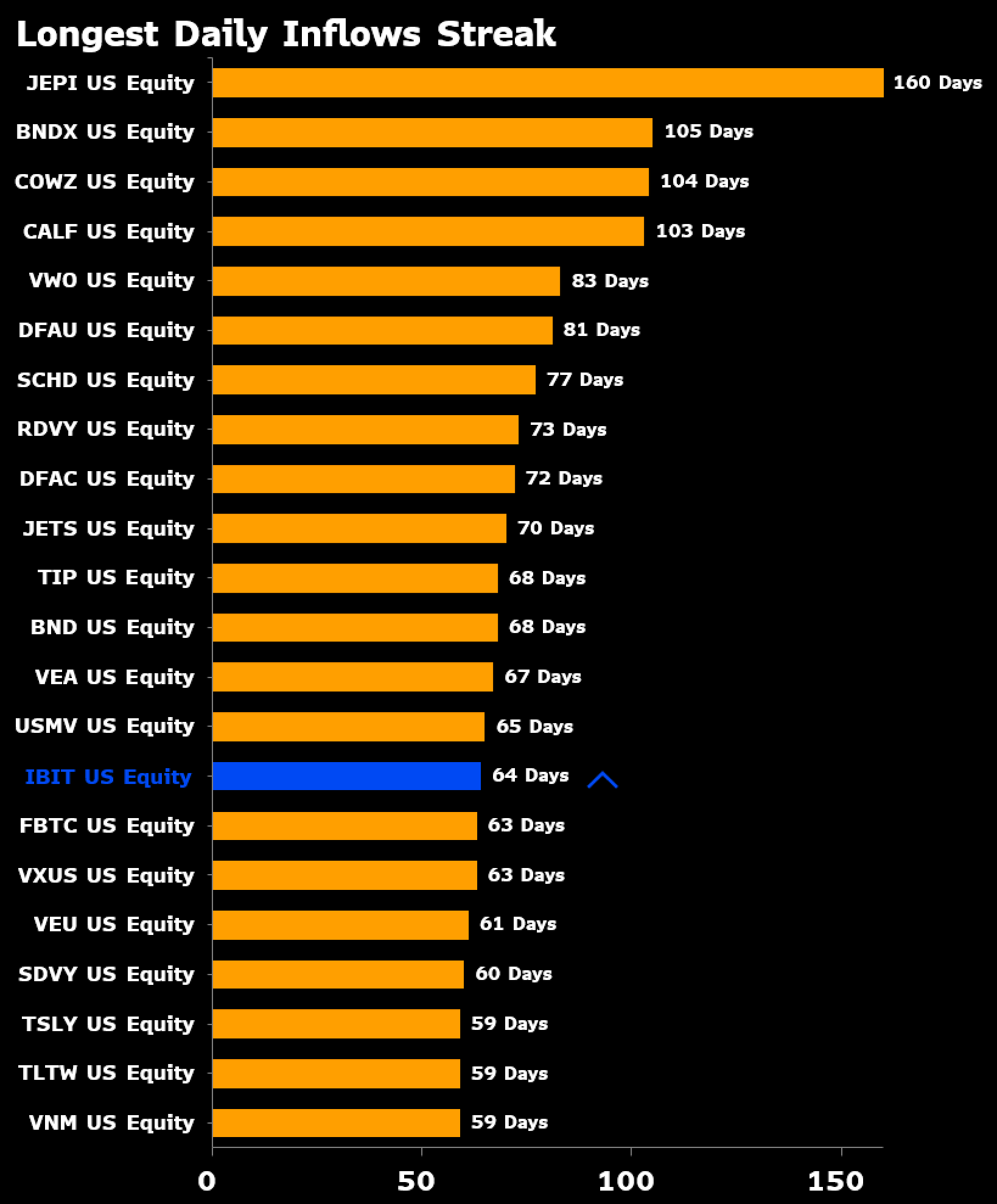

Balcheon' Fidelity's FBTC inflow streak in the US ended on April 12 after 63 days of zero inflows, according to the data. But what's notable is that there were no leaks.

Meanwhile, BlackRock IBIT remains active for 64 days and is poised to join USMV in the top 14 all-time spot.

The post Analyst Predicts Low Inflows of Newly Approved Bitcoin in Hong Kong, Ethereum ETF appeared first on CryptoSlate.