As institutional interest in the cryptocurrency sector grows, the prices of some large altcoins, including Optimism (OP) and Kaspa (KAS), are on the verge of hitting record highs.

With billions of dollars flowing into Bitcoin ETFs, native cryptocurrency investors appear to be reinvesting their profits into altcoins.

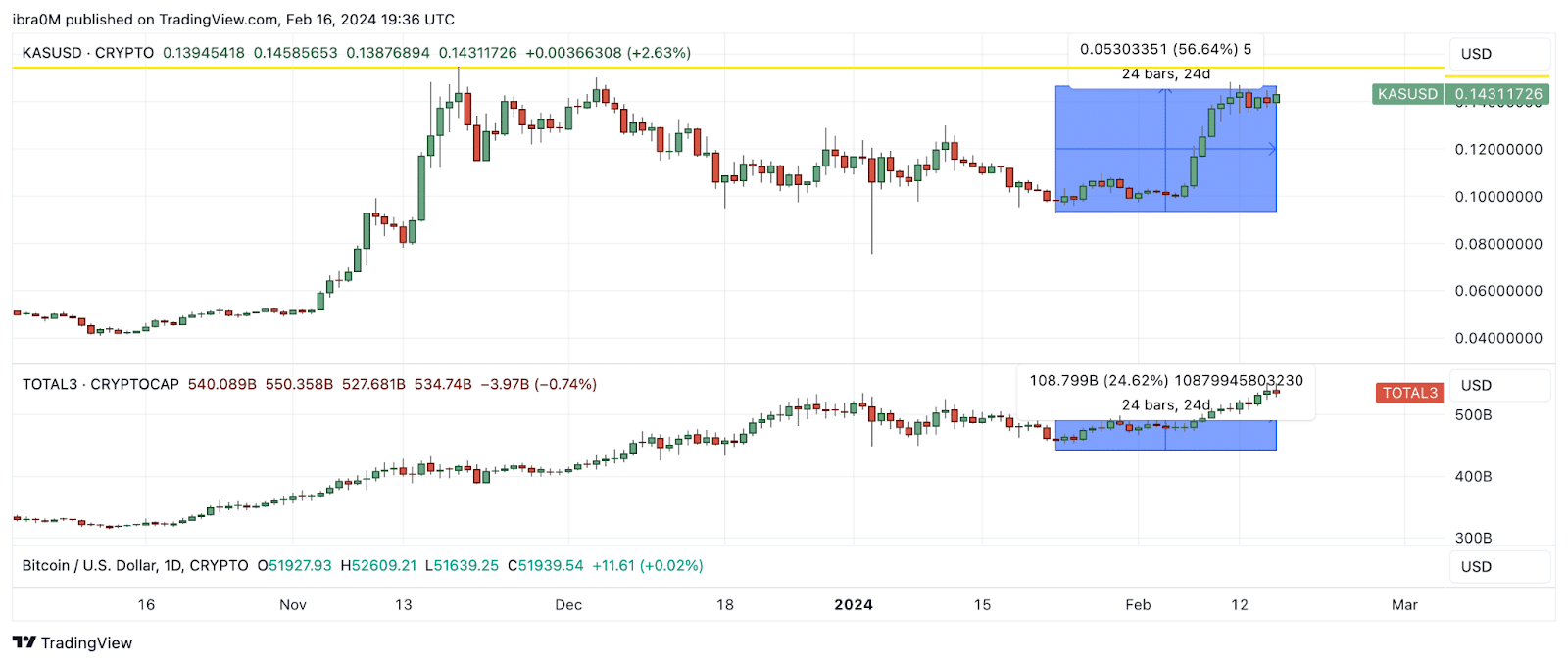

After weeks of uninterrupted gains between January 23 and February 16, the global altcoin sector grew by $108 billion as several large altcoins hit new all-time highs this month.

Caspar (KAS) Price: 7% Down from All-Time High

Kaspa (KAS) is a layer 1 proof-of-work (PoW) cryptocurrency that currently ranks 31st on the global cryptocurrency charts with a market capitalization of $3.2 billion. Through its GHOSTDAG protocol, Kaspa combines the security and decentralization of PoW architecture with the high blocking rates and minimal confirmation times of Proof-of-Stake (PoS) networks.

KAS has recorded significant price gains over the past three weeks, outperforming major PoW coins including Bitcoin (BTC), Bitcoin Cash (BCH), and Litecoin (LTC), as well as the entire altcoin market.

From January 23 to February 16, the price of KAS rose 56%, adding $1.1 billion to its market capitalization. KAS will register a further 7% gain, surpassing its previous global high of $0.16 recorded on November 19.

KAS has attracted about 1% of the total capital flowing into the altcoin market over the past three weeks, compared to an increase of $108 billion in total market capitalization excluding BTC and ETH.

Why is the price of Caspar (KAS) rising?

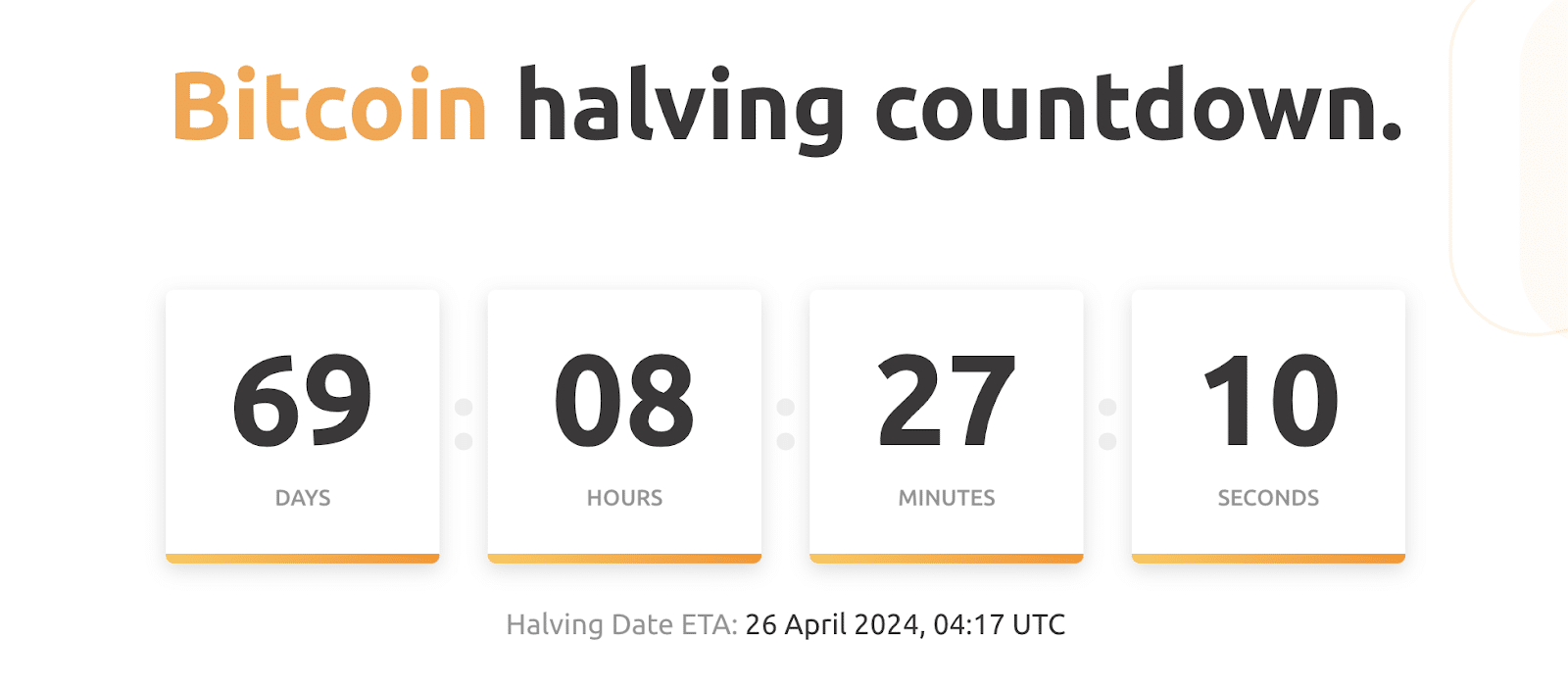

The upcoming Bitcoin halving is one of the dominant stories behind Kaspa’s recent growth. Industry experts predict that more than 20% of Bitcoin miners will go offline when the block reward is reduced from 6.25 BTC to 3.13 BTC in April 2024.

Many miners may focus their resources on alternative proof-of-work networks such as Kaspa, which offer more attractive returns.

Therefore, investors appear to be accumulating funds in KAS Coin to get ahead of the potential upside from the fallout of the upcoming Bitcoin halving. This could effectively send the KAS price race to new all-time highs in the coming weeks.

Optimism (OP) price: 9% down from all-time high

Optimism (OP) is a popular layer 2 blockchain built on Ethereum. Optimism leverages the security of the Ethereum mainnet and provides improved scalability using innovative, optimistic rollups.

Like other layer 2 scaling solutions, OP allows cryptocurrency investors to conduct faster and more cost-effective DeFi transactions without primarily interacting with the Ethereum mainnet.

OP tokens have caught the attention of investors as demand for DeFi trading has increased due to the cryptocurrency market rally.

From January 23 to February 16, Optimism’s price rose 53%, outperforming the market average and adding approximately $1 billion to its market capitalization. The operating profit price fell by only 10% on February 15, exceeding the all-time high of $4.30 recorded on January 12.

Why is the price of Optimism (OP) rising?

The ongoing increase in operating profit prices appears to have been driven by demand for DeFi services across the industry.

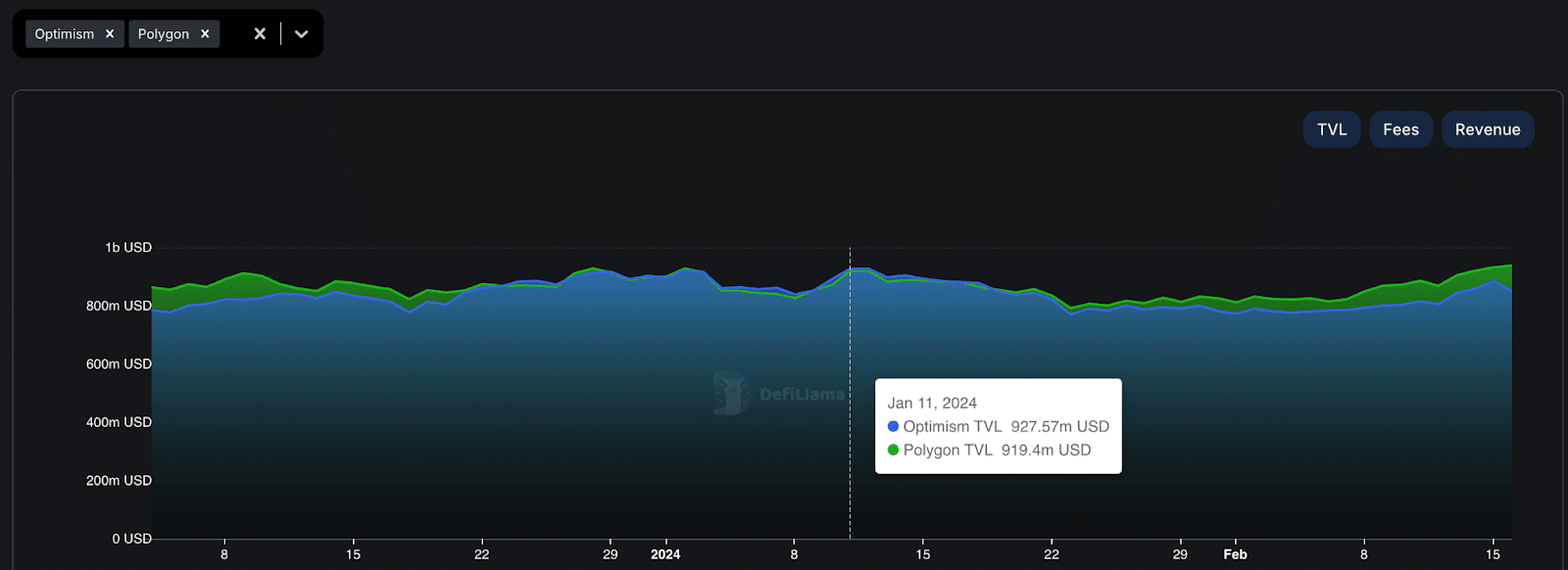

The Optimistic rollup was launched in 2019, but the OP governance token was not launched until June 2022. However, despite being a relatively new product on the market compared to Polygon (MATIC), Optimism has grown quickly to become one of the most sought-after extensions on Ethereum. Solutions over the past year.

Additionally, the chart shows that Optimsm briefly surpassed the Polygon network when TVL peaked at $927.6 million on January 11, the same day OP price hit an all-time high.

The close correlation between OP prices and TVL growth trends highlights that fundamental demand for DeFi solutions is the main catalyst for its continued rise.

Optimism has over 100 protocols, the largest of which include derivatives exchange Synthetix (SNX), DEX Uniswap (UNI), and AMM Velodrome (VELO).

As demand for these important DeFi services continues to grow, OP looks set to close the 10% gap and recover to new all-time highs in the coming weeks.