Bitcoin (BTC), the world’s largest cryptocurrency by market capitalization, appears to be sending a warning signal after trading sideways for nearly five days. These negative signals from BTC have changed the overall market sentiment.

Bitcoin technical analysis and future levels

According to Coinpedia’s technical analysis, BTC broke the bottom of the consolidation area and began a downward move. Recent price action suggests that if BTC closes its daily candle below or near the $95,000 level, it is likely to fall 10% to reach the $86,300 level in the next few days.

The asset is currently trading above the 200 exponential moving average (EMA) on the daily time frame, indicating an upward trend. Meanwhile, the relative strength index (RSI) is above 70, suggesting that there is limited room for further upward momentum.

RSI is a technical indicator used to determine whether an asset is in oversold or overbought territory. Traders and investors build positions based on behavior.

What is Driving Bearish Sentiment?

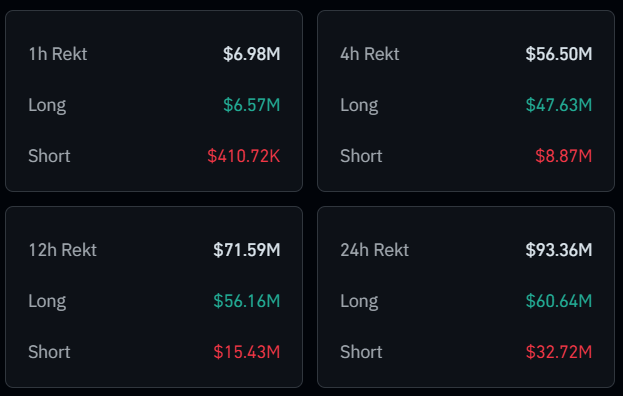

According to on-chain analytics firm Coinglass, this collapse in BTC led to the liquidation of millions of dollars worth of long positions.

The data shows that traders liquidated $47.65 million worth of long positions while they liquidated $8.87 million worth of short positions in the last four hours. Additionally, in the last hour, traders liquidated $6.65 million worth of long positions and $410,000 worth of short positions.

The large liquidation of long positions compared to short positions means that weakness is back in the market and could push BTC prices lower going forward.

Bitcoin recent updates and current price analysis

However, this major breakdown occurred after MicroStrategy, the world’s largest corporate Bitcoin holder, purchased 55,000 BTC worth $5.4 billion and healthcare company Semler Scientific acquired $30 million worth of BTC.

At press time, BTC is trading near $95,135 and has experienced a price decline of 1.05% in the last 24 hours. During the same period, trading volume surged by 38%, showing increased participation from traders and investors amid falling prices.