After a hotter-than-expected inflation report came out, Investors are breathing a sigh of relief that all price data for February is not as high as expected..

The most recent Consumer Price Index (CPI) and Producer Price Index (PPI) were both above estimates, with the exception of food and energy prices.

However, the personal consumption expenditures (PCE) inflation measure is widely known to be the Fed’s preferred measure. And February’s core figure was in line with expectations, up 2.8% compared to last year (orange line below). This also means that federal funds (blue line below) are still the most limited relative to inflation since 2007..

This is turning investors’ attention back to the timing of the first Fed rate cut, with market implied odds currently at 64% for the June meeting. However, as investors ponder the timing of the first interest rate cut, Major bond markets are reinforcing that a dovish pivot is coming..

In other words, don’t worry too much about the timing of the first interest rate cut. fairly, I measure the monetary policy outlook based on the two-year Treasury yield, which strongly suggests that a rate cut is coming soon..

The chart below shows the two-year Treasury yield (blue line) and the federal funds effective rate (red line). Two-year Treasury yields have remained below the federal funds effective rate and have driven changes in federal funds several times over the past two decades..

And that’s good news for stocks. The Fed cutting interest rates while the economy avoids a recession is a positive scenario for markets.. You can see this in the chart below. When the Federal Reserve cuts interest rates in a non-recession environment, the Dow Jones Industrial Average tends to rebound over the next 12 months..

But signs of a strong economic system combined with falling interest rates aren’t just a positive backdrop for stocks. There is another asset class that is showing various signs of a breakout, and may still be in the early innings of a strong uptrend..

Lagging indicators show that the economy is performing decently. Here are the March payroll reports this Friday: 200,000 jobs are expected to be added this month and the unemployment rate is expected to be near the low end of its historical range of 3.8%..

Fourth quarter gross domestic product (GDP) was revised upward to an annualized increase of 3.4%.. The Atlanta Fed’s GDPNow indicator is pointing to growth of 2.3% this quarter (chart below).

And last week in Market mosaic I made the following argument: Several indicators point to Accelerating economic activity in the future. It strongly suggests that: Interest rate cuts are on the way while the economy avoids falling into a recession..

As mentioned above, this is good for stocks, but lower interest rates as the economy expands are good for other asset classes as well. More specifically, A variety of commodities responded favorably to this scenario..

The chart below shows the performance of various commodities in a non-recession environment when two-year yields fall, which should reflect changes in monetary policy. Copper and other industrial metals perform well, as do gold and oil..

But there Other catalysts lining up for commodity trading, including positioning among professional investors. As an asset class, commodities have lagged significantly with the overall price decline in the S&P GSCI Commodities Index since mid-2022. Fund managers have little reason to pursue performance..

According to a recent survey of fund managers conducted by BofA, Institutional portfolios have the lowest exposure to commodities to bonds since the 2008 financial crisis.. However, this type of herd arrangement can quickly reverse, especially if commodities begin to recover. Fund managers are scrambling to adjust their exposures..

Institutional investors could be a source of demand for raw materials if momentum strengthens as they consider the composition of their portfolios. Especially since Commodities remain historically cheap relative to stocks..

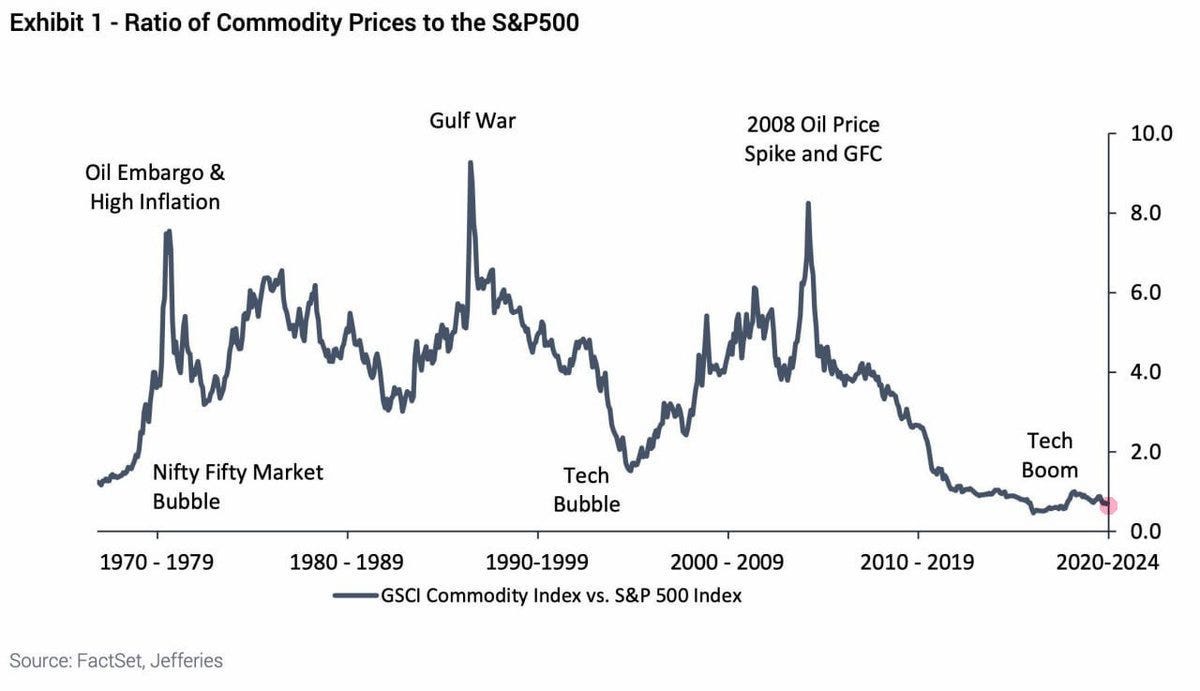

The ratio of commodity to equity prices remains near historical lows, with previous episodes showing an average reversal in favor of commodities.. The chart below dates this ratio back to the 1970s. A rising line indicates that commodities are outperforming stocks and vice versa. Current ratios have been trading at low levels for the past decade, but the backdrop is favorable for commodities to outperform depressed levels..

A strong economy, declining near-term interest rates, underweighting by institutional managers, historically low price-to-equity ratios and favorable macro dynamics combine to make commodities an attractive risk/reward opportunity. A rally in commodity-related miners and producers could also support further breadth expansion..

After the S&P 500 bottomed in late 2022, early signs of narrowing led many to worry that the rally was on borrowed time.… In particular, “Magnificent 7” leads the way with higher charging rates.

but There are increasing signs that the rally is expanding since the end of last year.. Various measures of broad thrust (or extreme measures comparing stocks that are rising with those that are falling) indicate that participation in the bulls is expanding rapidly and institutional investors are flocking in.

Since the October rally, the S&P’s rally has had many days with momentum and strong upside potential.. The chart below shows the number of days of high upward volume over the 100-day movement of the S&P, showing broad-based strength with strong momentum during this section of the rally.

and The Magnificent 7 still accounts for nearly 30% of the S&P 500, but its impact on the S&P’s rise is decreasing compared to last year.. Looking at the chart below, we can see that the Magnificent 7 accounted for 60% of 2023 returns in the S&P, but that figure has fallen to 41% so far this year and is declining even further in March.

I also noted the following in this week’s market update: The small-cap stock is operating higher after backtesting support from a major break above the $200 level.This has served as resistance since early 2022. At the same time, MACD is trending upward from the zero line and RSI in the bottom panel is breaking out of its recent range. Upward momentum is another positive development that is expanding in breadth..

and With bullish catalysts lined up to support commodity prices, relevant miners and energy producers could be primed for the next breakout to support the stock market rally.. To that end, I’m watching the XME exchange-traded fund (ETF), which holds metals and mining stocks such as Freeport-McMoRan (FCX) and Steel Dynamics (STLD).

After breaking out of the symmetrical triangle consolidation pattern, XME retested the price support and resistance trend lines in the triangle on the weekly chart below. The price is currently testing the next resistance level near the $60 level and is close to 2022 highs. Both MACD and RSI are rising from key support levels, indicating rising momentum.

That’s all for this week. Following the inflation data, another of the Fed’s missions will be in the spotlight this week: the March employment report. The first quarter of 2024 is also wrapping up, and the next earnings report begins in a few weeks. We will be watching to see how the corporate outlook develops, but if demand trends improve, we expect this to show up in commodity prices.

We hope you enjoyed The Market mosaic. Please share this report with your family, friends, colleagues, and anyone else who could benefit from observing the stock market objectively.

Visit here for updated charts, market analysis and other trading ideas. www.mosacassetco.com

Disclaimer: This is not a recommendation, just my thoughts and opinions. Do your own due diligence! I may have a position in the securities mentioned in this report.