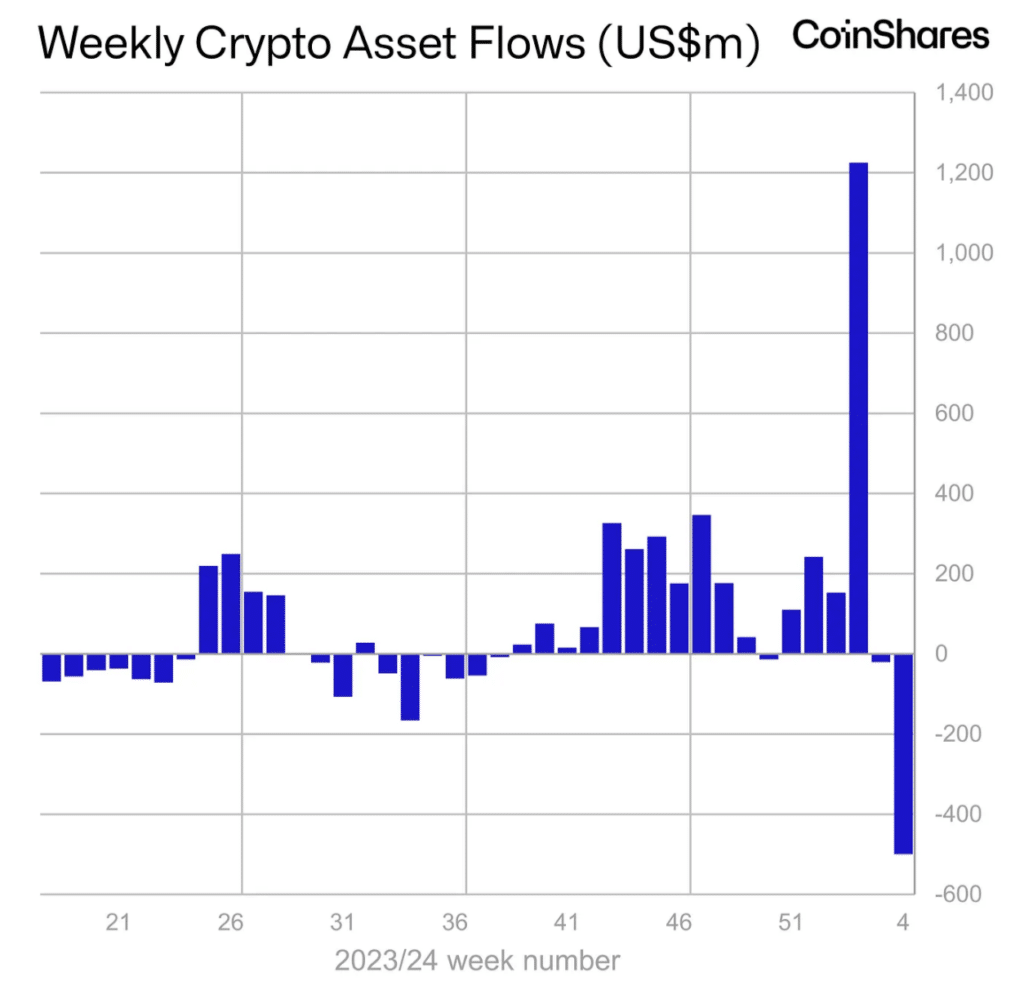

Digital asset investment products saw significant outflows totaling $500 million last week.

Analysis firm CoinShares released a report on the fund flow of cryptocurrency-based investment products from January 20 to January 26, 2024. According to available information, Grayscale Investments’ spot Bitcoin (BTC) ETF played a central role in the report. The amount of money outflow from cryptocurrency funds in one week exceeded $2.2 billion. At the same time, the total amount of assets withdrawn exceeded $5 billion.

At the same time, financial giant BlackRock’s investment products continue to receive significant infusions, analysts say. Inflows over the past week amounted to $744 million. In second place in this indicator is Fidelity Investments’ cryptocurrency fund, which received financial investments of $643 million.

In total, spot Bitcoin ETFs saw inflows of $1.84 billion. Moreover, since its launch on January 11, 2024, the cryptocurrency fund has received $5.94 billion inflows.

At the regional level, major outflows occurred in the United States ($409 million), Switzerland ($60 million), and Germany ($32 million). Net inflows of assets were observed in Brazil alone at $10.3 million and in France at $100,000.

Analysts point out that the main movement of funds during this period was related to the original cryptocurrency due to the spot Bitcoin ETF. These assets account for $479 million in outflows. At the same time, inflows from Bitcoin short positions reached $10.6 million.

At the same time, $39 million was leaked from Ethereum (ETH)-based exchange products. Most cryptocurrency funds based on other altcoins have also lost varying amounts of money.

Last week, CoinShares analysts said capital inflows into cryptocurrency investment products totaled $21 million, with issuers facing higher fees following the launch of spot Bitcoin ETFs in the U.S. on January 10, 2024. It was revealed. Hence, there was an outflow of money from these funds. It reached $2.9 billion. $4 billion has been invested in new equipment.