Bitcoin and Ethereum prices could plummet as $5.8 billion options expire! The market atmosphere is like this

Cryptocurrency markets did not experience the expected surge in January despite the SEC’s approval of a spot Bitcoin ETF. This event, which was expected to drive significant buying, failed to protect against Grayscale’s GBTC outflows, which continued to put downward pressure on the market. However, the scenario could soon become more intense as approximately $5.8 billion worth of Bitcoin and Ethereum options are set to expire. This event could result in significant price volatility, especially since the market is below ‘peak trouble’.

Selling pressure may be triggered

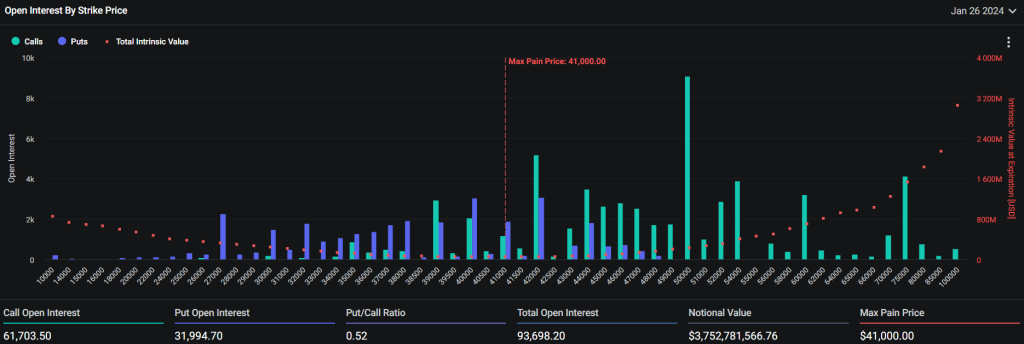

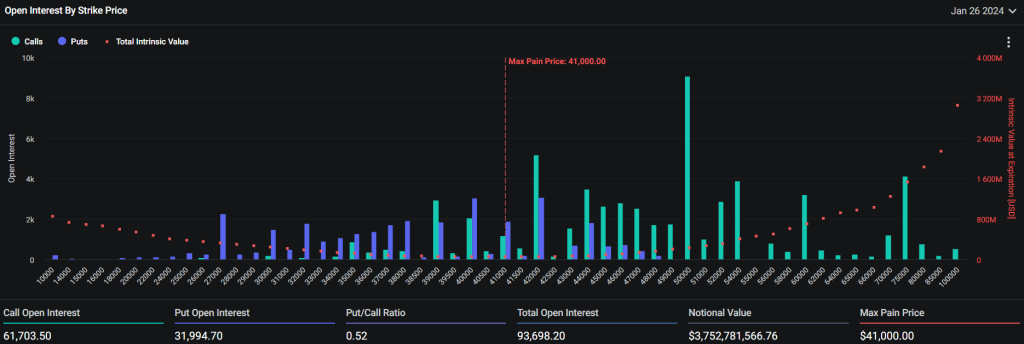

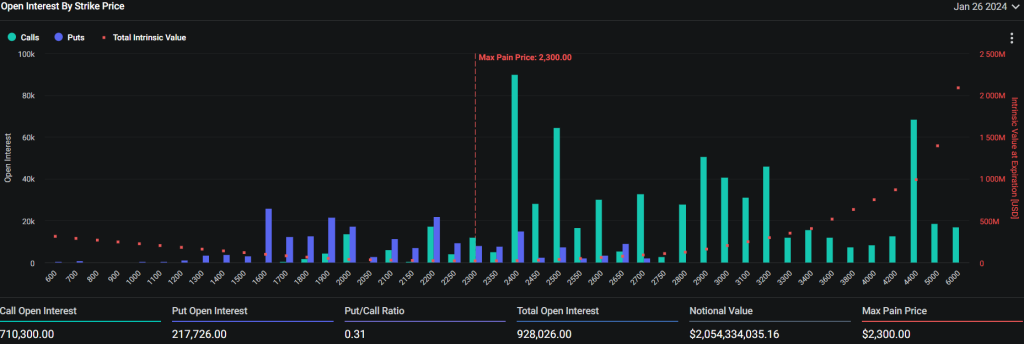

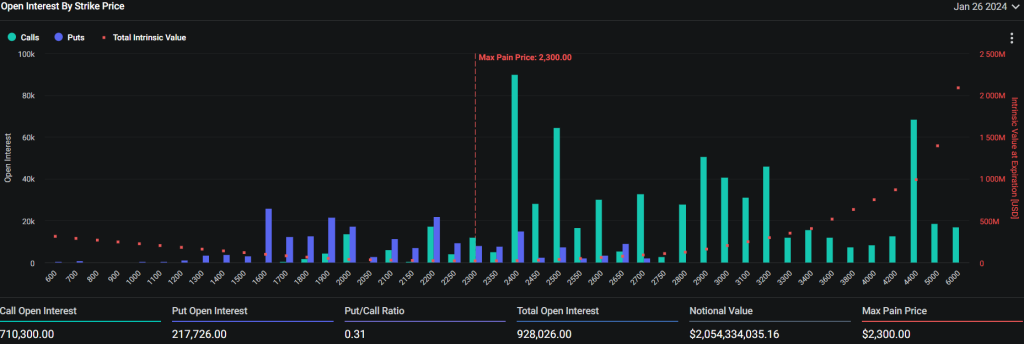

Weekly options expiration is scheduled to occur on January 26 at 08:00 UTC, with $5.82 billion worth of options on Bitcoin (BTC) and Ethereum (ETH) expiring. This could play an important role in validating the future trends of the market in February.

Looking at the breakdown of these options, we see $3.73 billion tied to BTC and $2.05 billion tied to ETH, presenting an interesting trend for these two major cryptocurrencies. For Bitcoin, the put/call ratio is 0.52, indicating a significant concentration of interest in call options.

In particular, Bitcoin’s ‘biggest problem’ is identified at $41,000, while at a higher strike price of $50,000 there is significant open interest in excess of $361,000,000.

The maximum pain point represents the price level at which the option holder is likely to suffer the greatest loss upon expiration. The theory is that in traditional financial markets, option sellers (often institutions with significant financial resources) attempt to control the spot market to this maximum problem as the expiration date approaches. This aims to maximize the option buyer’s losses.

With Bitcoin currently trading below the Max Pain Point, there are growing concerns that selling pressure will increase tomorrow. Investors holding call options may incur a loss if the price falls below the strike price, as the option becomes worthless. This can lead to increased selling pressure as investors try to minimize losses or hold onto positions. If BTC price loses the $40,000 level, it could retest support near $38,000.

$200M Ethereum Call at Risk Close to $2,400

The situation in Ethereum options presents a different picture, with a relatively low put/call ratio of 0.31 and the ‘maximum problem’ set at $2,300. There is also notable open interest of around $200 million centered around the $2,400 price. Call holders are often in a position to face the biggest losses tomorrow.

With Ethereum currently trading well below its biggest problem, this indicates the potential for increased selling pressure in the future. This scenario could trigger widespread liquidations in the market as traders brace for losses.

However, this is generally advantageous to the option writer (seller) because it allows the option buyer to keep the premium paid without having to deliver the underlying asset or pay cash.