Despite spot Bitcoin ETFs generating over $20 billion in trading volume, the cryptocurrency market continues to struggle with liquidity issues.

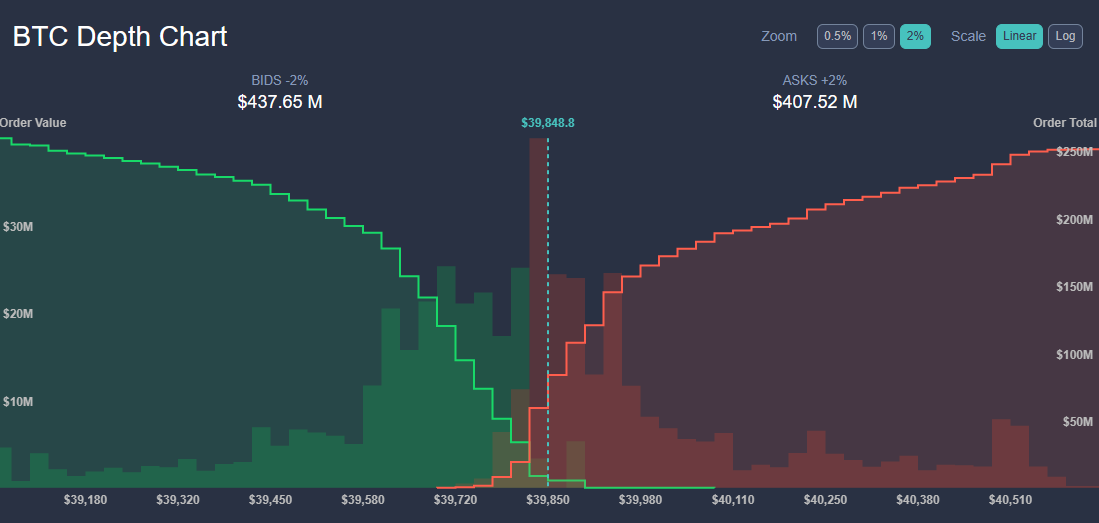

The liquidity of the market, as measured by Bitcoin’s market depth, indicates that the ease and speed of executing transactions with the digital currency is still suboptimal. Looking at the current Bitcoin (BTC) depth chart, there are quite a few orders to buy (bid) and sell (ask) Bitcoin, but liquidity (meaning the ability to execute large orders without significantly impacting the price) is currently low. Limited by price level.

Therefore, the ‘Alameda Gap’ impact is still visible in market liquidity. Major players such as Jane Street Group and Jump Crypto have also scaled back their cryptocurrency trading activities, contributing to the lack of liquidity.

The decline in market participation from these major players is leading to increased price volatility. For example, Bitcoin experienced price swings of up to 12% around the launch of the ETF. The retreat of these large companies, which previously played an important role in stabilizing the market, has been noticeable.

Small businesses trying to fill this gap are constrained by relatively few financial resources, which leaves them less prepared to handle significant risk during periods of high volatility. This scenario often leads to significant liquidations when market volatility intensifies.

Moreover, the influx of trading activity associated with new Bitcoin ETFs does not directly improve Bitcoin’s liquidity. A significant portion of ETF-related Bitcoin trading is over-the-counter, which does not affect market depth.

For example, converting the Grayscale Bitcoin Trust into an ETF resulted in a redemption of approximately $4 billion. This has resulted in GBTC shares frequently trading at a discount to their underlying assets, highlighting the disconnect between the trading volume of the stock’s shares and actual liquidity in the cryptocurrency markets.

The current state of the Bitcoin market, with reduced liquidity and increased susceptibility to price manipulation, highlights the challenges facing the cryptocurrency sector in the absence of larger, more stable market makers.