- A recent court ruling that XRP is not a security gives Ripple leverage, and Garlinghouse expects further legal victories.

- He urges stakeholders to embrace cryptocurrency and blockchain technology.

- Garlinghouse emphasizes the need for widespread adoption and interoperability across banks.

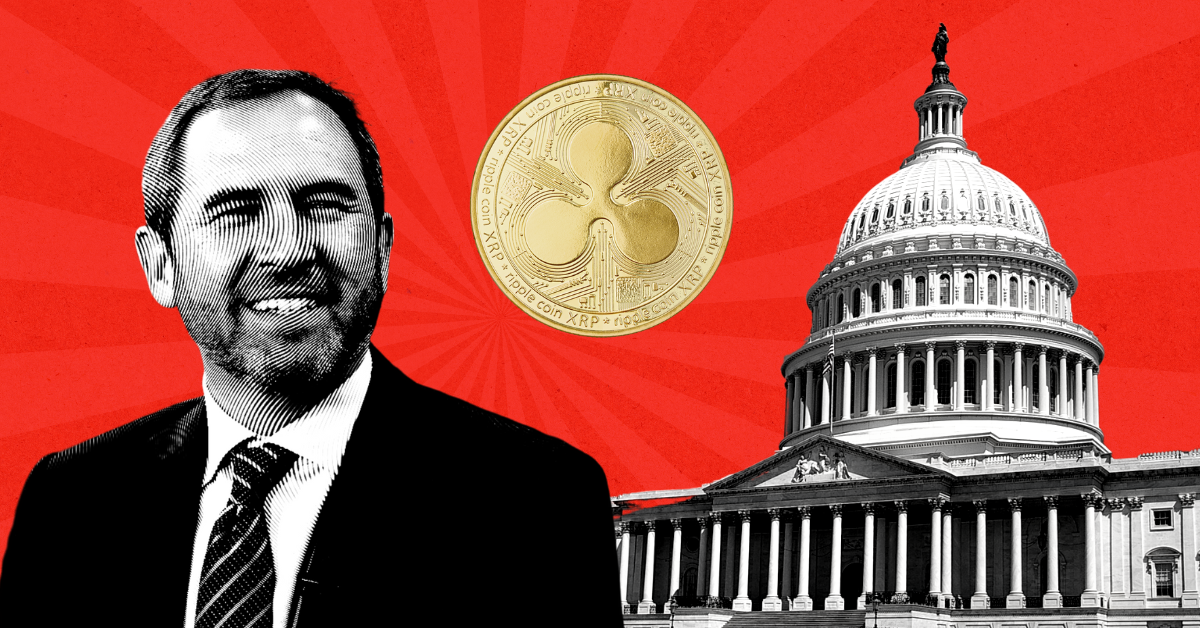

A recent World Economic Forum panel unanimously agreed that regulatory transparency is key to a thriving cryptocurrency industry. A notable figure at the Davos event was Ripple CEO Brad Garlinghouse, who took center stage and emphasized the important role of regulatory clarity for XRP in the U.S., deeming XRP a key driver of customer acquisition.

A game changer for XRP?

Reflecting on the positive aftermath of the previous year’s landmark court ruling, Garlinghouse clearly stated that XRP is not a security.

He emphasized that this legal clarity has empowered Ripple to pursue its business goals more effectively. This strategic advantage resulting from the court decision played a significant role in shaping the company’s movements.

Embracing Blockchain: A Call to Action

In an interview with Fox Business, Garlinghouse said it is time to embrace blockchain and cryptocurrencies on a larger scale, characterizing them as innovative technologies and enduring assets rather than simply passing trends. He urged stakeholders to embrace and understand this power of change.

Despite acknowledging regulatory challenges in the U.S., Garlinghouse expressed optimism, predicting that regulatory clarity will eventually be achieved as the legal victory opens up opportunities for Ripple in the U.S. market.

Ripple’s impact on payments around the world

Speaking directly about Ripple’s impact, Garlinghouse highlighted how technologies like Ripple can significantly reduce costs and improve the speed and efficiency of payments around the world. These payments, traditionally slow and costly, could witness a paradigm shift with the advancement of blockchain.

Garlinghouse also examined the slow adoption of blockchain technology, highlighting the need for financial institutions to embrace cryptocurrencies and their inherent interoperability benefits.

He argued that mainstream adoption would not be successful in a closed network, emphasizing the need for widespread acceptance and uptake across numerous banks. He believes this promises real improvements in trading efficiency and money movement.