Cryptocurrency Trading Volume Soars to $37 Trillion in 2023, Driven by Strong Q4 Surge: CoinGecko Report

Posted: January 17, 2024 8:03 AM Updated: January 17, 2024 8:04 AM

Correction and fact check date: January 17, 2024, 8:03 AM

briefly

The total market capitalization of the cryptocurrency market increased by 55% from $1.1 trillion to $1.6 trillion during the fourth quarter of 2023.

According to CoinGecko’s 2023 Annual Crypto Industry Report, the cryptocurrency market grew 55% in total market capitalization during the fourth quarter of 2023, from $1.1 trillion to $1.6 trillion.

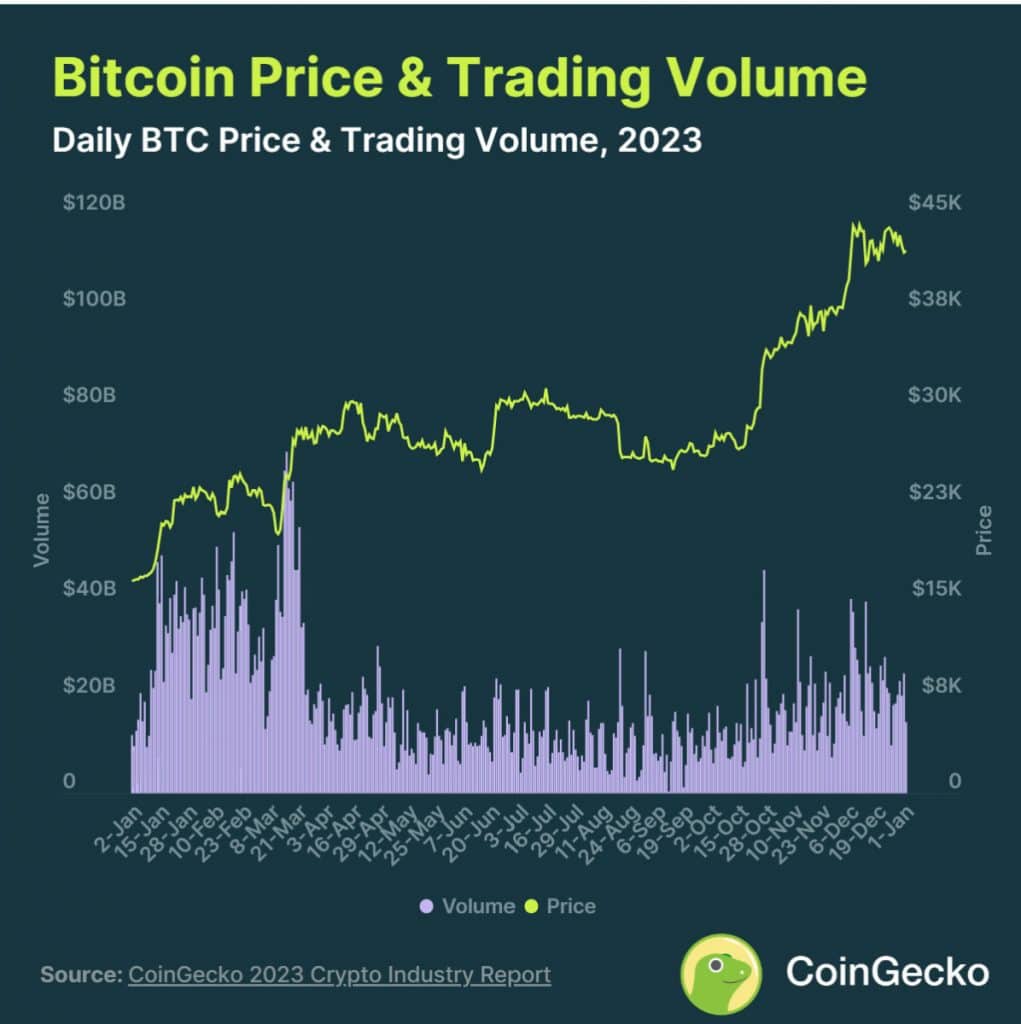

This surge was supported by optimistic sentiment following the prospect that the Bitcoin ETF would receive regulatory approval. In particular, the price of Bitcoin, the flagship cryptocurrency, rose significantly from $27,000 to $42,000 in the same quarter.

It is important to note that the U.S. Securities and Exchange Commission (SEC) recently approved the issuance of a physical Bitcoin exchange-traded fund (ETF), ending months of anticipation within the digital asset sector.

Zooming in to 2023 as a whole, the cryptocurrency market has seen impressive growth, more than doubling from a total market capitalization of $832 billion at the start of the year, according to a CoinGecko report. This was a remarkable 2.6x increase, largely due to the resurgence of Bitcoin.

The report analyzes the performance of key players such as Bitcoin and Ethereum, scrutinizes the intricate details of the market environment, and provides an exploration of the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems.

According to market statistics, the overall cryptocurrency market capitalization increased by 108.1% in 2023, reaching $869 billion. Trading volume also showed a notable trajectory, with average daily trading volume surging to $75.1 billion in the fourth quarter of 2023, a 91.9% quarter-on-quarter increase.

However, despite overall growth, annual daily trading volume still remained -31.6% below the 2022 record figure.

Bitcoin, Ethereum, Solana and NFT Analysis

Bitcoin, the pioneer of cryptocurrency, was in the spotlight with good performance in 2023. The cryptocurrency, popularly known as ‘digital gold’, is up +155.2% for the year, with a surge of +64.3% in the fourth quarter alone, sending its price soaring in the 2023-1 year. $26,918 to $42,220. Bitcoin hit a yearly high of $44,004 in December, reaching levels not seen since April 2022.

Ethereum, the second-largest cryptocurrency by market capitalization, ended 2023 at $2,294, registering a gain of +90.5% for the year. Ethereum’s highest return was recorded in the first quarter, when it increased +49.8% from $1,196 to $1,792. After a period of consolidation in the second and third quarters, Ethereum rebounded with a +36.4% increase in the fourth quarter, reaching a yearly high of $2,376 in December.

Solana (SOL) rose +917.3% from $10.0 to $101.3. While price movements slowed in the second and third quarters due to the sale of holdings by the bankruptcy estate of FTX, Solana showed an aggressive rise in the fourth quarter, reaching a high of $121.5.

In the non-fungible token (NFT) space, the trading volume of the top 10 chains reached $11.8 billion in 2023. However, this figure showed a decline, less than half of the 2022 NFT trading volume of $26.3. 10 billion.

Additionally, the report highlights that centralized exchanges (CEXs) continued to dominate trading volume in 2023 despite the regulatory challenges they face. The CEX:DEX spot ratio was 91.4%, highlighting the continued excellence of centralized platforms. Likewise, the CEX:DEX derivatives ratio was 98.1%, highlighting the market’s preference for centralized exchange products despite obstacles faced by major players such as FTX and Binance.

As the industry continues to evolve, the report sets the stage for further exploration and analysis of the dynamic cryptocurrency landscape.

disclaimer

In accordance with the Trust Project Guidelines, the information provided on these pages is not intended and should not be construed as legal, tax, investment, financial or any other form of advice. It is important to invest only what you can afford to lose and, when in doubt, seek independent financial advice. We recommend that you refer to the Terms of Use and help and support pages provided by the publisher or advertiser for more information. Although MetaversePost is committed to accurate and unbiased reporting, market conditions may change without notice.

About the author

Kumar is an experienced technology journalist specializing in the dynamic intersection of emerging fields including AI/ML, marketing technology, cryptocurrency, blockchain, and NFTs. With over three years of experience in the industry, Kumar has established a proven track record in crafting compelling narratives, conducting insightful interviews, and providing comprehensive insights. Kumar’s expertise lies in producing impactful content, including articles, reports and research publications for prominent industry platforms. With a unique skill at combining technical knowledge and storytelling, Kumar excels at communicating complex technical concepts in a clear and engaging way to diverse audiences.

more articles

Kumar is an experienced technology journalist specializing in the dynamic intersection of emerging fields including AI/ML, marketing technology, cryptocurrency, blockchain, and NFTs. With over three years of experience in the industry, Kumar has established a proven track record in crafting compelling narratives, conducting insightful interviews, and providing comprehensive insights. Kumar’s expertise lies in producing impactful content, including articles, reports and research publications for prominent industry platforms. With a unique skill at combining technical knowledge and storytelling, Kumar excels at communicating complex technical concepts in a clear and engaging way to diverse audiences.