Bankrupt cryptocurrency lender Celsius Network today revealed plans to unlock its existing Ethereum holdings in preparation for a speedy distribution to creditors.

Celsius, a lender currently undergoing bankruptcy proceedings after filing for Chapter 11 in July 2022, declared on January 5 that it would begin redistributing assets to secure sufficient liquidity before funds are redistributed to creditors.

Celsius also announced plans to unstake its current Ethereum (ETH) holdings, which has been generating significant staking reward returns for the property.

The launched Ethereum aims to cover various costs incurred during the restructuring process and quickly process distributions to creditors.

The decision appears to be a positive development for Chelsea customers who have been waiting for their funds to be returned for over a year and a half. According to Chelsea’s recovery plan, creditors will receive Bitcoin (BTC) and/or Ethereum as part of the settlement.

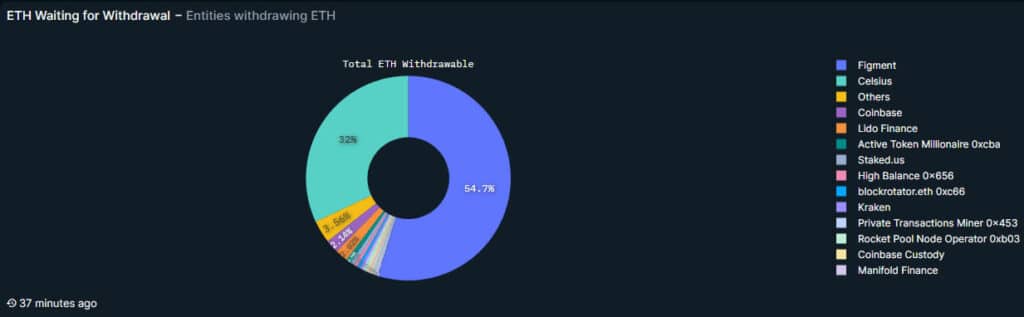

Blockchain analytics firm Nansen reports that Celsius currently holds about 32% of Ethereum pending withdrawal, or 206,300 ETH, worth about $468.5 million.

The company also revealed that Chelsea has withdrawn 40,249 ETH to date, with 19,906 validators waiting for the full withdrawal.

While some people are concerned that large withdrawals from Ethereum could have a negative impact on its market value, others are concerned that trust As Chelsea progresses through its restructuring, it will have a positive impact on Ethereum’s long-term prospects.

Chelsea’s bankruptcy journey began in July 2022 following a liquidity crisis triggered by the slump in the cryptocurrency market. This led to a halt in withdrawals and ultimately a filing for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court for the Southern District of New York.

Celsius has since been working on a settlement plan that would allow eligible users to withdraw 72.5% of their cryptocurrency holdings by February 28. Court documents from September showed that approximately 58,300 users held a total of $210 million in assets classified as “custodial assets.”

Chelsea Network founder and former CEO Alex Mashinsky is currently free on bail after being arrested on fraud charges. His trial is scheduled for September 17.

Celsius switches to cryptocurrency mining operations.

Last month, Judge Martin Glenn gave Celsius Network the go-ahead to pursue an alternative plan that creditors had previously ratified, involving the creation of a new public company focused solely on Bitcoin mining.

Chelsea’s creditors will be partially compensated through shares of this new Bitcoin mining venture, aligning their interests with the success and expansion of mining activities. This approach also releases $225 million worth of cryptocurrency assets that were initially earmarked for other projects but were rejected by the SEC.

The new company, called MiningCo, will focus on mining operations and be managed by Hut 8 under a four-year contract.

The transaction includes management of five Texas-based mining facilities with approximately 12 EH/s of computing power and a total energy output in excess of 300 MW, equivalent to a total of 122,000 miners.

MiningCo will focus on staking and mining activities, with a projected balance sheet of $1.25 billion, including $450 million in readily available cryptocurrency assets.

The company aims to generate $10 million to $20 million in annual revenue by staking cryptocurrency on the Ethereum network, according to court documents.