Changes to Reporting Requirements: A Closer Look

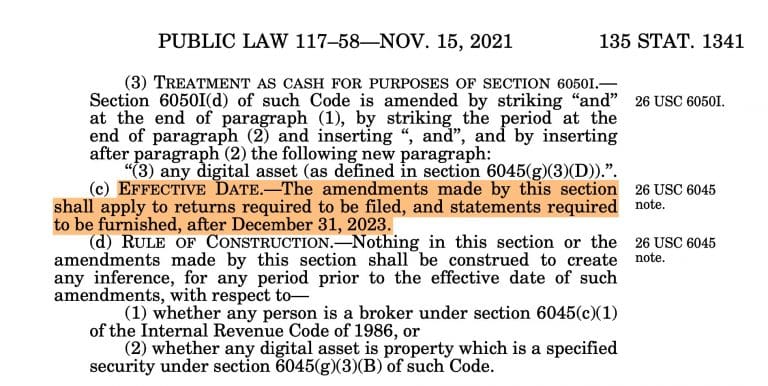

The Infrastructure Investment and Jobs Act, enacted in November 2021, introduced new provisions within the tax code, mandating that cryptocurrency transactions exceeding $10,000 be reported to the Internal Revenue Service. (revenue) Within 15 days of receipt. The regulation, which takes effect from January 1, 2024, requires comprehensive personal information including sender details, transaction amount, date, etc., creating compliance issues for cryptocurrency users.

Challenges and Uncertainties Surrounding Compliance

Although Coin Center, a leading cryptocurrency advocacy group, challenged the constitutionality of Act 6050I through a legal action filed against the Treasury Department in June 2022, the law is currently in effect. Jerry Brito, Managing Director of Coin Center, highlighted the compliance dilemma, citing the ambiguity of current obligations as well as compliance enforcement.

Identifying relevant information about transactions, such as block rewards or transactions conducted through decentralized exchanges (DEXs), is still unresolved, complicating the compliance process.

Practical obstacles faced by cryptocurrency participants

Complying with the new laws poses real challenges for various sectors, especially in the cryptocurrency space. Cryptocurrency miners or validators receiving block rewards of $10,000 or more face a dilemma when determining the reporting details required. Likewise, participants in decentralized exchanges have difficulty identifying counterparties, while organizations that receive anonymous cryptocurrency donations above a threshold have difficulty meeting reporting standards.

Ambiguity and unanswered queries

Several gray areas persist in applying this law. Assessing the $10,000 threshold for cryptocurrency value requires clarity, and the lack of guidance from the IRS adds to the uncertainty. The lack of a defined reporting method or form for cryptocurrency transactions further confuses the compliance environment.

Legal battles and enforcement dynamics

Despite the ongoing legal battle challenging the constitutionality of the law, its enforceability remains in place unless a court overturns it. As litigation continues, the lack of precise guidance, unresolved issues, and the absence of specific reporting mechanisms are adding uncertainty to cryptocurrency users’ compliance responsibilities.

The introduction of this regulation has created significant compliance hurdles, leaving cryptocurrency users, miners, validators, and organizations accepting cryptocurrency donations to grapple with reporting complexities as they await additional regulatory clarity. As the legal landscape evolves, the implications of this regulation continue to shape the future compliance framework for the cryptocurrency industry.

Also Read: XRP Becomes Most Traded Altcoin on US Cryptocurrency Exchanges