BTC price begins a sideways trend as several head-on attempts by buyers to break the $45,000 barrier fail miserably. As the indecisiveness continues, the pace of some altcoins is increasing, raising expectations of a bullish reversal.

Moreover, the outlook for 2024 from several players in the cryptocurrency industry remains optimistic, which helps overall sentiment. Common factors include a high likelihood of spot Bitcoin ETF approval, a Bitcoin halving in 2024, and a possible interest rate cut. Therefore, Bitcoin price predictions remain optimistic for 2024.

Last night’s 1.20% drop continued the bearish streak of 2.05%, following the ongoing BTC price action. However, the near-term trend maintains the formation of higher lows and predicts a bullish advantage at lower levels.

BTC price analysis

The 1D BTC price chart shows an elongating sideways trend. The longer the duration, the more likely a bearish reversal is. So, if buyers fail to cross the $45,000 barrier within the first week or 10 days of 2024, the bears could soon seize control of the trend.

Source – Trading View

Currently, the BTC price is trading at $42,056 and is forming a doji candle, signaling an upward reversal. Moreover, a highlighted eclipse results in lower price rejection, forming a higher low.

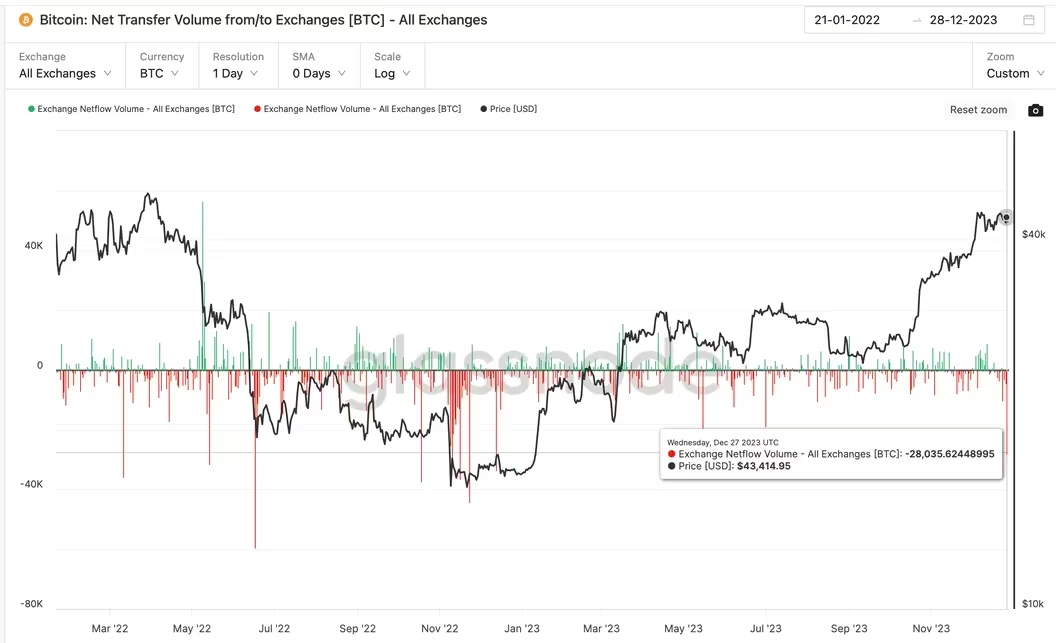

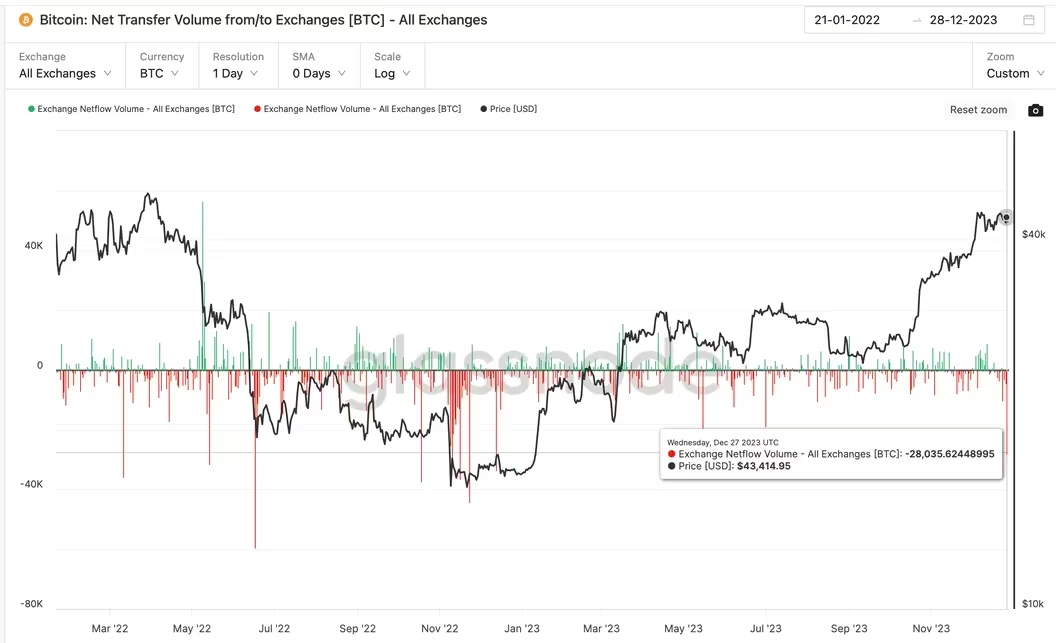

On Wednesday, a significant amount of Bitcoin (about 28,000 BTC worth $1.19 billion) was withdrawn from central exchanges. This was the largest withdrawal in a single day since December 14, 2022. When investors move their Bitcoin off exchanges, it often implies that they plan to store it for longer or that they want to manage it themselves.

The total number of bitcoins held in centralized exchange wallets has now fallen to 2,327,025 BTC, the lowest level since April 2018. Typically, if there are fewer Bitcoins available on exchanges, there may be less pressure to sell, which could help push the BTC price higher.

Is Bitcoin worth buying in 2023?

With Bitcoin showing sustainability above $40,000, buyers are likely to drive the upward trend past the $45,000 threshold and aim higher to reach the $50,000 mark. Potentially starting a new upward trend in 2024, BTC price is likely to enter levels above $50,000 in 2024.

On the other hand, failure to stay above $42K will likely extend the adjustment period to $40K. In this case, Bitcoin is likely to retest the important support area and the 50D EMA at $40,227.