The metaverse is Unbanked Newsletter For weekly level-ups on NFTs, virtual worlds, and more

Dear unbanked nations,

Ordinals recently launched an explosion of “Inscriptions” tokenization activity in Bitcoin (and beyond).

However, there is another relatively new Bitcoin tokenization protocol. stampThat too has been gaining strength recently.

Never heard of Stamps or SRC-20? don’t worry. In today’s post, we’ll take a look at how Stamps works, how it compares to Ordinals, and how you can try it out for yourself!

-WMP

👉 Kraken NFT was created for secure NFT transactions. ✨

released by mic in space March 2023, Bitcoin Stamp System It started with Proof of Concept Project Bitcoin L2 has been used by Counterparty since 2014. Stamps have since changed. Completely with Bitcoin That’s thanks to an update last summer to the base protocol, now called SRC-20.

Creator Mike originally conceived of it as a way to mint stamps. Perpetual Bitcoin NFT. However, the protocol has also been extended to replicate BRC-20, the bulk (semi-)fungible token that boomed in Bitcoin. Thanks to the inscription craze Casey Rodarmor launched Ordinals in January 2023 and has since taken off.

The main difference between Stamps and Ordinals is their architecture.. This is because Stamp stores metadata in a multi-signature unspent transaction output (UTXO), while Ordinal stores metadata in the “witness” segment of a Bitcoin transaction.

This design contrast leads to a subtle but notable trade-off here. In other words, Stamps’ UTXO method is unorganized So although they appear to be permanent, they cost more to make than Ordinals style mints. Conversely, the way Ordinals uses witness data ultimately makes it possible (although unlikely) to cleanse the witness data. cheaper Making more than stamps.

Unbanked Citizens Completed Our Zito Quest airdrop hunter equipment I just earned over $15,000 🏹

Don’t miss out on: 👇

So while Ordinals may offer the best; Permanence to Cost Ratio In the case of today’s cryptocurrency NFT (It is possible to obtain on-chain NFTs on Ethereum, but they are relatively more expensive to build than Ordinals.) Currently the Stamps system appears to provide the simplest method. everlasting guarantee here.

But not everyone will find this project interesting or useful!

For example, old-school hardline Bitcoiners like Luke Dashjr have recently taken swings at both Ordinals and Stamps, and welcome these minting systems with a following. spam attack Compared to Bitcoin. Dashjr’s new offshore mining pool is set up to filter inscription and stamp transactions, and he has already presented the concept of changing Bitcoin to: Other proof-of-work (PoW) algorithms To combat NFT-friendly Bitcoin miners.

Perhaps the Bitcoin community will eventually split into new About the difference of opinion here. Other block size war On one side you will have the creative experimenters and on the other you will have the “Bitcoin is just money” veterans.

But for now, Dashjr’s recent comments have only added fuel to the fire. This is because interest and activities in stamps are showing new aspects. Best ever In recent years. In fact, the first and second stamps ever produced were sold as follows: 1.7 Bundles for BTC (~$150,000 USD), which signals a surge in interest.

Of course, the Stamps market, like all assets, can go through boom and bust cycles, but the technology is legitimate and attractive either way. Stamps are interesting not only because of their permanence, but also because, like Ordinals, they provide a new, open token standard. new possibilities This is something that has never existed in Bitcoin before.

Smart contract platforms like Ethereum and Solana have already been using native token standards for years and have little need for this kind of system. Conversely, Bitcoin decisively broke into the tokenization big leagues in 2023 as developments like Ordinals and Stamps began to come to the fore. unprecedented demand.

In other words, a Bitcoin Renaissance like you’ve never seen before. Let’s say you’ve already tried Ordinals and now you want to explore Stamps as well. Where should I start?

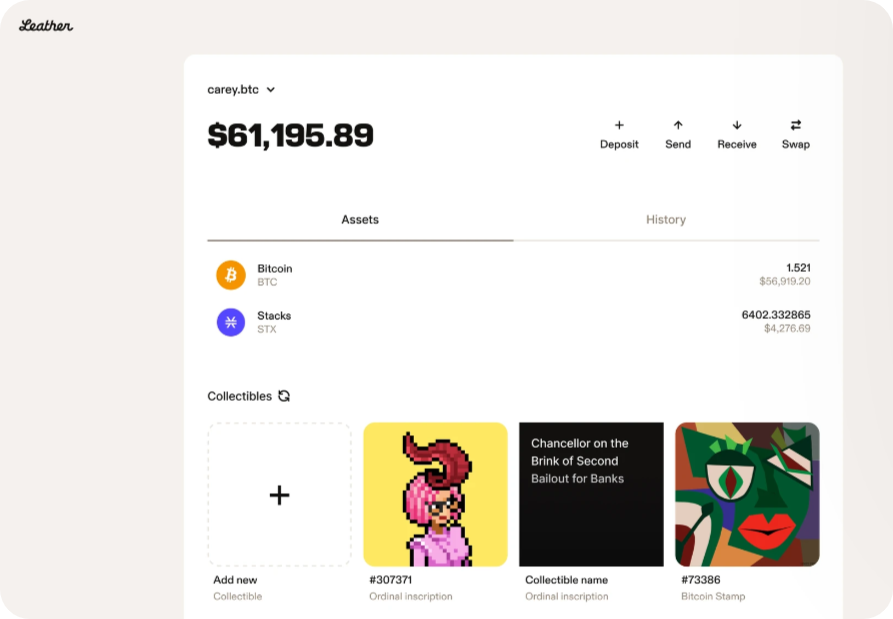

On the wallet side, I recommend starting with: leather A Bitcoin wallet that supports (formerly Hiro). Ordinal numbers and stamps and BRC-20 and SRC-20 also. If you have previous experience with browser wallets like Coinbase Wallet, MetaMask, or Rainbow, you’ll find navigating Leather familiar and simple as it offers a similar UX to those mainstream, albeit in a Bitcoin-centric approach.

That said, whatever you do, don’t jump into Stamp with your existing Bitcoin wallet. you can lose assets Try using an incompatible wallet!

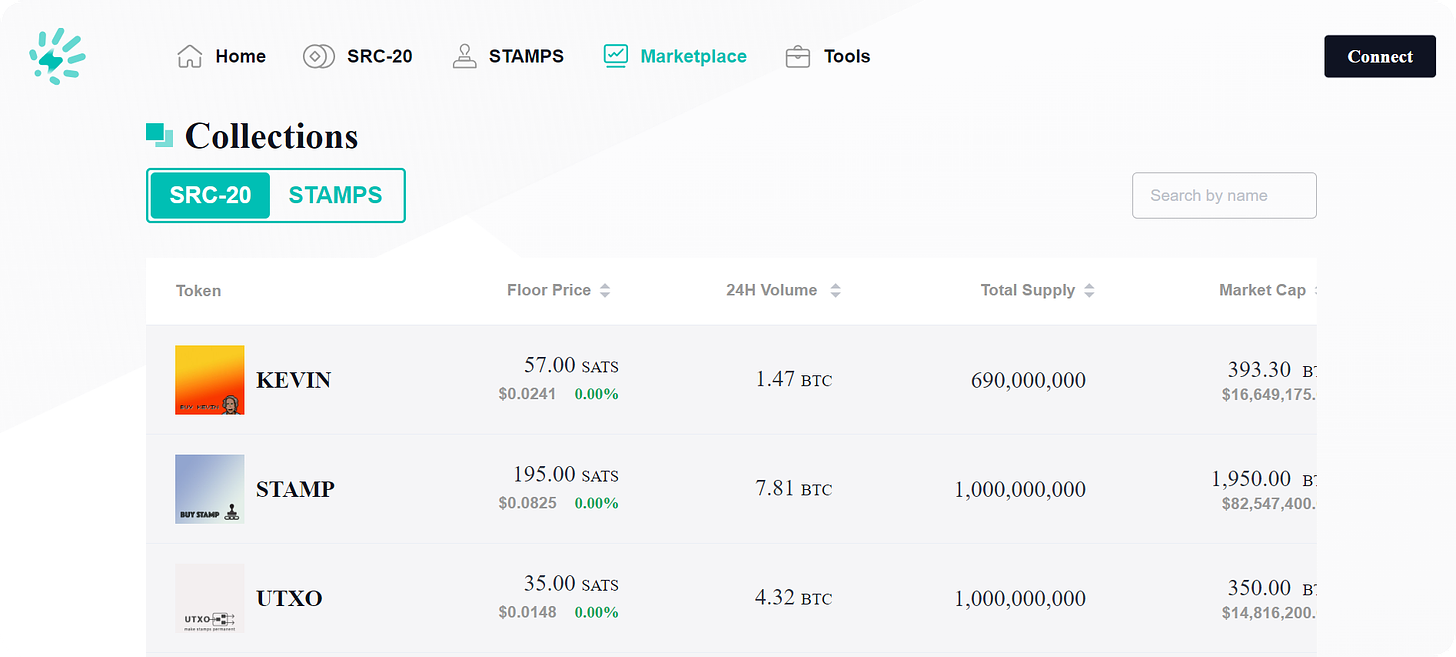

Once you have your wallet ready and ready to use, you can retrieve your Stamp NFT mint or SRC-20 tokens. open stamp Currently there is one platform that can do both, but there are others. nascent market You might want to consider it right now. rare stamp, Stamp Scanand StampedNinja. If you are curious about making your own stamp, stamp bot We offer casting services that you can try.

Ultimately, whether the Stamps system will become a permanent fixture in the cryptocurrency ecosystem remains an open question. However, the current burgeoning popularity of Stamps mint and the new possibilities it brings to Bitcoin cannot be ignored. Combined with Ordinals, Stamps positions Bitcoin’s creative scene to become increasingly rich in the coming years, which means the showdown with the JPG-hating Bitcoin maxis is more certain. We’ll see what happens from here!

William M. Feaster is the creator of metaverse — Bankless newsletter focused on the emergence of NFTs in the cryptocurrency economy. He also serves as a senior writer for the Bankless newsletter.

Kraken NFT One of the most secure, easy to use and dynamic marketplaces. Active and new collectors alike will benefit from no gas fees, multi-chain access, payment flexibility using fiat or over 200 cryptocurrencies, and built-in rarity ranking. Learn more Kraken.com/nft

👉 Visit Kraken.com to learn more and open an account today.

It is not financial or tax advice. This newsletter is strictly educational and does not constitute investment advice, a recommendation to buy or sell any asset, or a recommendation to make any financial decisions. This newsletter does not constitute tax advice. Consult your accountant. Do your own research.

expose. Occasionally I may add links to products I use in this newsletter. If you purchase through one of these links I may receive a commission. Bankless authors also hold cryptocurrency assets. see us Investment disclosure here.