The cryptocurrency market showed early signs of recovery today after a sharp sell-off, with Bitcoin climbing back above the $71,000 level. The bounce followed a wave of panic selling that sent market sentiment to extreme levels of panic, leaving investors unsure whether the move represented a true recovery or just a short-term bounce before another downturn.

The Crypto Fear and Greed Index fell to 5, one of its lowest levels ever, indicating the level of negative sentiment. Similar levels were last seen in major market crashes, including the COVID-19 crash and the FTX collapse, highlighting the scale of fear that has gripped the markets recently.

Bitcoin and altcoins recover as oversold conditions ease

Bitcoin briefly fell close to the $60,000 level before finding support and rebounding. At the same time, major altcoins also recorded strong short-term gains. Ethereum is up nearly 9%, Solana is up more than 14%, and XRP has surged more than 20% from its peak during the rebound.

Despite the recovery, prices remain well below recent highs, showing that the overall market remains vulnerable. Analysts say the rebound is likely to be driven by traders unwinding short positions and new liquidity flowing into the market, rather than strong long-term buying confidence.

Tether has minted nearly $2 billion worth of USDT over the past few days, which may have helped support prices in the short term by adding liquidity to the market.

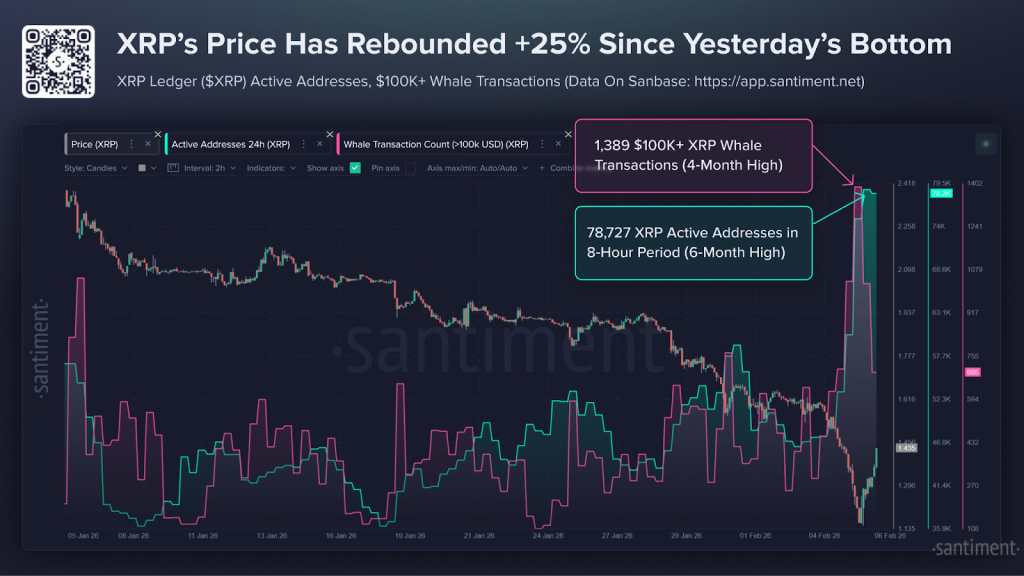

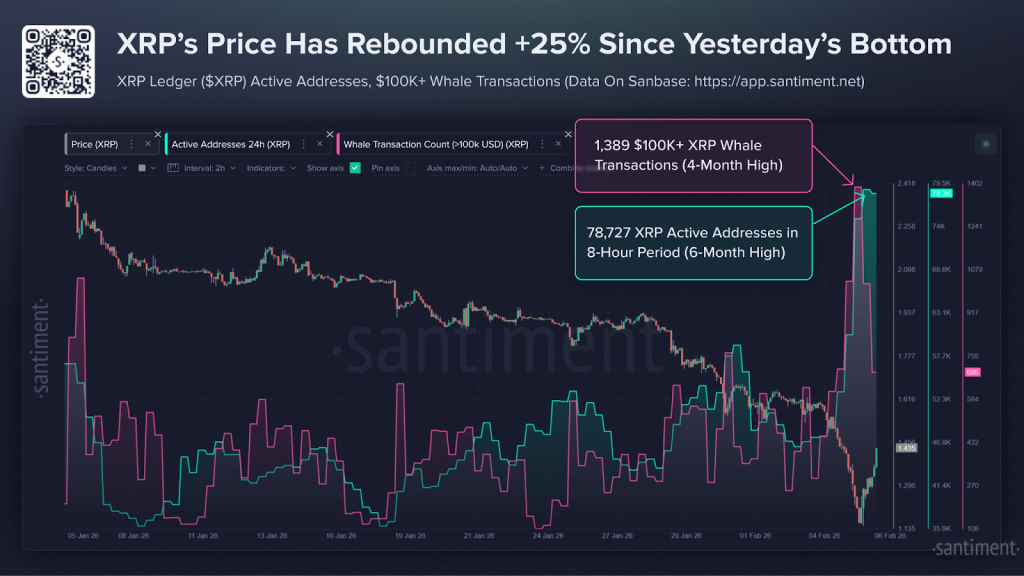

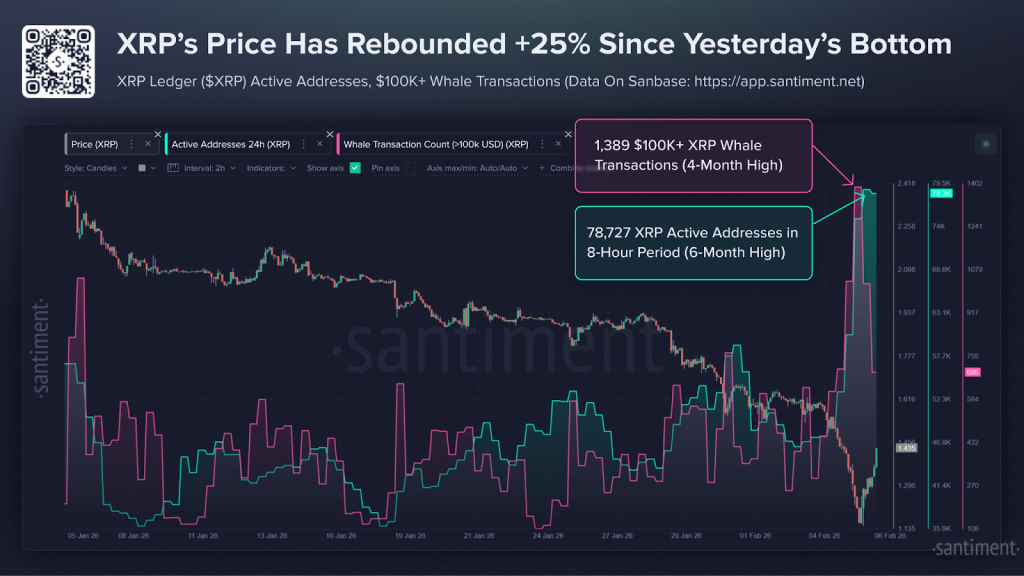

XRP price shows strong signs of recovery amid whale buying

XRP stood out during the rebound, posting sharper gains compared to the overall market. According to Santiment data, the price of XRP recovered from under $1.15 to over $1.50 in less than a day.

The rally was fueled by whale activity, with more than 1,389 transactions worth more than $100,000 recorded, the highest level in four months. At the same time, the number of active XRP ledger addresses has surged to a six-month high, suggesting renewed interest is emerging during the downtrend.

These signals often indicate strong buying during panic situations seen near short-term market bottoms.

Is a Bitcoin relief rally or further decline still possible?

Bitcoin has yet to confirm a complete trend reversal. Buy signals appear on shorter time frames, but for stronger confirmation a weekly signal is needed and is still missing.

Past market cycles often show that an initial bounce is followed by weeks of choppy price action or even a further decline. In recent months, similar setups have led to brief optimistic outlooks followed by failures.

Bitcoin may move into the $75,000-$80,000 range in the near term. However, a sustained move above $80,000 appears to be needed to restore confidence in a new bullish phase.

Trust CoinPedia:

CoinPedia has been providing accurate and timely cryptocurrency and blockchain updates since 2017. All content is produced by an expert panel of analysts and journalists following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, Credibility). All articles are fact-checked against reputable sources to ensure accuracy, transparency and reliability. Our review policy ensures unbiased evaluations when recommending an exchange, platform, or tool. We strive to provide timely updates on all things cryptocurrency and blockchain, from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the author nor the publication is responsible for your financial choices.

Sponsorship and Advertising:

Sponsored content and affiliate links may appear on our site. Ads are clearly visible and our editorial content is completely independent of our advertising partners.