Ethereum (ETH) entered the week under significant pressure, down nearly 8% today and decisively below the $2300 level amid a broader cryptocurrency market sell-off. This move unfolded quickly as leveraged long positions disappeared and spot demand failed to stabilize prices, accelerating downward momentum. On-chain behavior suggests that the Ethereum price is facing more than just routine declines, although we see capital moving to exchanges rather than long-term storage as macro uncertainty increases. This is similar to how ETH may enter circulation.

On-chain flows signal increased distribution risk.

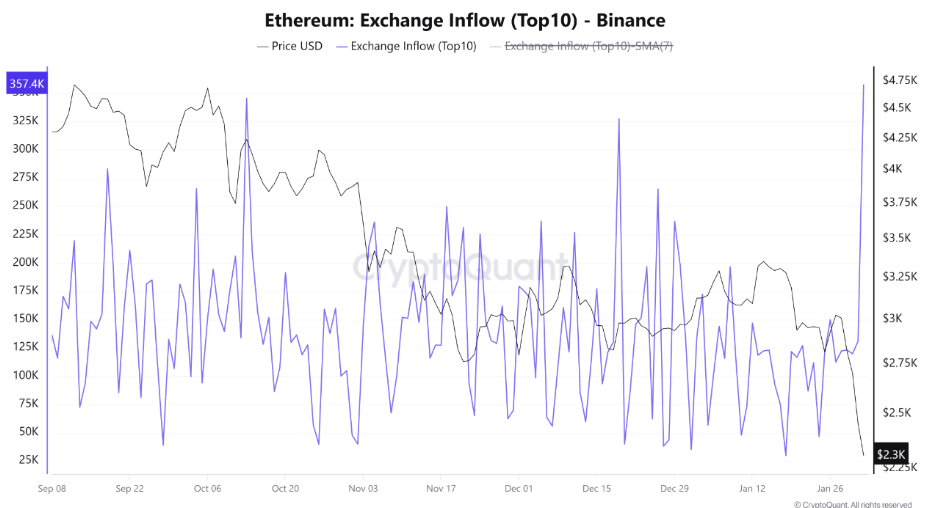

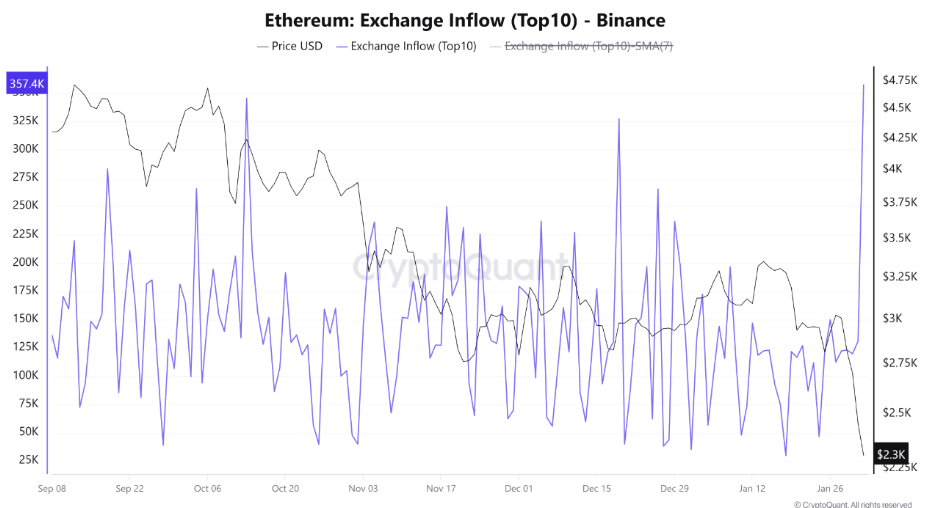

Ethereum’s shortcomings have been driven by notable changes in on-chain behavior, particularly among large holders. Exchange inflow data shows a synchronized increase in ETH deposits. This is often a signal related to preparation for selling, hedging or risk reduction. On February 1, inflows to Binance surged to approximately 357,000 ETH, the highest daily inflows to the exchange since September. At the same time, total inflows across all major exchanges reached 600,000 ETH, one of the largest collective surges seen in recent months.

Such concentrated inflows are rarely seen during periods of strong accumulation. Instead, they tend to surface when large holders reposition their exposure near key price levels. The timing of this surge in inflows, just before ETH fell below $2,300, significantly increased the market’s sensitivity to a downside move. These inflows, along with increased leverage, reduced the market’s ability to absorb selling pressure and amplified the liquidation cascade once prices began to fall.

Liquidation pressure increases as leverage is aggressively unwound

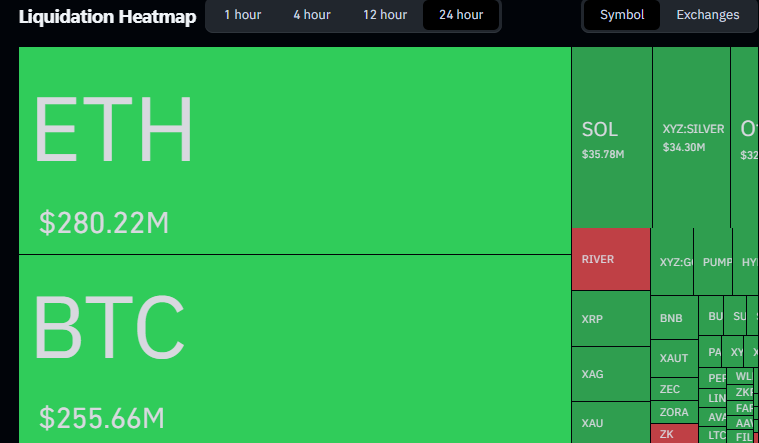

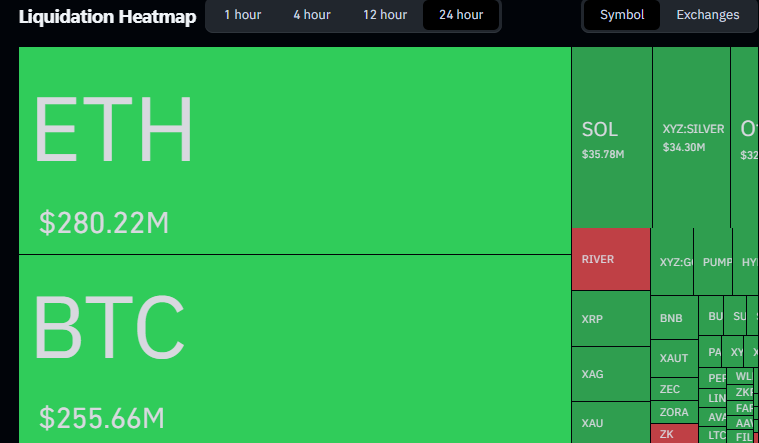

Derivatives data shows Ethereum is at the center of the latest liquidation wave. Over the past 24 hours, ETH-related liquidations have surged to around $280 million, surpassing Bitcoin’s $250 million and reinforcing Ethereum’s role as a major stress point in the market.

The liquidation heatmap shows that long positions dominated losses, confirming the overcrowding of bullish leverage near recent consolidation highs.

Once ETH fell below short-term support, a cascading break accelerated the decline, sending the price quickly higher through areas of low liquidity. This pattern reflects structural weakness rather than panic selling. When liquidations are clustered this tightly, price movements tend to exceed fair value before stability is restored, leaving Ethereum vulnerable to additional volatility in the near term.

Ethereum price structure weakens below key support

The recent breakdown of Ethereum below the $2,500 support area has significant implications. The loss of the $2300-$2500 support level invalidated the previous consolidation structure and shifted market control firmly to the sellers. Ethereum price is currently trading below its short-term moving average, and momentum indicators are declining rather than stabilizing.

The lack of strong buying volume during the downtrend further suggests that demand remains cautious rather than aggressive. Immediate support is near $2000, a break of which could lead to a big decline towards $1600 next.

Is the worst of the ETH sell-off already priced in?

Despite the continued selling, Ethereum’s higher term structure is starting to hint at a potential inverse head and shoulders formation. This structure was formed after ETH fell into the $2100-$2500 area, where selling momentum started to disappear and volume failed to extend to new lows. Recent price action suggests that a right shoulder is developing, which means it is stabilizing rather than falling.

This reversal scenario will only gain credibility if ETH price recovers the $2500 neckline with strong volume. Until then, the pattern remains conditional, with a loss of $2,100 invalidating the setup and restoring downside risk. A period of consolidation or technical relief bounce cannot be ruled out if ETH maintains its current demand zone. Until recovery levels are decisively broken, the broader outlook remains cautious and volatility is likely to remain elevated.

Trust CoinPedia:

CoinPedia has been providing accurate and timely cryptocurrency and blockchain updates since 2017. All content is produced by an expert panel of analysts and journalists following strict editorial guidelines based on EEAT (Experience, Expertise, Authority, Credibility). All articles are fact-checked against reputable sources to ensure accuracy, transparency and reliability. Our review policy ensures unbiased evaluations when we recommend an exchange, platform, or tool. We strive to provide timely updates on all things cryptocurrency and blockchain, from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making any investment decisions. Neither the author nor the publication is responsible for your financial choices.

Sponsorships and Advertising:

Sponsored content and affiliate links may appear on our site. Ads are clearly visible and our editorial content is completely independent of our advertising partners.