Infini collapse causes a new investigation into KAST’s tokenized cashback models as the systematic risk increases.

Gregory Pudovsky

Post: June 25, 2025 12:18 PM Update: June 25, 2025 12:18 PM

Recently, Infini Card, which is considered a fast -growing encryption payment player, has suddenly closed the global encryption card business. This shutdown reaffirmed industrial concerns about the sustainability of the encryption payment business model. Cash flow, profit margin reduction, rising compliance costs and rising agreements ultimately overwhelmed the financial capacity of the platform. But Infini’s collapse is still fresh, but the waves of the new platform are emerging as a more complex financial structure designed to expand the fantasy of rapid growth.

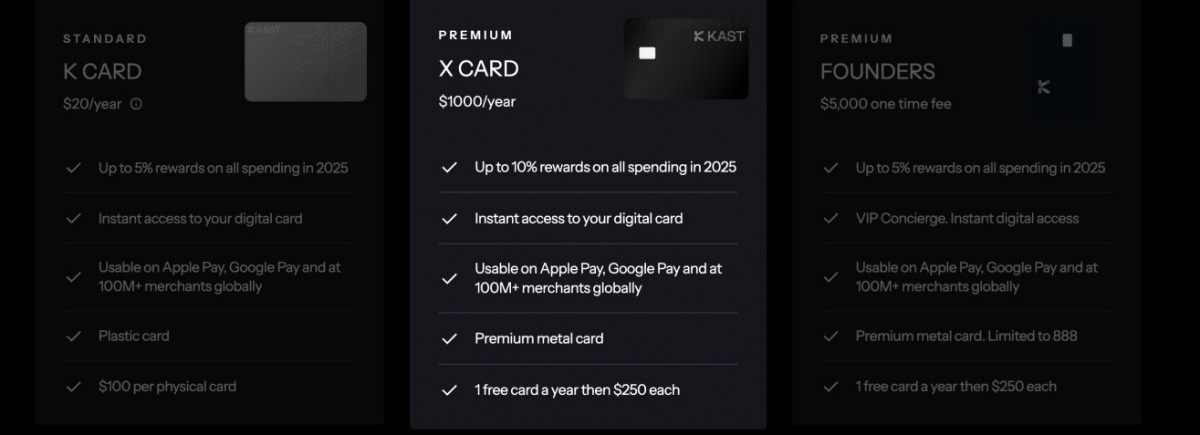

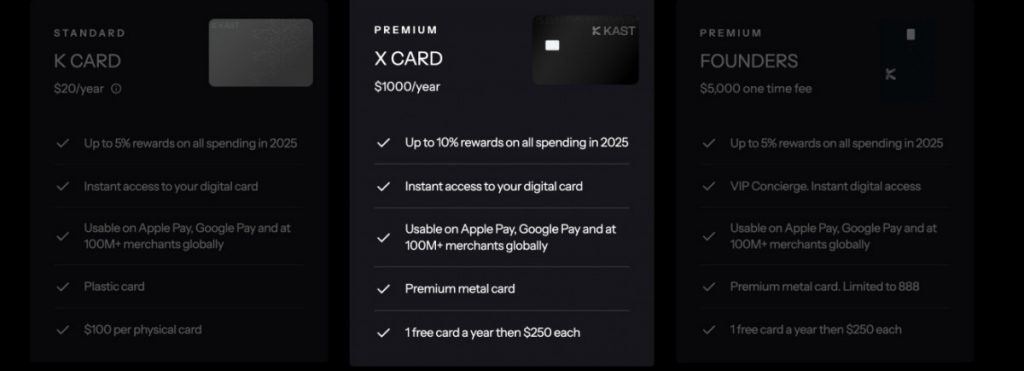

Among them, KAST provides up to 10%cashbacks in KAST POINTS, rapidly refining in traditional cashback logic. Unlike conventional cash backs that users receive cash or stablecoin that users spend after each transaction, KAST provides a compensation point that cannot be repaid immediately. This point can only be converted to KAST’s basic tokens after the future token generation event (TGE). Nevertheless, the user faces the unlock schedule and the secondary market volatility before the actual cashback occurs.

On the surface, this model provides significant short -term financial flexibility to the platform. Points do not require immediate cash expenses, so the project can promote the initial stage growth while minimizing short -term financing pressure. High cashback rates can easily attract users. You can overlook that what users are receiving are token generation promises that are not inherently delayed.

Every point issued core is the obligations of the future. As the outstanding point of outstanding points increases, the dependence on the system for new capital inflows and future token price audits will intensify. In order to absorb the final sales pressure in the second market, it is necessary to acquire continuous user and fresh liquidity injection. If the user growth rate is slowed or the market conditions deteriorate, the systematic risk of systematic repayment can be quickly surface.

Some platforms rely on indirect venture funds to increase token prices, maintain market trust, and delay repayment pressure. Such capital injections are often suggested as growth funds, but some of them can be effectively shifted to support token liquidity and price stability, and cover the fundamental vulnerability of the system.

By default, tokenized cashbacks do not eliminate restraint obligations. Simply hide, delay and combine over time. All tokens distributed today are the responsibility of the actual cash flow that must be paid. If the basic profitability of the platform does not match the token debt, the aggressive cashback incentive can ultimately push the platform into a sudden collapse scenario.

The structure reflects the previous risk. In recent years, platforms such as Celsius and Voyagers have used similarly used growth models. While attracting users with high -profit promises, there is a lack of sustainable profits that can emit these obligations. When the market conditions were reversed, the financing was dry, and the regulatory authorities entered, the system was released at an amazing speed, leaving a collapsed token and a user loss that could not be returned.

KAST provides a sustainable cashback proposal, and unlike Infini, which is burning directly through cash, tokenization changes the burden into the future. The short term is healthy, but long -term redemption debt is growing and growing. The expansion of volatile token prices, uncertain unlocking schedules, broken secondary market liquidity and continuous expansion of fundraising will eventually have a delicate risk of rapidly solving.

Regulatory uncertainty makes these models more complicated. Is this tokenized cashback system that is not effectively registered? Do they go to the realm of illegal funding? Did the user receive a complete and transparent disclosure of true restraint rights and dangers? In the global environment of rapidly evolving encryption regulations, these questions can attract more and more attention from regulators.

In an ambiguous industry with vague profitability, business models need to be basically returned. Real profit fund cashback; Rewards are immediate and can be spent. And the user’s rights are clear, predictable and no complex token economy.

Infini’s collapse may not be an isolated event. As the tokenized cashback model continues to expand actively, it is probably the moment when the industry is suspended and reflected in the current industry to truly organize sustainable financial innovations.

The more powerful the growth story is, the more important it is to recognize the balloon redemption hole in which the balloon restraint hole grows quietly.

disclaimer

The trust project guidelines are not intended and should not be interpreted as advice in law, tax, investment, finance or other forms. If you have any doubt, it is important to invest in what you can lose and seek independent financial advice. For more information, please refer to the Terms and Conditions and the Help and Support Pages provided by the publisher or advertiser. Metaversepost is doing its best to accurately and unbiased reports, but market conditions can be changed without notice.

About the author

Gregory, a Polish digital nomadic citizen, is not only a financial analyst but also a valuable contribution to various online magazines. Based on his abundant experience in the financial industry, his insights and expertise have been recognized by numerous publications. Gregory is now dedicated to writing books on cryptocurrency and blockchains.

More

Gregory, a Polish digital nomadic citizen, is not only a financial analyst but also a valuable contribution to various online magazines. Based on his abundant experience in the financial industry, his insights and expertise have been recognized by numerous publications. Gregory is now dedicated to writing books on cryptocurrency and blockchains.