The Federal Reserve Bank decided not to change the interest rate on May 7 and maintained from 4.25%to 4.50%. This made encryption assets more attractive to investors. As a result, Bitcoin is rising today, with $ 100,000. Ether Leeum is also going up, but experts believe that STHS can soon be sold to benefit. This is supported by a decline in major hot chains, which may soon be reversed.

ETH’s MVRV ratio to trigger the reversal

In the last 24 hours, the encryption market has seen a strong surge. Bitcoin rose to $ 100,000 and lasted last February. Ether Lee also rose to more than $ 2,000, recovering from the initial tensions of the United States and China.

According to CoingLass, more than $ 175 million in Etherrium has been cleared during this period. Among them, the buyer closed $ 27 million, and the seller saw a $ 148 million forced liquidation. Ether Leeum’s price has increased by 18%, resulting in an increase of $ 24.8 billion.

Also read: Altcoin Season is here: XRP, ADA, Sui, Eth Rally

Ether Lee’s recent profits are partly because of the increase in the interest of large investors since April. Coinshares reported for two consecutive weeks with ether -based ETFs. Some also believe that the PECTRA upgrade released on May 7 has helped to increase the price.

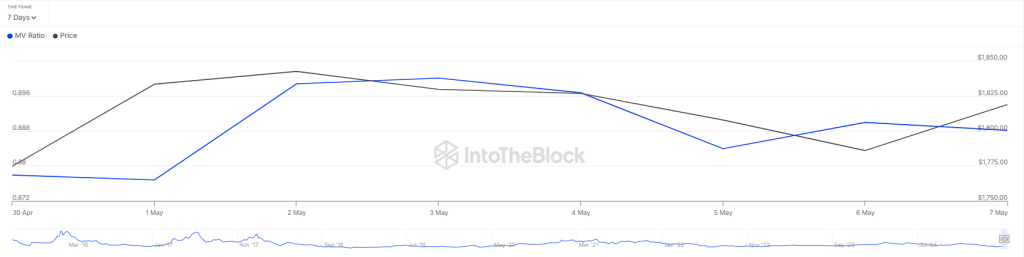

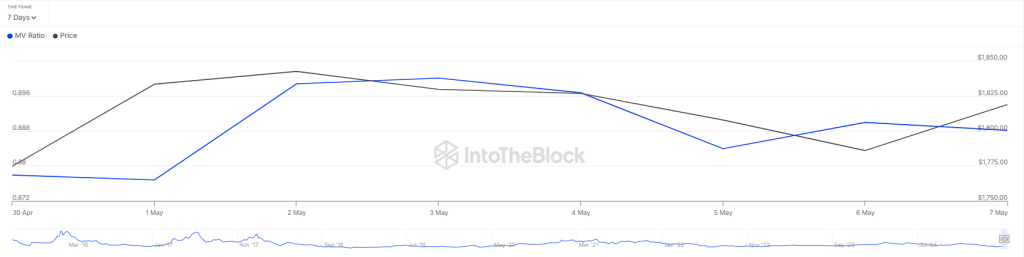

The current demand for purchase in the encryption market may not last long. Intotheblock’s data shows that the MVRV ratio has dropped to 0.888. In other words, it means that many investors are selling losses even if the price rises. This kind of panic sales can lead to more sales and can lead to stagnation.

Nevertheless, some major players (“Smart Money”) are purchased. Wintermute has made a large -scale purchase for the last 24 hours, and has probably benefited from a surge and has earned a market production fee. Similarly, Lookonchain reported that Binance and Krake have withdrew more than 41,000 ETHs ($ 75 million) in Binance and Krake. Despite the rise in prices, almost half of all Etherrium wallets of about 65.5 million people still have losses.

What is the next price of ETH?

The seller is having a hard time pushing the ether under the moving average, which suggests that there is not much pressure to be sold during the upward rally. The buyer has a price around the immediate resistance line. At the time of writing, the price of ETH is $ 2,048, so it increases more than 13% over the last 24 hours.

Buyers can use this as an opportunity to pierce this for $ 2,109. If they succeed, the ETH/USDT pairs can get momentum and increase the $ 2,500 level. There are smaller obstacles at 23.6%FIB level, but it is expected to be overcome.

The seller, on the other hand, will be dragged down the price. If this happens, the ETH can drop to $ 1,734. The buyer is probably going to go there, but if you can’t maintain that level, the price can be lowered with a major support of $ 1,542.

As the RSI trades in the excessive area of Level 78, ETH prices are prepared for short -term decline.