After an 18-month lull, the cryptocurrency market has seen new inflows as the stablecoin market expands.

The cryptocurrency space is experiencing a resurgence as the stablecoin market, particularly Tether’s USDT, has seen a significant surge of $7 billion in market capitalization since September, demonstrating notable capital inflows into the cryptocurrency space, as highlighted by Matrixport. there is.

Active stablecoin market signals increased cryptocurrency liquidity

The stablecoin market, which has been dormant since May 2022, is showing a significant upward trend as follows. USDT on Tether, has achieved an unprecedented market capitalization of nearly $90 billion. This represents a pivotal shift as capital injections surge into the cryptocurrency space, boosting liquidity levels and energizing market momentum.

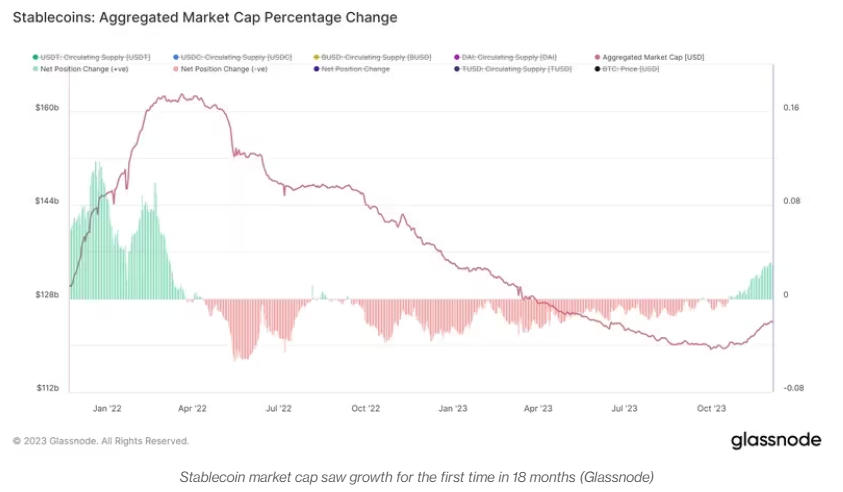

The combined market capitalization of major stablecoins, as evidenced by Glassnode data, has increased by almost $5 billion over the past month, reaching a significant valuation of $124 billion. This expansion symbolizes a decisive reversal in the long-term downward trend that coincided with the start of a challenging phase commonly referred to as “crypto winter.”

Stablecoins, which serve as the digital equivalent of fiat currencies, play an important role in facilitating smooth transactions within the cryptocurrency ecosystem. It acts as a fundamental bridge between traditional fiat currencies and blockchain-based digital asset markets, providing essential liquidity for trading and lending activities.

Interpreting the resurgence of stablecoins as a positive sign

The resurgence in stablecoin market size is a bullish indicator of the overall vitality of the recent cryptocurrency surge. Coin Metrics analyst Tanay Ved interprets this upward trajectory as an early sign of a surge in on-chain liquidity, indicating a scenario where surplus capital is ready to be deployed into the cryptocurrency landscape.

Also Read: Cryptocurrency Market Updates: Weekly Winners and Losers

As outlined in a recent report from Matrixport, Tether (USDT), a major stablecoin widely used on centralized exchanges and across global exchanges, has seen its supply surge by $7 billion since September. This meaningful increase has gained significant traction, especially since mid-October, pushing USDT’s market capitalization past $90 billion, surpassing its previous high in 2022, according to CoinGecko data.

However, while USDT’s growth has been significant throughout 2023, rivals such as USDC and BUSD have suffered contractions, offsetting USDT’s gains until recently.

Market analysts view stablecoin rebound with cautious optimism.

Market analysts, including Noelle Acheson, analyst and author of the Crypto Is Macro Now newsletter, perceive this upward trend as an indication of increased investor interest in crypto assets. Acheson is careful to emphasize that overall stablecoin market capitalization is below levels observed earlier this year, suggesting that while the outlook has improved, there is still room for growth in the current environment.