Main takeout

- Since November 2024, Ether Lee’s short position has increased by 500%, reaching fresh peak.

- Bitcoin and other major password assets have rebounded, but Ethereum has achieved results.

Share this article

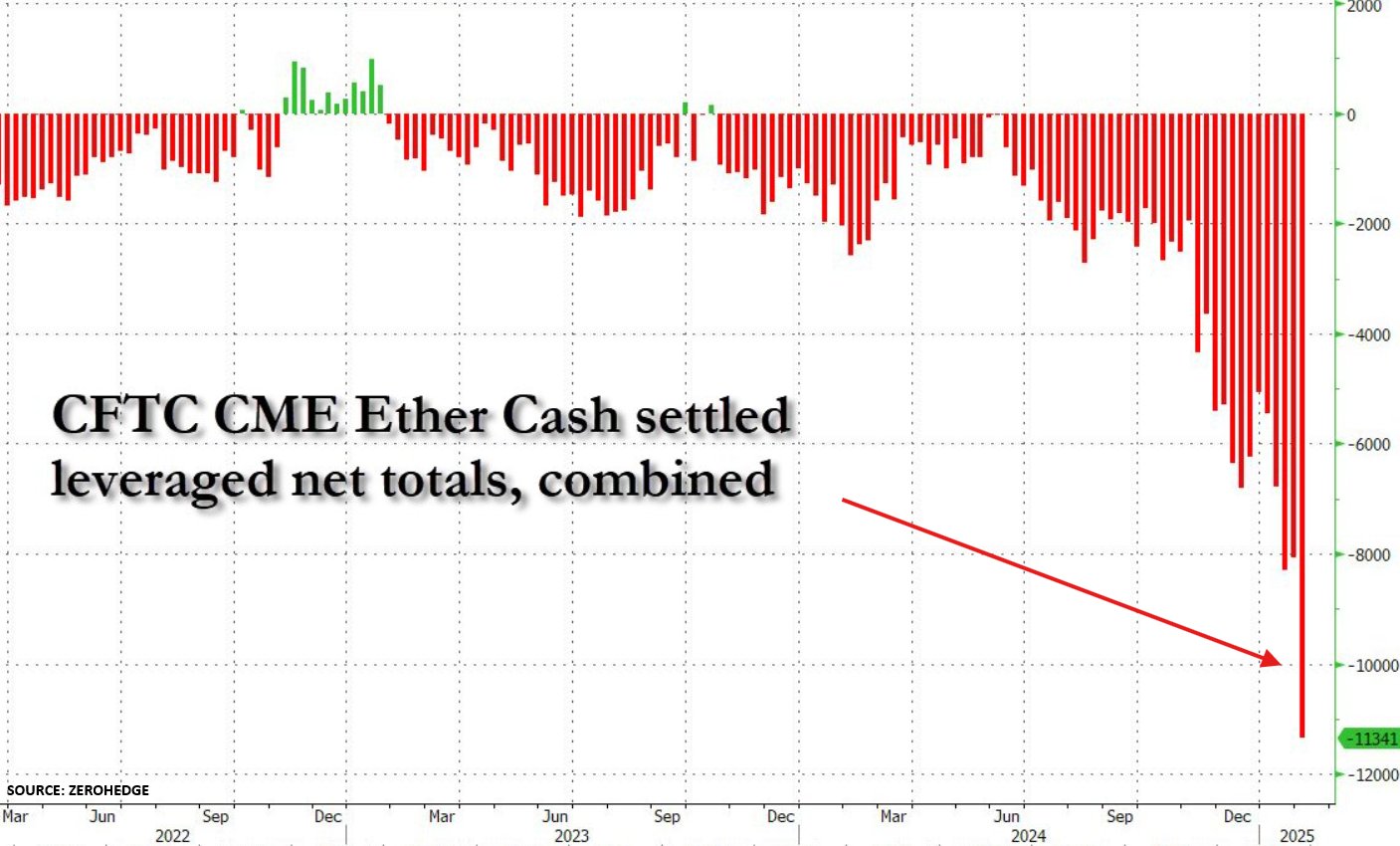

Ether Lee is faced with a short sales level in hedge funds, CME’s futures contract has reached the new highest 11,341, according to the new chart of Zero Hedge.

As analyzed by Kobeissi Letter, Bearish Bets has soared more than 500% since November and more than 500% since November. The aggressive paragraph increases the timely time for Ether Leeum’s short -term prospect.

According to the analysis of Kobeissi Letter, Ethereum’s history shows a clear correlation between a large short position and a subsequent price conflict. On February 2, ETH plunged 37%in 60 hours after President Trump’s tariff announcement.

Analyst added, “In 2010, there was almost no flash conflict, but it felt like there was no headline.” The sale added that more than $ 1 trillion was erased in a wider password market in a few hours.

Despite the obvious support of the Trump administration, the shortage of short positions has recently been temporarily raised by saying that it is a good time to add ETH.

According to the latest Coingecko data, ETH has been around $ 2,500 in about $ 2,500 over the last 24 hours. Digital assets are currently trading about 45% compared to the best record in November 2021.

Bitcoin has left Etherrium on dust since early 2024 and has soared more than 100%, while ETH has gained 3.5% increase. According to Kobeissi Letter, this difference has increased the market cap of Bitcoin to six times the size of Etherrium.

In the recovery market of recovery, Ether Leeum’s performance raises concerns about factors that cause negative emotions. Potential explanations include Ether Leeum’s basic technology, regulatory uncertainty and anxiety about macroeconomic headwinds.

The record short position amplifies the potential of price volatility. Continuous decrease will verify the prospects of the weak, but the size of the short position also increases the short pressure if positive development is realized.

Share this article