Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, is poised for massive upward momentum as it forms a bullish price action pattern on daily time frames. In the last few hours, the sentiment across the cryptocurrency market has completely changed and prices have shifted from downward momentum to upward momentum.

Crypto Whale $5.92 ETH purchase value

Before the US market opened, ETH witnessed a slight price decline, but the situation changed completely when the price moved from the $3,190 level to the $3,445 level in 6 hours. This massive upward momentum has garnered significant interest from cryptocurrency enthusiasts, resulting in significant accumulation.

Today, January 15, 2025, Lookonchain, a blockchain-based transaction tracker, posted on X (formerly Twitter) that a newly created wallet had withdrawn 1,799 ETH worth $5.92 million from Binance. In these market conditions, the withdrawal of an asset is considered a purchase and represents a new acquisition, making it an ideal buying opportunity.

Current price momentum

This recent accumulation, upcoming political events, and the SEC’s latest plans for the pending case have resulted in a significant surge in the price of ETH. Currently, ETH is trading near $3,460 and has witnessed a price increase of over 8.2% in the last 24 hours. Additionally, during the same period, the participation of traders and investors also increased by 15% compared to the previous day.

Ethereum (ETH) technical analysis and future levels

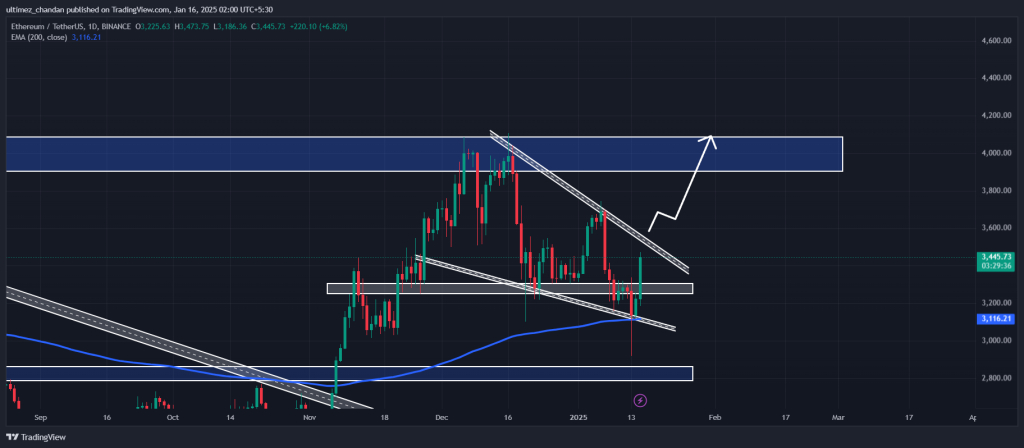

According to expert technical analysis, ETH has again crossed the important support level and is poised to violate the descending wedge price action pattern on the daily time frame.

Based on recent price action and historical momentum, if ETH breaks the pattern and closes the daily candle above the $3,600 level, it is likely to rise 15% in the coming days and reach the $4,000 level.

On the positive side, ETH’s Relative Strength Index (RSI) is still below overbought territory. This indicates that there is ample room for the asset to soar to the forecast target.