Key Takeaways

- Bitcoin’s rise to $80,000 was due to strong institutional demand via spot Bitcoin ETFs rather than retail FOMO.

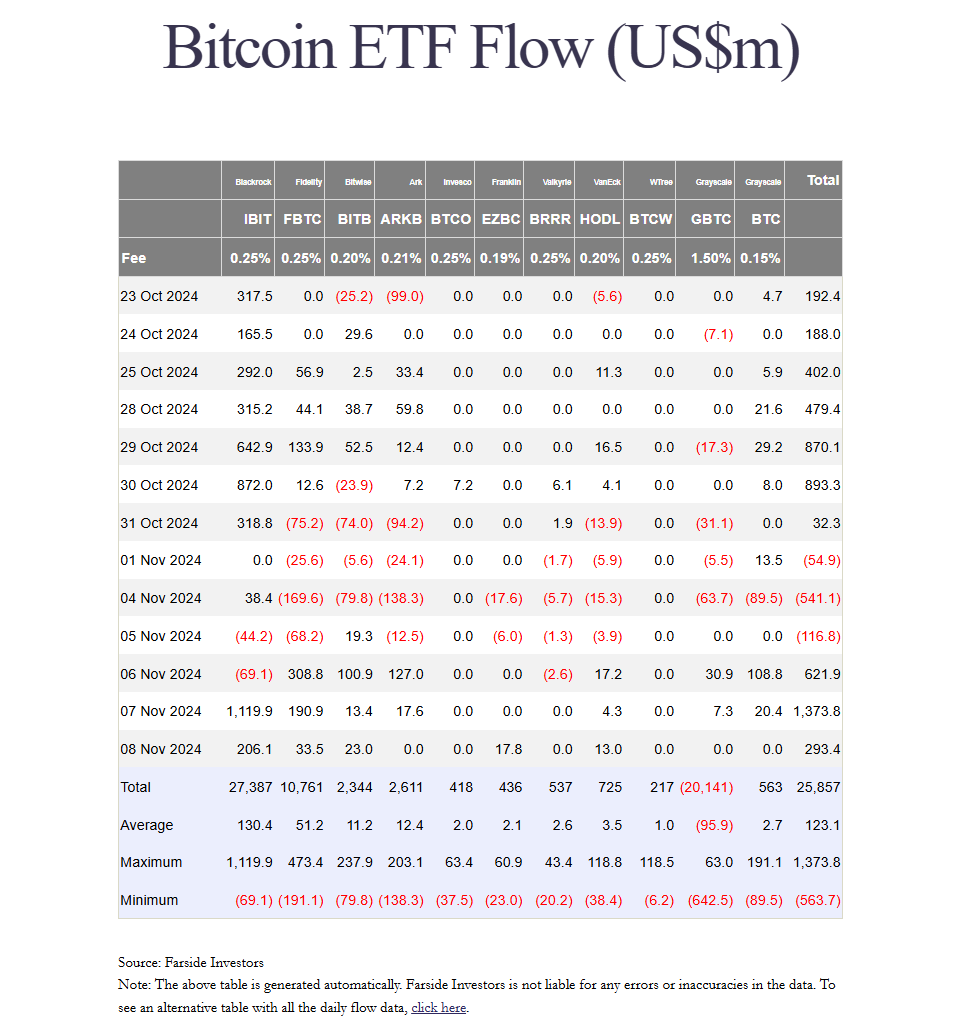

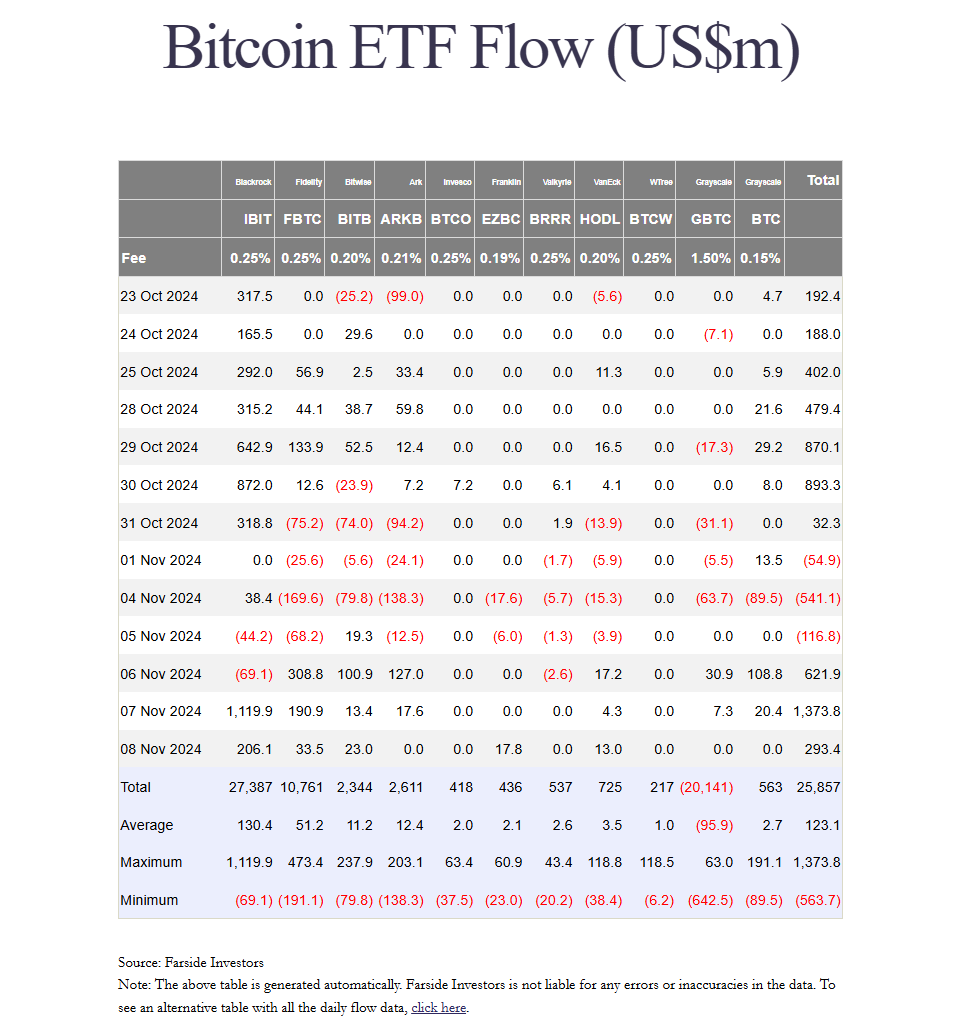

- Spot Bitcoin ETFs accumulated net inflows of approximately $2.3 billion immediately following the US presidential election.

Share this article

According to Gemini co-founder Cameron Winklevoss, Bitcoin reached $80,000 due to consistent institutional demand through spot Bitcoin ETFs rather than retail investor activity.

He believes this “sticky” demand from institutional investors is a sign of long-term bullish sentiment and that the current market cycle is still in its early stages.

“The road to $80,000 Bitcoin is paved by steady ETF demand. It’s not retail FOMO. Little fanfare. People buy ETFs but don’t sell them. This is sticky HODL type capital. The bottom continues to rise,” Winklevoss said. “We just won the coin toss and the inning never started.”

The performance of U.S. cryptocurrency ETFs this week was largely influenced by the results of the presidential election. After Trump declared victory on November 5, spot Bitcoin and Ethereum ETFs reversed the trend.

A group of 11 spot Bitcoin ETFs attracted net inflows of about $622 million on Wednesday, according to Farside Investors data. BlackRock’s IBIT achieved record trading volume of $4.1 billion despite the day’s outflows.

IBIT subsequently recorded net inflows of more than $1 billion on Thursday, bringing its assets under management to more than $33 billion. The ETF has now surpassed the size of BlackRock’s iShares Gold Trust (IAU).

In total, U.S. spot Bitcoin ETFs accumulated net inflows totaling $2.3 billion in the three trading days following Election Day. Other cryptocurrency products also benefited, with the spot Ethereum ETF attracting nearly $218 million from Wednesday to Friday, according to Farside Investors data.

Bitcoin is on a hot streak, and it’s all thanks to a perfect storm of factors. Institutions have been scooping up Bitcoin through ETFs, while the halving event has caused supply to tighten. According to Bitwise CIO Matt Hougan, the combination of these factors could push the price of Bitcoin into six figures.

Hougan also expects global monetary adjustments, such as China’s stimulus measures and the Federal Reserve’s interest rate decision, to push Bitcoin prices higher.

The Federal Reserve and Bank of England continued their monetary easing policies on Thursday, with both central banks cutting interest rates by 25 basis points. This follows the Federal Reserve’s more aggressive 50 basis point cut in September.

Share this article