Market sentiment across cryptocurrencies is very bearish. Among these, Chainlink (LINK) is in a downward trend and is expected to see a noticeable price drop, but is currently at a strong support level.

This negative outlook could be caused by LINK’s recent price action and traders’ bets over the past 24 hours.

Chainlink (LINK) Technical Analysis and Future Levels

According to expert technical analysis, LINK is bearish and is on the verge of breaking the sloping trendline of the ascending triangle price action pattern on the daily time frame. Since early August 2024, LINK has experienced buying pressure and upward rallies each time, supported by these sloping trend lines.

However, due to the negative outlook and bearish sentiment from traders, the asset now appears to be at risk of breaking away from this support level.

Based on historical price action, if LINK closes its daily candle below this important support level of $10.65, the asset is likely to fall 20% to reach the $9 level in the next few days.

LINK is currently trading below the 200 exponential moving average (EMA) on the daily time frame, indicating a downtrend. In trading and investing, traders often use the 200 EMA on daily charts to determine whether an asset is suitable for the short side or the buy side.

LINK Bearish On-Chain Indicator

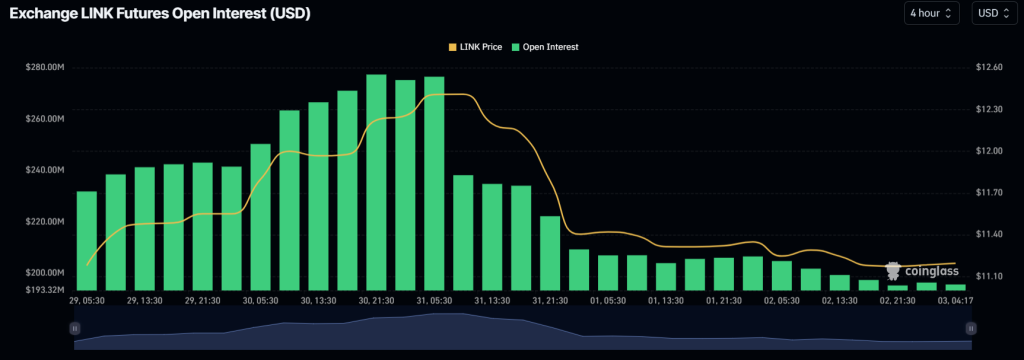

LINK’s negative outlook is further supported by on-chain indicators. According to on-chain analytics firm Coinglass, LINK’s long/short ratio is currently at 0.94, indicating bearish sentiment among traders. Additionally, open interest is down 4.5% in the last 24 hours and up 1.5% in the last 4 hours.

The decrease in open interest for LINK indicates a decrease in interest among investors and traders.

Current price momentum

At press time, LINK is trading near $11.20 and has experienced a 1.1% price decline over the past 24 hours. During the same period, trading volume decreased by 34%, indicating a decline in trader participation amid deepening price declines across cryptocurrency markets.