Why Spot Bitcoin ETFs Are Changing the Game in Financial Markets and How They Affect Cryptocurrencies

Victoria d’Este

Posted: Oct 25, 2024 3:00 PM Updated: Oct 25, 2024 11:39 AM

Correction and fact check date: October 25, 2024, 3:00 PM

briefly

Binance’s latest paper examines the impact of spot BTC ETFs on market demand, liquidity, and adoption trends, revealing their significant influence on market supply.

A recent Binance paper examining these dynamics, “Spot ETFs in Cryptocurrency Markets,” explains how spot BTC ETFs impact market demand, liquidity, and adoption trends.

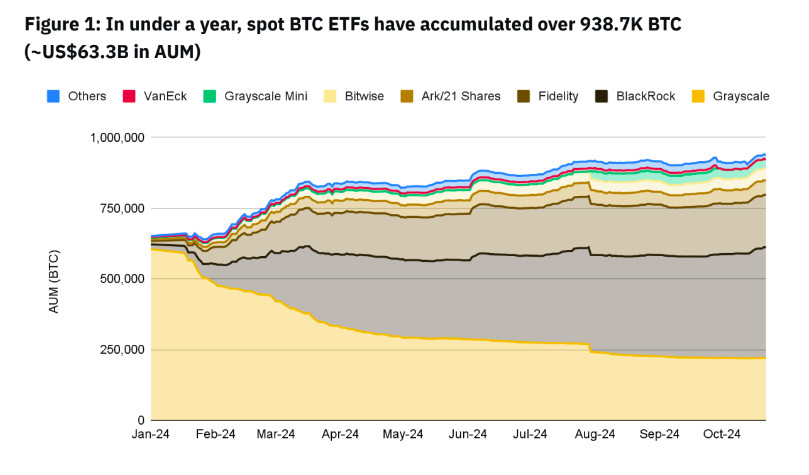

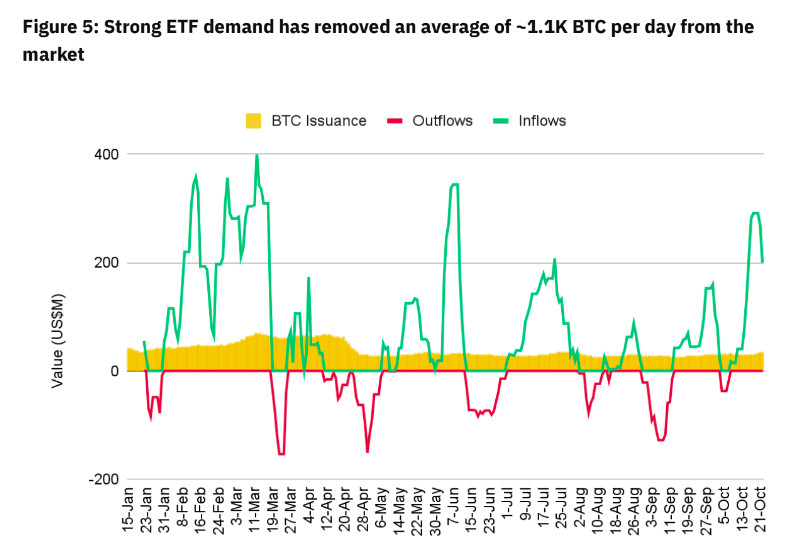

Major capital has quickly flowed into spot Bitcoin exchange-traded funds, with holdings already totaling 938,700 BTC, or over $63.3 billion. This figure, which represents almost 5.2% of the total Bitcoin supply, highlights just how much of an impact the spot BTC ETF has on the market. Large net inflows of over 312,500 BTC support this demand, demonstrating the ETF’s ability to drive consistent demand and lower market supply.

As part of a larger trend to securitize digital assets, spot Bitcoin ETFs have been introduced, making them more accessible to investors who prefer to interact with cryptocurrencies through traditional financial instruments.

The scale of these inflows, along with their impact on price dynamics and liquidity, demonstrate that spot BTC ETFs are more than just financial instruments. They are playing an increasingly important role in the Bitcoin market structure. ETF mechanisms are not new to the financial industry, but their use in the cryptocurrency space has revealed demand levels that surpass those of the first gold ETFs, indicating that Bitcoin ETFs have distinct appeal.

ETF Divergence vs. Gold ETF

Gold ETFs, which are considered more stable and set the pattern for past asset-backed funds, have grown very modestly in their early stages, pulling in about $1.5 billion over a similar period. But in less than a year, the BTC ETF has amassed nearly $18.9 billion, demonstrating growing interest in Bitcoin not only as a speculative asset but also as a hedge against broader economic volatility. Surprisingly, while only 95 institutions invested in gold ETFs in the first year, over 1,200 institutions have already invested in Bitcoin ETFs.

However, the Ethereum (ETH) ETF has not been as successful as the Bitcoin ETF. According to Binance data, the Ethereum ETF withdrew nearly 43,700 ETH, or $103.1 million, with negative flows occurring in eight of the first 11 weeks.

As Bitcoin becomes a more popular digital asset for ETF investments, this difference between the BTC and ETH ETFs signals a shift in investor interest and market sentiment. Bitcoin’s status as the first cryptocurrency and its reputation as a digital store of wealth may contribute to this trend as it appeals to more cautious investors.

Contribution of Institutional and Non-Institutional Investors to Bitcoin ETF Growth

Participation from both institutional and non-institutional investors has greatly aided the growth of the spot BTC ETF. High interest in these products was seen by non-institutional investors, who accounted for approximately 80% of demand. Retail investors and individual traders who prefer the ease of Bitcoin exposure through ETFs over personally managing wallets, keys, and exchanges make up this investment base.

Institutional investment in Bitcoin ETFs has also increased significantly. Institutional holdings have increased nearly 30% since the first quarter, thanks to financial advisors whose Bitcoin holdings surged 44.2% to 71,800 BTC. The move towards a more regulated and controlled approach to digital assets is reflected in the slow adoption of Bitcoin ETFs by institutional investors.

However, full-scale institutional adoption involving banks, consulting services, broker-dealers and others is expected to be a slow process that will take years to complete. These changes could bring Bitcoin and other digital assets into the mainstream of international financial markets and lead to greater acceptance.

Convergence of Bitcoin and Traditional Finance (TradFi)

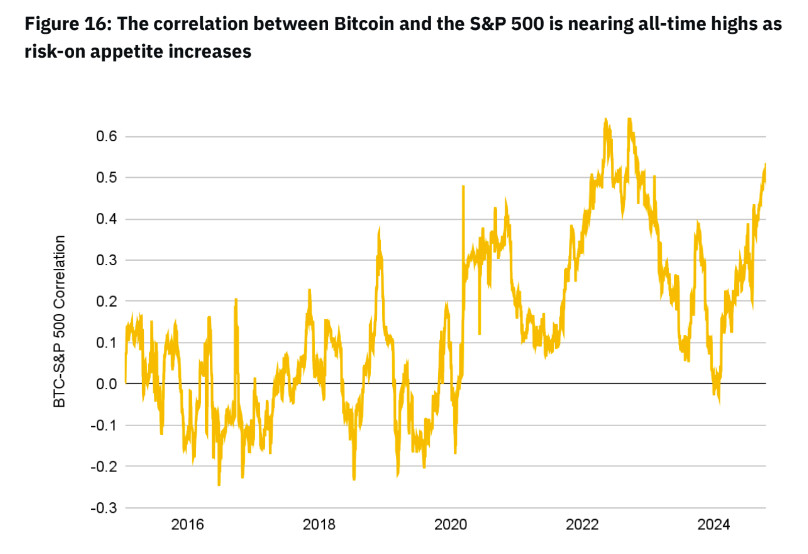

Binance research highlights a notable trend: the growing connection between Bitcoin and traditional financial assets, namely the S&P 500 Index. This growing link, which has become stronger since early 2024, points to a shift in the way investors view Bitcoin. Bitcoin is now seen as a risk asset and a hedge against macroeconomic uncertainty, but previously it was viewed as largely uncorrelated. This dual role reflects a shift in investor perception, as many now see Bitcoin as both a growth-oriented asset and a buffer during periods of market volatility.

Both market stability and investment methods are influenced by the convergence of Bitcoin and traditional finance. For example, if the cryptocurrency market begins to behave more like other well-known asset classes and has a stronger correlation with stocks, it could indicate that the market is maturing. Additionally, the interaction between traditional financial assets and digital currencies is expected to strengthen as institutional players allocate higher percentages of their portfolios to BTC ETFs, strengthening Bitcoin’s position in traditional investment frameworks.

Impact of Spot BTC ETF on Market Volatility and Efficiency

In addition to creating direct demand for Bitcoin, the spot BTC ETF has also had a significant impact on the cryptocurrency market as a whole through secondary impacts. According to a Binance report, the spot BTC ETF accounts for an average of 26.4% of Bitcoin spot trading volume, sometimes as high as 62.6%. The introduction of the ETF mechanism in the form of a more controlled demand for Bitcoin has helped improve market efficiency and lower volatility. The reliability of these ETFs allows them to maintain more consistent price patterns, attracting more traders to the market.

Venture capitals are increasingly interested in spot BTC ETFs due to their liquidity, which allows for broader market inclusion beyond Bitcoin to include a variety of blockchain-based assets. Expanding on-chain presence, driven directly or indirectly by ETF demand, could make the market more stable and liquid. For example, the greater legitimacy and liquidity offered by a spot BTC ETF could spur new developments in the tokenized RWA space.

disclaimer

In accordance with the Trust Project Guidelines, the information provided on these pages is not intended and should not be construed as legal, tax, investment, financial or any other form of advice. It is important to invest only what you can afford to lose and, when in doubt, seek independent financial advice. For more information, please refer to the Terms of Use and any help and support pages provided by the publisher or advertiser. Although MetaversePost is committed to accurate and unbiased reporting, market conditions may change without notice.

About the author

Victoria is a writer covering a variety of technology topics, including Web3.0, AI, and cryptocurrency. Her extensive experience allows her to write insightful articles for a wider audience.

more articles

Victoria d’Este

Victoria is a writer covering a variety of technology topics, including Web3.0, AI, and cryptocurrency. Her extensive experience allows her to write insightful articles for a wider audience.