Abstract: We take a look at Babylon, a Bitcoin-based staking system that has already attracted inflows of nearly 24,000 BTC. We compare Babylon to CoreDAO and note Babylon’s interesting use of Tapscript spend conditions. Unlike Ordinals, Babylon uses Taproot less in a somewhat trivial way and more in the way the developers intended. Whatever we think of Babylon and the new wave of Bitcoin staking systems, we argue that the use of Babylon was a unique and impressive upgrade to Bitcoin, and supports the argument that Taproot was a success despite the low expectations of some. We conclude by saying:

outline

Following the August 2024 article Bitcoin Layer 2 and CoreDAOIn this article we focus on Babylon, another apparent Bitcoin “layer 2”. This Bitcoin staking system has more funds locked up than CoreDAO, at just under 24,000 Bitcoin at the time of this writing. This is worth more than $1.6 billion. Like CoreDAO, Babylon does not. really Instead of Bitcoin Layer 2, you can think of it as a system that allows you to lock down your Bitcoin. Bitcoin lock time Provide functionality and earn money in return for other alternative coins.

Babylon Institute

Despite having 24,000 BTC locked, the Babylon blockchain or staking system does not yet exist and is still under development. Currently, it appears that companies are staking to earn bonus points. The platform is backed by an impressive roster. Cryptocurrency VC Babylon has a partnership with Binance, which may explain how the platform has been able to attract so much capital. The platform also aims to position itself as the Bitcoin equivalent of EigenLayer. Babylon wants to be to Bitcoin what EigenLayer is to Ethereum. Most of the culture and ideas developing in Babylon appear to originate from the Ethereum ecosystem. The core idea of EigenLayer is re-staking, which increases returns by staking on multiple systems simultaneously using the same coins.

As with the CoreDAO piece, we will not be evaluating the re-staking concept, the Babylon multi-staking protocol, or the potential Babylon blockchain, and will focus on the Bitcoin aspect.

Staking Mechanism and Taproot

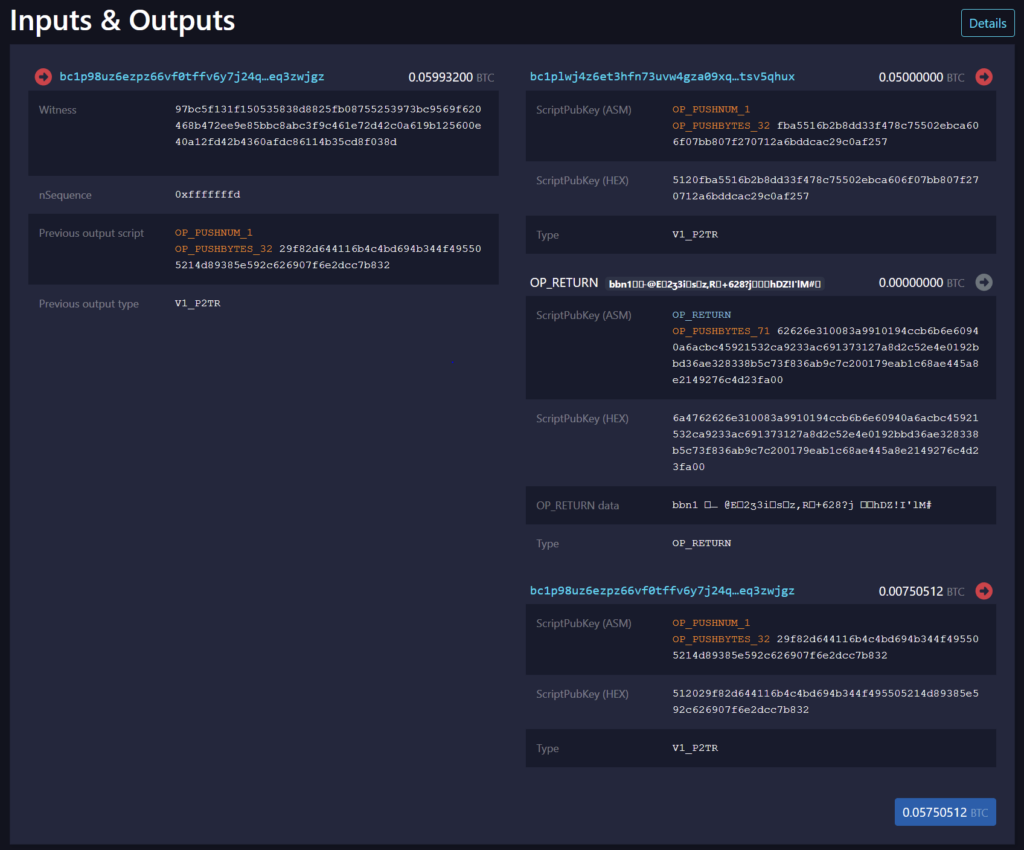

Like CoreDAO, staking on Babylon requires you to create a custom complex transaction that essentially sends your Bitcoin to yourself. Add a custom OP_Return output that provides details about staking, such as which validator will be used and where to send the rewards. An example of a Babylon staking transaction is below:

Source: https://mempool.space/tx/06d8def161112c6c004be7a1684d706731d9e54d5e706bee73c1f6f50418d3be

Staking transactions are not particularly interesting compared to CoreDAO. The first output of 0.05 BTC is staked, the third output is change, and the middle output is OP_Return. The Babilon team informed us that many exchanges will need to upgrade their Bitcoin wallets to allow customers to send Bitcoin to P2TR outputs using Bech32m format addresses.

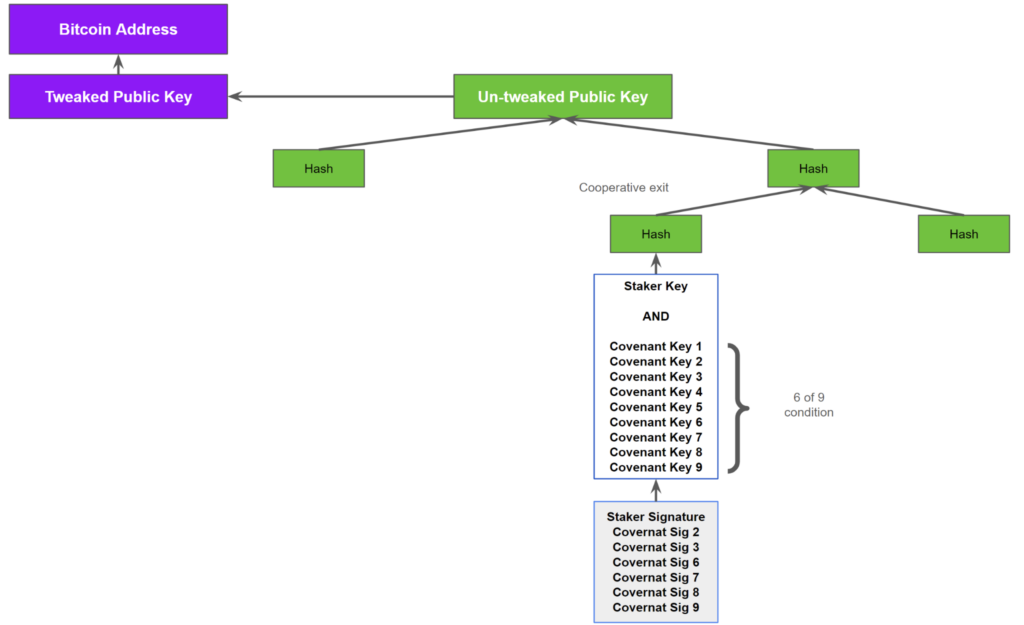

It is when you redeem from the staking system that the Taproot magic starts to happen. You can view buyback transactions. hereat the same address bc1plwj4z6et3hfn73uvw4gza09xqmc8hwq87fc8z2ntmh9v98q27ftsv5qhux. Redemption shows that Babylon leverages Tapscript and multiple spending paths in the Taproot tree. The diagram below shows the information disclosed by the “cooperative exit” of the staking system. Note that to redeem Bitcoin in a taproot tree, you must satisfy exactly one leaf and use the hash to indicate the path to the Merkle root.

Babylon Staker’s basic root redemption tree – visible at the end of normal co-op

Source: BitMEX Research

In the redemption situation above, two of the paths for spending the money were hidden and two additional hashes had to be provided to get to the Merkle root. The chosen spending path must be signed by the staker and signed by six members of the nine-member Babylonian Federation. The spending terms are essentially 1/1 and 6/9.

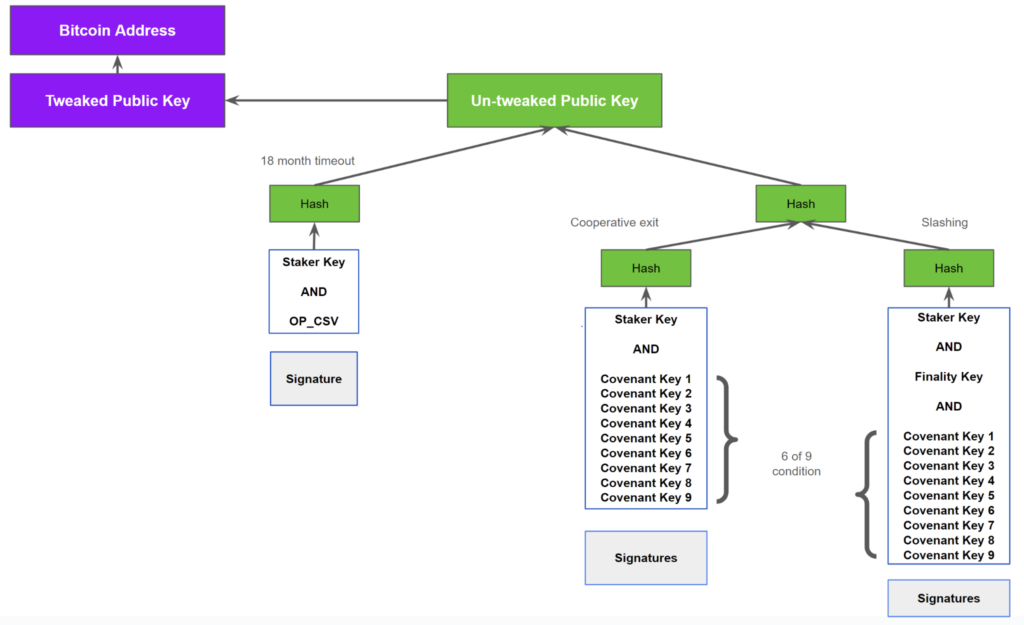

Based on reading Babylon Protocol Specification And in review another dealWe were able to describe the entire Taproot tree along with all spending paths. The tree below shows three spending scenarios:

Full Rooted Redemption Tree for Babylon Stakers

Source: BitMEX Research

- time lock – This first path requires a staker signature and the OP_CHECKSEQUENCEVERIFY(OP_CSV) opcode. The relative time lock is 15 months. This allows stakers to get their funds back without having to rely on the Federation. This path is a higher branch of the tree, allowing for more efficient repayment.

- On-demand unbonding – This is considered a normal or cooperative redemption route and requires staker signatures and federation approval. This is like a collaborative outlet for the Lightning Network.

- Slashing – This is similar to the unbinding case, except that it is a final path and requires an additional signature from a “finality provider”. This will be explained in more detail in the next paragraph.

sharp

We criticized CoreDAO for not having a slashing system and therefore called CoreDAO “fake staking.” But Babylon, with its roots in EigenLayer and Ethereum staking, believes in slashing. In some ways, Babylon is taking a harder path by now implementing slashing, but potentially building a more sustainable platform with “less fake” returns. However, as we explained, the Babylon yield generation system does not really exist yet, so slashing does not exist at the moment either. But taproot trees still have a way to salvation for this. Therefore, the third redemption path in the Taproot tree has not yet been implemented because there is no blockchain or ultimate agent. The idea is that once the system is activated, stakers must sign up in advance for a redemption path where the funds from their transaction outputs are either moved to a Bitcoin address controlled by someone else or burned, which will result in them being burned. Who these funds can be sent to has not yet been determined by Babylon Labs. There is real counterparty risk if the third path is pre-signed by the staker. However, while it remains unsigned, stakers may consider Babylon “risk-free.”

If the third path is not pre-signed after slashing is enabled, the transaction will not be considered a valid staking transaction and you will not be eligible for rewards. We consider this a minor weakness, as Bitcoin blockchain observers have no way of knowing whether it is a valid deposit or not. However, as this is not live at the moment, no such pre-signature is required. Therefore, as with CoreDAO today, there is no counterparty risk in the system. You can get your Bitcoin back at any time without having to rely on anyone else (although the lock time is longer). So for now, it may be a good place to store your Bitcoin before the system goes live, but it’s very unclear how much of a reward you’ll get.

Criticism of Bitcoin core developers

Bitcoin Core developers and protocol engineers have come under criticism from some quarters in recent years. In particular, there have been claims that it does not implement new protocol upgrades or add enough new features. Developers have also been criticized, with some critics claiming that even if Bitcoin engineers add new features, no one will or will use them because the developers are out of touch with the cryptocurrency industry and too inward-looking.

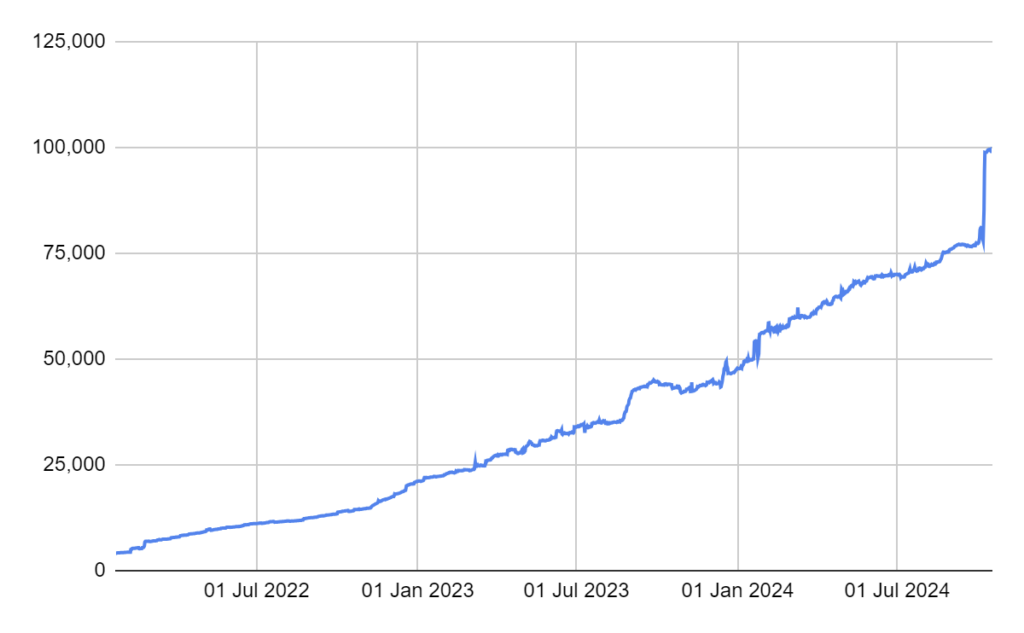

We argue that Babylon’s use of the Taproot tree and other Taproot adoptions are strong evidence to the contrary. In our view, Taproot is actually a very clever upgrade, enabling many new custom spending conditions without increasing downside risk. Hiding unused parts of the tree helps with privacy and scalability. Moreover, Taproot adoption indicators have been much stronger than expected a few years ago. There are currently nearly 100,000 Bitcoins stored in Taproot output.

Bitcoin stored in Taproot output

Source: BitMEX Research

Bottom line – Taproot is a success

What do you think of Merkelized Abstract Syntax Trees, an idea first proposed on the BitcoinTalk forum by Bitcoin engineer Johnson Lau in 2013 and formalized in 2019? 2016 Can it actually be successful with Bitcoin? In Babylon alone, these trees are worth $1.6 billion. And this isn’t a particularly trivial use of Taproot. It’s not like Ordinal related images are stored there. Some may think it’s a bit silly, but the script path is actually is being used With a significant amount of money.

On the other hand, many readers may question the fundamental efficiency of proof-of-stake systems, and re-staking may be much more difficult to conceptualize. In fact, floating staking and re-staking systems may represent a fundamental problem with Proof-of-Stake. Some readers may think of Babylon as a bit of an altcoin. Stakers are incentivized by the idea of being rewarded in alternative coins that don’t even exist yet. But Taproot adoption has to happen somewhere. Capital must be invested in building a Taproot script system, and examples of Taproot script use must be available for others to follow. Perhaps someday altcoins or projects that don’t rely on proof-of-stake systems will follow.

But whatever you think of Babylon, Taproot is in use, and Taproot is undoubtedly a brilliant idea, and it’s been a success. This needs to be handed over to the Bitcoin developers to make it happen, given all the constraints they are working with.