How Aave’s latest update is driving DeFi innovation by improving risk management and increasing lending efficiency

Victoria d’Este

Posted: Oct 11, 2024 6:23 PM Updated: Oct 11, 2024 5:30 PM

Correction and fact check date: October 11, 2024, 6:23 p.m.

briefly

Cryptocurrency assets have grown significantly in value since 2010, driven by investor interest and financial use. Aave’s v3.2 update introduces Liquid eMode, improving asset classification and borrowing strategies.

Cryptocurrency assets have grown at a very impressive rate. The overall value of cryptocurrencies has increased from almost nothing in 2010. This exponential rise can be attributed to the growing interest of investors and the increasing financial uses of digital assets.

Aave’s v3.2 release is one recent example. This update highlights continued innovation in the industry by introducing notable improvements to our lending and risk management tools.

The addition of Liquid eMode, which extends the previously applied High Efficiency Mode (eMode), is one of the key features of the update. These improvements allow assets to be more accurately classified by loan-to-value (LTV) ratio, liquidation bonus, and limits. This development is important as the ability to apply multiple eMode to a single asset provides consumers with unprecedented flexibility with their collateral and borrowing strategies.

Risk Recognition and Reduction

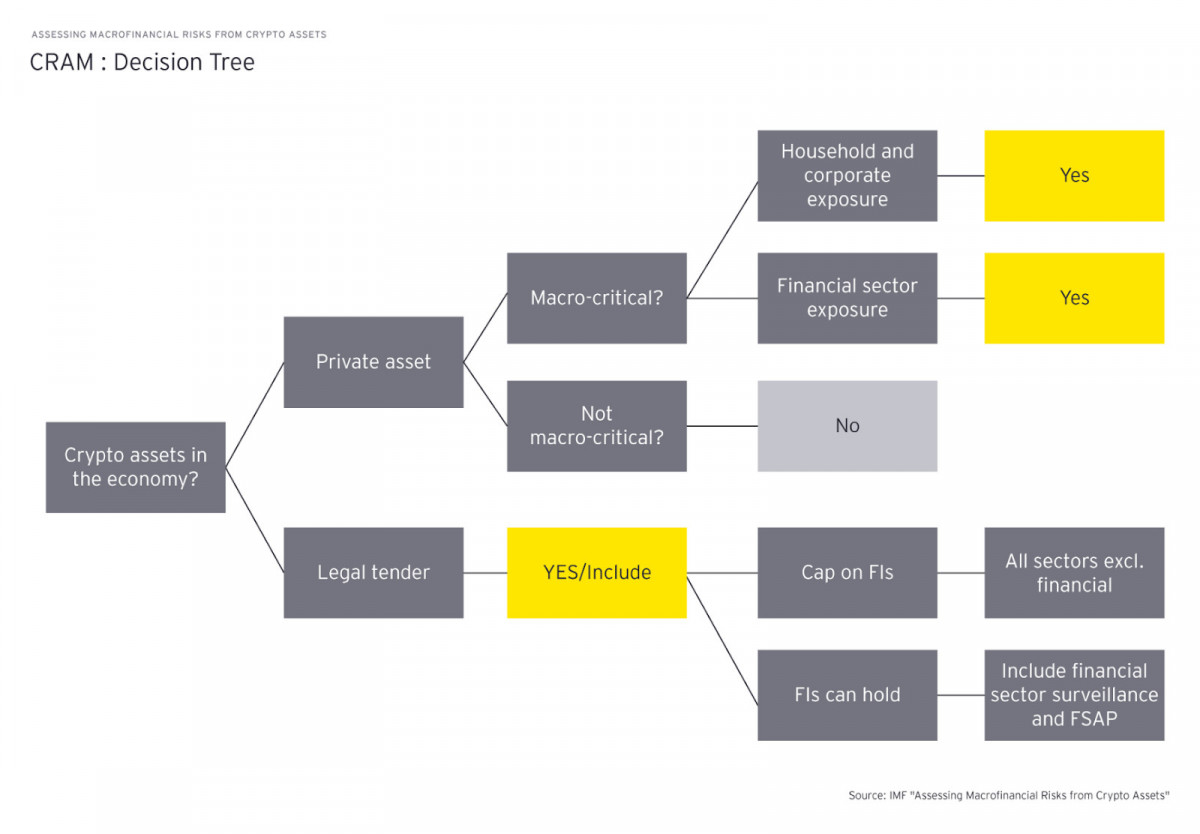

As DeFi businesses expand, they increasingly need robust solutions for risk assessment and management. The Cryptocurrency Risk Assessment Matrix (C-RAM) model is one method that is becoming increasingly popular. This methodology provides a thorough approach to assessing the risks associated with cryptocurrencies both domestically and globally.

The operation of the C-RAM model consists of three steps. We first assess the macro importance of cryptocurrency assets in the economy. We then map each country’s specific risks across different areas of sensitivity. Finally, we assess the risks associated with the widespread use of cryptocurrencies at a global level. This systematic approach allows for a comprehensive awareness of possible risks, from operational weaknesses to system criticality.

Photo: EY

Simplifying risk management for smart contracts

In the DeFi industry, smart contracts have become a powerful tool for risk management. These blockchain-based self-executing contracts have the ability to automate complex financial transactions and enforce specific terms without intermediaries.

Smart contracts are advantageous in many ways when it comes to risk management. Lending platforms can reduce risk by enforcing collateral requirements, automatically triggering safeguards during market volatility, and controlling asset concentration. Additionally, smart contracts are essential for preserving liquidity on decentralized exchanges, executing stop-loss orders to minimize the potential for losses, and enabling automated checks to facilitate regulatory compliance.

Throughout the lifecycle of a blockchain, smart contracts can create and store on-chain data that provides valuable information for risk assessment. By using this data to improve compliance procedures and identify fraud, DeFi operations will have an additional level of security.

Improved loan function

As DeFi protocols develop, more advanced lending features are added, providing users with more efficiency and flexibility. Efficiency Mode, or eMode, is a notable discovery that provides more precise control over collateral and borrowing strategies.

These advanced leverage capabilities allow users to apply more sophisticated investment strategies, obtain higher leverage for specific asset combinations, adjust risk parameters based on asset properties, and maximize capital efficiency under different market scenarios. These features will allow users to customize their borrowing strategies based on their investment objectives and risk tolerance, which will open up new use cases and attract a wider range of players to the DeFi ecosystem.

The importance of protocol upgrades

Regular updates to DeFi protocols are essential to improve efficiency, security, and usability. These updates often focus on minimizing gas usage, simplifying the code base, and improving risk management techniques.

Thanks to recent protocol updates, features such as different efficiency modes for a single asset have now been added, allowing for more adaptive risk management. In an effort to improve overall system performance, they also focused on removing useless or unnecessary code.

Enhanced clearing processes are in place to protect lenders and ensure protocol solvency, and upgraded oracle systems provide more accurate and reliable price feeds. These updates demonstrate how the DeFi initiative remains committed to improving its services and meeting the changing needs of its customers and the larger financial ecosystem.

Improvements in borrowing characteristics and risk management are encouraging, but they also bring with them some new challenges. As these systems become increasingly complex, they can be more difficult for the average user to understand and utilize. If advanced features are not developed properly, there is a potential for malicious actors to take advantage of them.

Additionally, as DeFi protocols increase in interconnectivity, they must consider the systemic risk resulting from the collapse of a single core protocol or a series of platform-wide liquidations. Regulatory issues are also very important. As DeFi grows in importance, regulators are paying more attention to this market. To maintain long-term viability, future advancements in risk management and borrowing capabilities must balance innovation and compliance.

disclaimer

In accordance with the Trust Project Guidelines, the information provided on these pages is not intended and should not be construed as legal, tax, investment, financial or any other form of advice. It is important to invest only what you can afford to lose and, when in doubt, seek independent financial advice. For more information, please refer to the Terms of Use and any help and support pages provided by the publisher or advertiser. Although MetaversePost is committed to accurate and unbiased reporting, market conditions may change without notice.

About the author

Victoria is a writer covering a variety of technology topics, including Web3.0, AI, and cryptocurrency. Her extensive experience allows her to write insightful articles for a wider audience.

more articles

Victoria d’Este

Victoria is a writer covering a variety of technology topics, including Web3.0, AI, and cryptocurrency. Her extensive experience allows her to write insightful articles for a wider audience.