XRP bulls appear to have re-emerged in the market, with volume surging despite price consolidation within a narrow range of support levels. October 7, 2024 While most major cryptocurrencies have experienced notable price spikes, the price of XRP has remained stable over the past 24 hours.

XRP Current Price Momentum

XRP is currently trading near $0.538 and has experienced a slight increase of 0.75% in the last 24 hours. During the same period, trading volume surged by 90%, suggesting strong participation from investors and traders, which is a positive sign for XRP holders.

XRP Technical Analysis and Future Levels

According to expert technical analysis, XRP appears to be bullish, but has remained in a sideways range between $0.512 and $0.545 for the past five trading days. Recent performance shows that whenever the price of XRP reaches this level, it tends to rise by 20%.

However, if XRP breaks out of this consolidation area and closes the daily candle above the $0.55 level, it is likely to surge 20% and reach the $0.65 level in the next few days.

This bullish outlook is further supported by XRP’s Relative Strength Index (RSI), which is currently in oversold territory, suggesting a possible bullish price reversal in the future. However, it is still trading below the 200 exponential moving average (EMA) on a daily basis, indicating a downward trend.

Bullish on-chain indicators

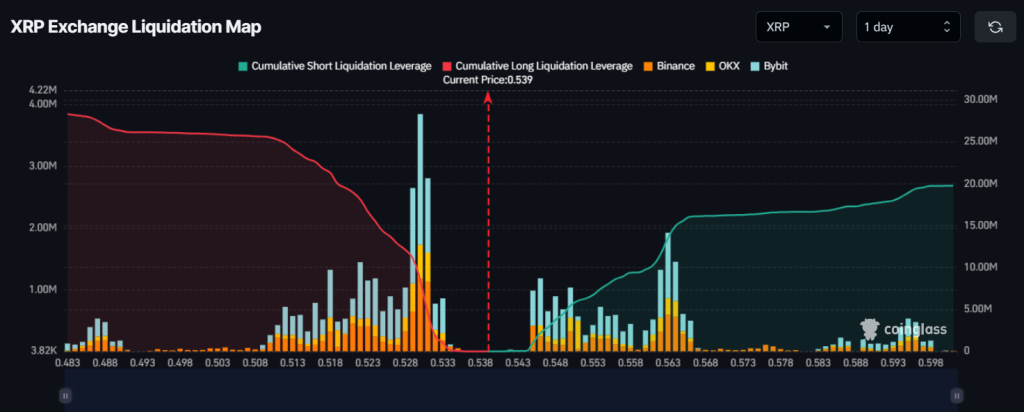

In addition to technical analysis, XRP’s on-chain indicators also support this optimistic outlook. According to on-chain analytics firm Coinglass, key liquidation levels are $0.53 and $0.563. This is because traders are overleveraged at this level.

However, data shows that bulls have taken $8.45 million worth of long positions, believing the market will not fall below the $0.53 level.

Additionally, XRP’s future open interest has increased by 3.75% in the last 24 hours and has been increasing steadily, indicating that trader interest is increasing and many are likely to bet more on long positions.