Victoria d’Este

Posted: October 5, 2024, 2:00 PM Updated: October 4, 2024, 5:04 PM

Correction and fact check date: October 5, 2024, 2:00 PM

briefly

Japan’s new Prime Minister Shigeru Ishiba plans to bring about significant technological change in the country as he plans to use blockchain technology and NFTs to revitalize the economy.

Japan finds itself at a technological crossroads as new Prime Minister Shigeru Ishiba unveils bold ambitions to use blockchain technology and non-fungible tokens (NFTs) to revitalize the country’s economy. This legal change marks an important turning point for Japan, which has a deep history of cryptocurrency and digital assets.

Ishiba’s Proposal for Digital Japan

Shigeru Ishiba, former Japanese defense minister and president of the ruling Liberal Democratic Party, is scheduled to take over as prime minister next week. His fame has sparked a new understanding of how technological advancements will affect Japan’s economic future.

In a newly released policy statement, Ishiba announced its intention to use NFTs and blockchain innovation as a tool for economic development, especially in local communities.

“We will strive to optimize the value of various analog local items such as food and travel experiences by utilizing blockchain, NFT, etc. We will do this by bringing its value back to parity with world prices.” Ishiba said.

This strategy responds to calls from cryptocurrency industry groups calling for the use of NFTs and DAOs to boost rural economies. The Ishiba government’s goal is to digitize local assets and experiences to create new revenue streams and draw attention to Japan’s diverse regional offerings.

New Minister of Digital Affairs

Ishiba plans to demonstrate his commitment to digital transformation by electing Taira Masaaki Taira, the current leader of the Liberal Democratic Party’s Web3 Task Force, as the new Minister of Digital Affairs. Considering her expertise and prior comments, Taira appears to be strongly in favor of integrating blockchain and NFT technology into several sectors of the Japanese economy.

Taira made a strong case for how NFTs can increase the value of Japanese intellectual property abroad. He also emphasized the need for tax reform to foster cryptocurrency entrepreneurs, saying the existing system is “not optimal” for modern businesses, especially those using little-known currencies.

Taira noted the challenges faced by new companies in the cryptocurrency industry, especially when it comes to auditing token holdings. His nomination suggests that efforts to improve Japan’s blockchain and NFT innovation environment may be taking a turn in that direction.

Historical Background: Japan’s Cryptocurrency Adventure

To understand the significance of this legal change, it is important to look at Japan’s turbulent cryptocurrency past. The country has been a leader in embracing cryptocurrencies, although there have been some notable issues.

Japan suffered two of the largest cryptocurrency exchange hacks in history. The most well-known incident was the 2014 hack of Mt. Gox, which at the time was the world’s largest Bitcoin exchange and accounted for 7% of the cryptocurrency’s total supply. This has forced Japanese authorities to enter the cryptocurrency space much sooner than their peers in other countries, resulting in a more cautious approach to digital asset regulation.

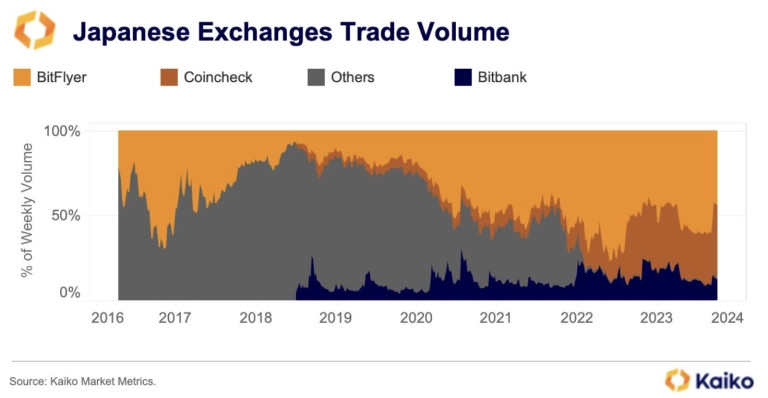

Photo: Kaiko

Despite these obstacles, Japan is one of the first countries to create a thorough regulatory framework for cryptocurrency assets.

Purpose of Japanese Yen in Cryptocurrency

The exchange’s yen-denominated trading volume pattern reflects Japan’s attitude toward cryptocurrencies. JPY trading volume surpassed USD trading volume at one point, showing the early enthusiasm for cryptocurrencies among Japanese investors. However, exchange listing restrictions and unfavorable tax rules have been the main reasons why Japan’s cryptocurrency sector has lagged behind other sectors in recent years.

The difficulties of Japan’s cryptocurrency ecosystem have been evidenced by domestic exchanges’ struggles to compete with global giants like Binance in terms of trading volume, especially since the start of the COVID-19 pandemic. Despite these obstacles, well-known exchanges such as BitFlyer have continued to dominate the domestic market.

Current developments in regulation

Japan has been a leader in cryptocurrency regulation in recent years. The new stablecoin law was introduced by the Bill amending the Payment Services Act and was enacted in June 2022. These amendments, which take effect from June 1, 2023, demonstrate Japan’s continued commitment to establishing a stable and secure environment for digital assets.

The country has also experienced increased interest in security tokens, also called digital securities. Recent amendments to key laws and regulations have paved the way for financial institutions to enter this new sector, with a particular focus on tokenized equity holdings in digital corporate bonds and real estate funds.

Japan’s first asset-backed security token public sale, conducted in July 2021 by a division of renowned real estate company Kenedix, was a significant event in this field. This business, along with other ventures of similar nature, has traditionally used a blockchain-based trust mechanism for issuing beneficiary certificates.

The rise of Japanese NFTs

Japan is not excluded from the global NFT boom. Digital art and digital trading cards, represented by NFTs, have become more popular in this country, with some works selling for high prices. The differentiated quality of NFTs, which generate unique data based on blockchain technology, has attracted the attention of investors and artists alike.

The growing popularity of NFTs coincides with Ishiba’s plans to use these digital assets to advertise local products and experiences. By tokenizing localized characteristics such as traditional crafts and delicious cuisine, Japan can open up new markets and revenue streams for many local economies.

Japan’s growing emphasis on NFTs and blockchain technology could have significant implications globally. Japan is a technological leader and one of the world’s leading economies. Therefore, its actions often influence trends in other countries, especially in Asia.

If effective, other countries looking to use blockchain and NFTs for economic development could take inspiration from Japan’s integration of these technologies into their own economic strategies. This could also change the dynamics of the global cryptocurrency and NFT markets, leading to increased activity and innovation on Japanese platforms.

Additionally, how Japan regulates these technologies could have implications for global norms. As countries around the world grapple with how to deal with the rapidly changing digital asset space, Japan’s experience and regulations may provide useful guidance.

disclaimer

In accordance with the Trust Project Guidelines, the information provided on these pages is not intended and should not be construed as legal, tax, investment, financial or any other form of advice. It is important to invest only what you can afford to lose and, when in doubt, seek independent financial advice. For more information, please refer to the Terms of Use and any help and support pages provided by the publisher or advertiser. Although MetaversePost is committed to accurate and unbiased reporting, market conditions may change without notice.

About the author

Victoria is a writer covering a variety of technology topics, including Web3.0, AI, and cryptocurrency. Her extensive experience allows her to write insightful articles for a wider audience.

more articles

Victoria d’Este

Victoria is a writer covering a variety of technology topics, including Web3.0, AI, and cryptocurrency. Her extensive experience allows her to write insightful articles for a wider audience.