The entire cryptocurrency market is gaining momentum once again. Among these, Ripple has locked 800 million XRP tokens in escrow. As reported by blockchain transaction tracker Whale Alert, this substantial locking of XRP occurred in three different transactions.

800 million XRP locked,

In general, this substantial locking of XRP is often seen as a bullish sign as it provides more stability and confidence in the market. Additionally, this is Ripple’s long-term strategy for managing token distribution.

With such a notable amount of XRP locked up, the question arises as to whether this will put buying pressure on the market or whether we will experience a significant rally in the future.

XRP Price Momentum

Currently, XRP is trading near $0.622 and has experienced a price decline of 1.45% in the last 24 hours. During the same period, trading volume fell by 50%, potentially indicating low participation from traders and investors due to high volatility in the market.

XRP technical analysis

According to expert technical analysis, XRP is struggling to break through strong resistance levels near $0.65. Additionally, when a daily candle pattern is formed at a resistance level, a bearish candle is formed, indicating a price reversal.

If XRP breaks this level and closes the daily candle above the $0.65 level, it is likely to surge 12% and reach the $0.74 level in the next few days. Despite this optimistic outlook, the asset is still in an upward trend, trading above its 200 exponential moving average (EMA) on daily time frames.

On-chain metrics for XRP

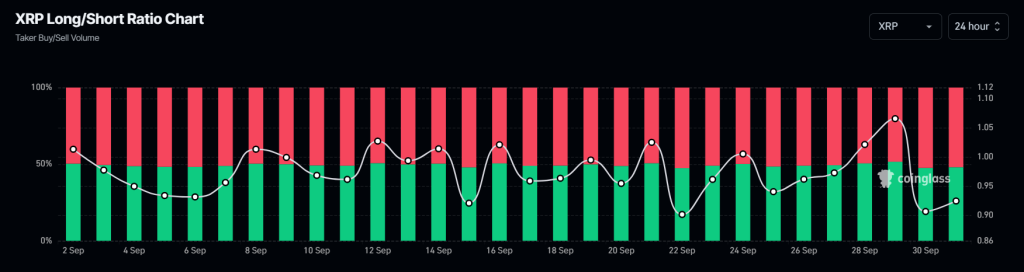

In addition to the positive outlook driven by technical analysis, on-chain indicators indicate bearish sentiment. According to on-chain analytics firm Coinglass, XRP’s long/short ratio is currently at 0.924, indicating strong bearish sentiment among traders.

In addition, future open interest has decreased steadily by 4.5%, suggesting that there is a possibility of position liquidation amid recent market volatility.

Currently, 52% of top traders have short positions and 48% have long positions. Analyzing all this data, it appears that bears are currently ruling the asset and XRP’s struggles will continue until it breaks the $0.65 level.