German authorities have shut down 47 cryptocurrency exchanges as part of a broader effort to crack down on illegal cryptocurrency activity. The exchanges were allegedly involved in money laundering operations. The shutdowns followed a detailed investigation. Authorities found that the platforms allowed criminals to bypass important security measures and transfer illicit funds undetected.

Authorities, including the Frankfurt Public Prosecutor’s Office, the German Federal Criminal Police, and the German Office for Combating Internet Crime, said the targeted exchanges had failed to implement know-your-customer (KYC) policies. By allowing users to remain anonymous, these exchanges became major hubs for cybercriminals, allowing them to launder huge amounts of money. The closure of these cryptocurrency exchanges is a significant step toward curbing this illicit activity.

What Happened: KYC Loopholes Allow Criminals to Thrive

The crux of the problem is the KYC process, which is a standard verification procedure that ensures that platform users are who they say they are. This key safeguard helps prevent illegal activities, including money laundering. However, exchanges have made it easy for users to bypass these rules, creating a haven for cybercriminals, ultimately leading to the closure of several cryptocurrency exchanges.

Authorities have found that these platforms are particularly popular with malicious actors, such as ransomware groups, darknet traders, and botnet operators, who can move illicit funds without fear of detection.

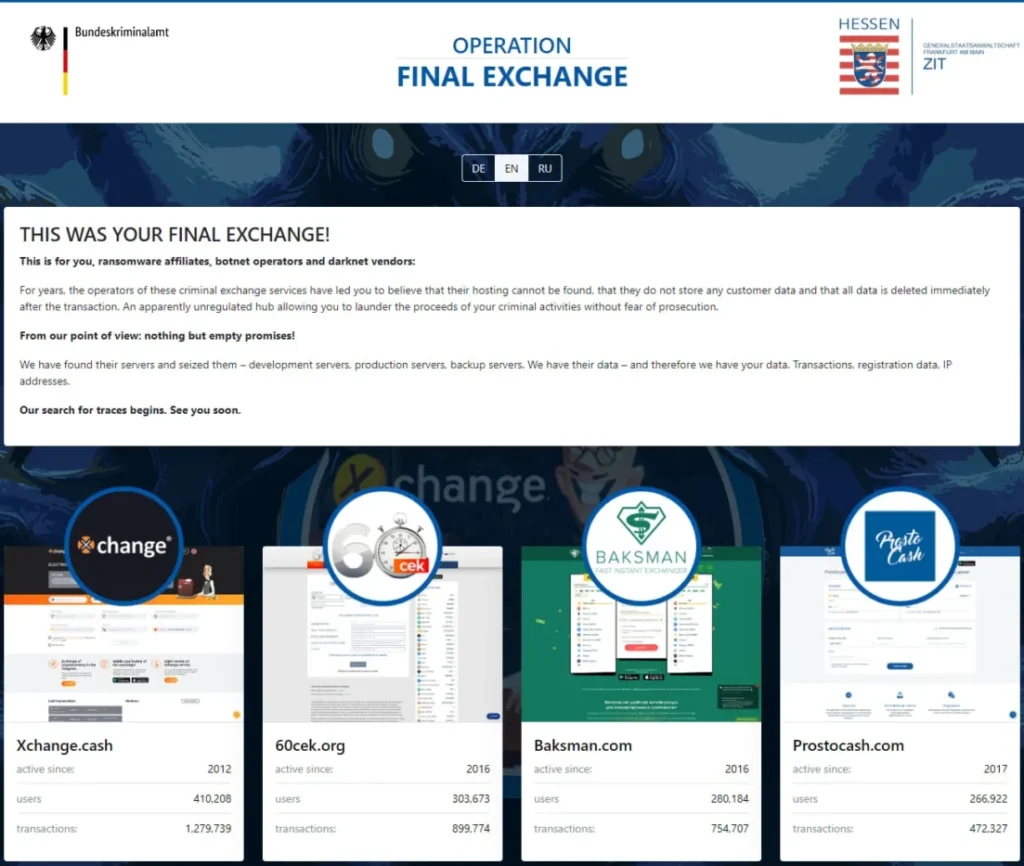

The closed exchanges are as follows:

- Xchange.cash

- 60cek.org

- banksman.com

- prostocash.com

These platforms are now out of operation due to the closure of cryptocurrency exchanges. They played a central role in enabling illegal activities. However, with the servers being seized, the anonymity that these criminals once relied on is beginning to disappear.

Tracking Criminals: The Data Trail to Follow

The shutdown of the exchanges was just the beginning. German authorities also seized the servers behind these platforms, and with them valuable data. They now have access to users’ transaction records, registration details, and IP addresses that they thought were operating in the shadows.

Now, anyone who visits these exchange websites will see a message titled “Operation Final Exchange”, a stern warning to those involved in illegal activities, and a clear message that anonymity will no longer be guaranteed after these important cryptocurrency exchanges are shut down.

The message reads:

“We have located and seized their servers. Development servers, production servers, backup servers. We have their data. So we have your data. Transactions, registration data, IP addresses… Our search for traces begins. See you soon.”

This is a powerful reminder that the days of criminals hiding behind cryptocurrency exchanges are numbered.

Also Read: Cryptocurrency Trading Bots for Beginners

Challenge: International Boundaries

While the closure is a major victory for German authorities, tracking down the criminals presents a daunting task. Many of the individuals involved in these illegal activities reside outside Germany, often in countries that tolerate or protect them from prosecution.

Law enforcement acknowledged the obstacles in a statement.

Cybercriminals often reside abroad and are often inaccessible to German law enforcement, as some countries tolerate or even protect them.

Despite these challenges, investigators are confident that the detailed user and transaction data obtained from the servers will be invaluable in their ongoing investigation. While it may take time to track down the criminals, authorities are determined to bring them to justice even after these cryptocurrency exchanges are shut down.

What’s Next: Legal Action for Exchange Operators

While the investigation focuses on the users of these platforms, the operators of the seized exchanges also face serious legal consequences. They are charged with money laundering and operating an illegal trading platform under sections 127 and 261 of the German Criminal Code (StGB).

If convicted, these operators could face years in prison for facilitating this illegal activity. The German authorities are sending a clear message: they will not tolerate platforms that allow criminals to exploit cryptocurrencies. The closure of this crypto exchange is a testament to their commitment.

Germany’s ongoing fight against cybercrime

This latest crackdown is part of a larger effort by the German government to dismantle the infrastructure that cybercriminals rely on. Earlier this year, German authorities made headlines when they seized $3 billion worth of bitcoin linked to illicit activity.

It is clear that Germany is taking a hard line against misuse of cryptocurrencies, and this latest crypto exchange shutdown shows that they are not slowing down. By targeting exchanges that do not enforce KYC policies, Germany is making it harder for criminals to hide in the shadows of the crypto world.

Closing Thoughts: The Road Ahead

The world of cryptocurrencies offers incredible opportunities for financial freedom, innovation, and privacy. But it also has challenges when it comes to regulation and security. The closure of 47 crypto exchanges by German authorities is a stark reminder that while the crypto world is often associated with anonymity, it is not immune to the influence of law enforcement.

As investigations continue and more cryptocurrency exchanges are shut down, governments around the world are likely to increase their efforts to regulate and monitor these platforms. The message to criminals who once used them to launder money is clear: there is no place to hide anymore.